Canada tax chiefs knew foreign money’s big role in Vancouver housing market 20 years ago, leaked documents show, but they ‘ignored’ auditors’ warning

Team of investigators tried to raise alert about tax cheating after 1996 analysis found rich new immigrants dominated luxury property market, buying 93 per cent of homes in two cities, while declaring extremely low incomes

Leaked documents have revealed that Canada’s tax department was warned 20 years ago about the impact of millionaire migration on greater Vancouver, by a team of auditors who discovered the influx was playing a huge role in the luxury housing market and suspected the buyers were engaged in widespread tax cheating.

But the “alarming” results of the auditors’ investigation were “ignored” by Canada Revenue Agency bosses who failed to commit the resources needed to tackle the issue, and just “wanted the problem to go away”, one of the auditors, now retired, told the South China Morning Post.

Instead, Vancouver went on to become one of the world’s most unaffordable housing markets, with rich mainland Chinese flocking to the city in recent years under the same wealth-migration model that raised the auditors’ concern two decades ago.

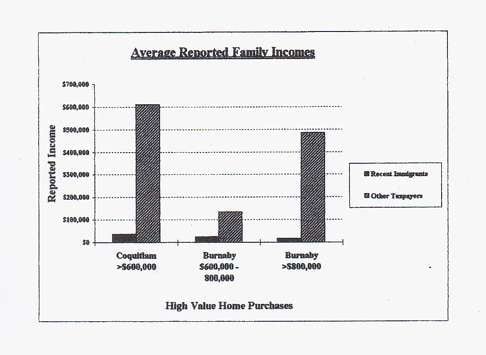

The 1996 investigation, described in interviews, leaked memos and a spreadsheet obtained by the SCMP, compared luxury home sales in two regional cities against buyers’ social insurance numbers and tax records, amid the arrival in Vancouver of thousands of rich immigrants from Hong Kong and Taiwan. It showed that recent immigrants made up more than 90 per cent of top-end, C$600,000-plus purchases in which buyers were identifiable.

However, these buyers only declared average household incomes of about C$23,000, compared to more than C$368,000 for the handful of long-term Canadian residents who bought in the same price brackets.

The existence of the CRA team’s 1996 analysis has never before been publicly revealed. It was conducted by CRA’s Underground Economy Workload Development Unit in the Burnaby-Fraser tax office, which had been tasked with identifying potential audit targets.

A retired auditor who was involved in the analysis said the results were sent to Ottawa in what amounted to “a call out for help…’look, we have identified significant non-compliance from this group of people. We will not start audits unless you can do something [to help us]’. Nothing was ever done.”

He said “senior CRA management just wanted the problem to go away and did not want to put resources towards these high-hour audits”, which could take many months.

Only a handful of audits were ever conducted as a result of the initiative, which was “abandoned” for lack of interest and resources, he said.

The account of the investigation - and its apparent snubbing by CRA bosses - was corroborated by a second person who worked in the Burnaby-Fraser CRA office at the time.

The leak of the documents to the SCMP comes amid concerns that millionaire migrant money from China is helping fuel Vancouver’s current home-price explosion, with the average price of a detached home in the metropolitan region standing at C$1.8million and the “benchmark” price for all residential sales at C$930,400, a whopping 32.6 per cent increase in the past year.

From 1986 to 2014, two main millionaire migration vehicles, the Federal Immigrant Investor Programme and a parallel scheme run by Quebec (the QIIP), brought 190,487 wealthy immigrants to Canada. An estimated 120,000 of those likely moved to Vancouver, including a majority of QIIP migrants, who are not required to stay in the French-speaking province.

The first waves of immigrants using the scheme were mainly Hongkongers and Taiwanese arriving in the wake of the 1989 Tiananmen crackdown and ahead of the 1997 SAR handover. Since then, the schemes have been dominated by rich mainland Chinese. The federal IIP was shut down in 2014, but the QIIP continues to operate, and is on track to bring about 5,000-5,500 millionaires and family members to Canada every year.

‘The numbers were alarming’

The retired auditor said the schemes had long raised concern among auditors, prompting the 1996 study.

