China Braces for Economic Growth to Fall Below 6%

Dec 29 2019

(Bloomberg) -- China’s policy makers are preparing for two key policy meetings in the coming weeks with fresh evidence that sooner rather than later, the number for gross domestic product growth will start with a 5.

Data released Friday showed an economy expanding at just 6.0%, the slowest in almost three decades, and with broad investment growth too tepid to rely on an upturn down the road.

People’s Bank of China Governor Yi Gang responded to the data not by hinting at much greater stimulus in the pipeline, but by reminding investors that China’s focus remains on keeping its heavy debt load under control.

Yi’s comments may set the scene for a meeting of the Politburo, the Communist Party’s top leaders, and the ensuing Fourth Plenum of the Party’s Central Committee, a broader gathering that may mull longer-term questions of economic policy. While those events could produce a shift away from the current targeted, moderate stimulus regime, there have been few signals to date of any change.

The leaders are “looking at a very long horizon,” and that approach makes the headline growth rate -- either above 6% or slightly below it -- not that important, Yao Wei, chief China economist at Societe Generale SA in Paris, said in an interview on the sidelines of the International Monetary Fund’s annual meetings in Washington last week.

“They measure the policy scope by looking at the overall debt, by looking at how much risk there is in shadow banking, in the housing sector and in inflation,” Yao said. “Looking at all these things, they judge they actually don’t have much scope from a long-term perspective. So they’re very careful about how to use it and when to use it.”

With few major monetary policy moves in the past month, the Loan Prime Rate, a market gauge of borrowing costs, remained unchanged in October, according to a PBOC release Monday.

In his statement to the IMF’s steering committee at the meetings, Yi said that growth had been stable this year and the “main economic indicators kept within an appropriate range.” While keeping credit growing, the bank should also pay attention to “maintaining a stabilized leverage ratio,” he said.

Yi won support for China’s approach from the IMF, which otherwise has been urging more action to support the global economy. Kenneth Kang, deputy director of the fund’s Asia and Pacific Department, said any support to prop up the Chinese economy should be “contained, calibrated to the shock, it should be temporary in nature and it should be focusing on re-balancing growth down the road.”

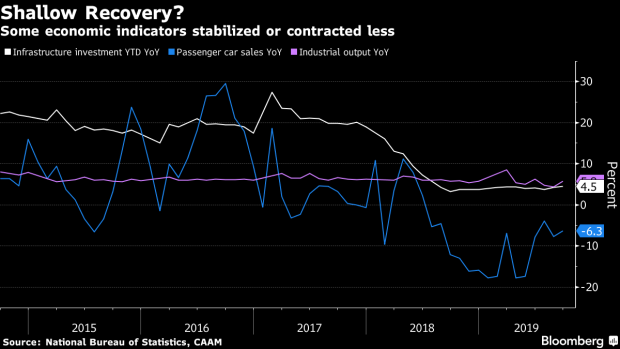

Stabilization Signs?

Even though the third quarter growth numbers came in below estimates, policy makers may in fact be seeing signs of a stabilization, particularly if the nascent trade-war truce with the U.S. holds.

Corporate demand for long-term credit picked up in recent months, the growth of auto sales -- an important part of the country’s retail sales -- contracted less, and infrastructure investment stabilized at a low level. These factors are among those that have prompted economists from Citigroup Inc, Barclays Plc, Oversea-Chinese Banking Corp Ltd, and Natwest Markets Plc to cautiously call a bottoming-out.

“The positive factors such as the trade truce, low base effect, the stabilization of manufacturing sector and pickup of infrastructure investment may give the PBOC more reason to take a wait and see approach,” Tommy Xie, an economist at Oversea-Chinese Banking Corp., wrote in a note.

To be sure, if conditions were to worsen materially from here, China still has ample room to react, with interest rates far above zero. Before last week’s growth data, economists surveyed by Bloomberg saw full-year expansion for 2019 coming in at 6.2% before slowing to 5.9% in 2020.

For now, the early signs of stabilization give the authorities a chance to debate some long-term issues at the coming meetings, such as a graying population and the merits of freer internal migration of labor. These reforms could be more important than imminent policy loosening in ensuring a steady performance of the economy in the longer term.

“There are a lot of ways that China could manage its long-term demographic problems,” Scott Kennedy, an expert on the U.S.-China economic relationship at the Center for Strategic and International Studies in Washington. “There are many things they could do, from eliminating the hukou system to delaying the retirement age to permitting inward immigration.”

Some of these topics are likely become the topics at the upcoming Party meetings.

“We wait for the upcoming Politburo meeting and a possible fourth Plenum for signals on the medium-term policy outlook,” Liu Peiqian, China economist at Natwest Markets Plc. “In particular we look for the Politburo’s assessment about external uncertainties and how the authorities will balance their priorities of growth, deleveraging and stability.”

No comments:

Post a Comment

Comments always welcome!