He said the investigation began with auditors obtaining a list of immigrant investors from administrators of their funds; their social insurance numbers were compared against tax rolls to deduce that although most were living in high-income neighbourhoods and relatively young, they had “minimal declared income”.

“Based on this information…it was decided by the Burnaby-Fraser TSO (taxation services office) underground economy team to start analysing high-end home purchases in the lower mainland,” he said.

The study examined all sales in Burnaby and Coquitlam worth more than C$600,000 - which at the time represented a top-end luxury sale - in a two-month period of 1994. The auditors identified buyers, studied their tax records and determined their immigration status based upon filing history and the sequencing of social insurance numbers.

“The numbers were alarming,” the ex-auditor said. “New immigrants made up the largest proportion of buyers, but their incomes were significantly lower than long-term Canadian residents.”

A memo describing the study, dated October 1, 1996, was sent from team leader Dino Altoe to John Fennelly, at the International Tax Directorate in Ottawa.

Neither could be reached for comment, and the CRA declined to discuss the leaked papers. “The Canada Revenue Agency cannot comment on the authenticity of the documents you have provided. We respectfully decline your request for an interview,” a spokesperson said.

Foreign home buyers in Vancouver hit with HK-style 15pc tax, but millionaire migrants will be exempt

Altoe says in the memo: “Based on the lifestyle and average age of these taxpayers, it is likely that many of these new Canadians still have active business activities, but are not reporting all their sources of income.”

Just four out of 243 home sales in Burnaby priced between C$600,000 and C$800,000 involved identifiable long-term Canadian residents, the memo says. A spreadsheet accompanying the memo shows that 21 out of 29 identifiable buyers of C$600,000-plus properties in Coquitlam were recent immigrants; they made up 18 out of 21 C$800,000 buyers in Burnaby. Recent immigrant buyers in the three categories had average incomes ranging from C$16,430 to C$33,785. Across all three categories, the average income of long-term resident buyers was C$368,530.

The exact figure for the entire Burnaby cohort of 243 C$600,000-C$800,000 buyers who were not identifiable was not given, but a random sample of 31 buyers by the auditors suggested a rate of 32 per cent. Assuming that held true for the group of 243, the percentage of recent immigrant buyers in the entire study was 93 per cent.

David Ley, a University of British Columbia geography professor who has studied the phenomenon of wealth migration to Vancouver for decades, said that at the time of the study there was an intense debate in the city about whether the role of rich immigrants in the housing market was being exaggerated.

He said the leaked data would have been valuable to this discussion had it been made public at the time, and pointed out that the same debate and doubts were echoed today.

“It certainly elucidates what was going on. If we wanted a transparent sense of this trend in society, then this would have informed that debate,” he said, adding that he “most certainly would have” wanted the data himself back in the 1990s.

The Altoe memo goes on to say that a separate analysis of sales in the cities of Richmond and Vancouver had been conducted “with similar demographic results”. However, any spreadsheets showing this could not be obtained by the SCMP.

In a follow-up memo to Fennelly, dated October 2, Altoe says a high proportion of the Burnaby-Coquitlam recent immigrant buyers were likely of Taiwanese origin. The writer maps out the challenges of pursuing audits against such taxpayers – including the absence at the time of tax treaties with Hong Kong and Taiwan, the difficulty of searching for assets in Taiwan, and the likely uncooperativeness of the audit targets.

He says his audit team planned to “revisit this data if meaningful offshore asset reporting data becomes available or information from immigration”, before signing off with a request for suggestions on how to proceed.

However, the SCMP’s source said the team was “powerless to do anything without better access to immigration records”. “A few audits were done, and the initiative was abandoned,” he said, describing the study as having been “ignored”.

The source of the leak came forward after the SCMP reported last month that CRA was planning a tax crackdown on suspected real estate tax cheats buying homes with foreign earnings in Vancouver. However, the secret strategy briefing obtained by the Post that described the crackdown revealed there had been just one successful audit of global income conducted in British Columbia last fiscal year.

NOTE: This story has been updated to include a response from the CRA, which had not been provided at the time of initial online publication.

No comments:

Post a Comment

Comments always welcome!