Chinese Gangs And Canadian Real Estate, The Odd Correlation

RCMP-CSIS analysts made some pretty bold claims in their 1997 Sidewinder report. The statement that Chinese Triads are manipulating real estate is one of the boldest. Back then, it seemed absurd that organized crime would focus on Canadian real estate. 20 years later, we wanted to take a look at just how crazy that seems now.

While we don’t have the ability to tap people’s phones, and open emails (thanks Harper!), we do have a metric s**t-ton of data. Sifting through this, there’s a pretty interesting correlation between the crackdown on the triads, Macau casino revenues, Canadian real estate, and Canada’s banking loopholes.

What Are Triads?

Triads are a secret fraternal society that police forces claim engage in organized crime. They’re kind of like the Sicilian Mafia, but bigger and Chinese. It’s alleged they dominate illicit markets around the world. They’ve cornered the market on human smuggling, heroin, and money laundering. Recently they’ve transformed from a violent street gang, to favoring more discrete operations. They also engage in legit businesses like entertainment and property development.

They’re based out of Hong Kong, where membership is theoretically illegal. Despite this, two operations to crackdown on membership last year led to the arrest of 60,000 members. Yes, that number is correct. The kicker? It hardly put a dent in triad operations.

Triads In Canada

Triads operate in every large Chinese population, and Canada is no exception. In fact, Canada is home to some of the oldest, largest, and wealthiest triad families in the world. Most of their membership is concentrated between Toronto and Vancouver.

When Wo Shing Wo, the oldest triad branch, decided to set up a foreign syndicate in 1930, the location they chose was lucky Toronto. They were soon followed by other families like Sun Yee On (the largest syndicate), as well as other groups like 14K. At one point triads were so prominent in Toronto, theToronto Police Services (TPS) had an Asian Organized Crime Task Force. This unit became later known as the Gun & Gang Task force, since crime became so multi-ethnic in their city. Cute, right?

The triads in Vancouver go back over 100 years, and have close ties with Hong Kong branches. It’s estimated that they produce 70% of Canada’s meth, and export to the U.S. and Australia. Additionally, a US Congressional report titled Transnational Activities of Chinese Crime Organizations, notes that Vancouver is the “central distribution point [of heroin] for North American sales.” It’s gotten so bad the US Drug Enforcement Agency setup shop in Vancouver to assist with intel.

Vancouver’s triads have been making the news more often recently. Pressure from China led to an immigration hearing in 2013 for Vancouver-based Lai Tong Sang, who was revealed to be the leader of the Shui Fong triads in Macau. More recently, a Vancouver real estate agent was accused of threatening a local business owner for discouraging bidding wars.

“I’m telling you – people above me are from Harbin [China] gangs. Gangsters, right? You don’t want to be alive,” said a voice on a recording in Mandarin. The call was allegedly from a number connected to Layla Yang, a talented realtor that has a knack for selling multi-million dollar teardown properties. She’s so talented in fact, that this property in dispute was already sold by her earlier in the year. I really need to work on my sales skills.

China’s Crackdown On Triads

In 2013, President Xi Jingping was appointed to centralize power in China with a mandate to remove corruption. Since taking power he’s cracked down on thousands of politicians for collaborating with criminal groups, or embezzling money from the state. Even the mother of Vancouver mayor’s girlfriend was swept up in the crackdown.

20 years ago, Sidewinder alleged that China’s government was working with organized crime. Years later, under a new President, China is making moves to clean up the corruption. This recent clean up implies that individual politicians may have been collaborating with organized crime, and the Communist Party is now putting a stop to it. State media in China outright accuses Hong Kong’s chief-executive of using triads to manage the city. Well, even legislators in Hong Kong are saying triads are being used by the government of Hong Kong.

The crackdown extended to Guangdong, Macau, and Hong Kong – the triad financial centers. Macau in particular is important, because their massive casino industry is uniquely structured. You see, in Macau, unlike the rest of the world, casino’s are dependent on junket operators. Junket operators are anyone from a sole proprietor to corporations. They attract VIPs and issue debt for them to use while they’re at the casinos. The casino only needs to vet the junket operators, because they’re the debt holders. If a VIP client defaults, it’s the junket operator that’s stuck footing the bill.

This unique system is opaque, protecting the identity of the VIP gambler. To complicate the issue more, VIP gambling occurs in separate rooms from the main casino. This ensures that the identity of the gambler is almost never known. The US-China Economic and Security Review Commission (USCC)estimates that over 69% of gaming revenues come from these VIP rooms. In case you couldn’t guess, the USCC report notes these rooms are “dominated by Asian organized crime commonly referred to as triads.”

Macau is also dragging their feet on anti-money laundering schemes. The US State Department notesthey have no requirement to report large transactions. Additionally, there is no tracking of cross-border transfers of money. If you can evade China’s capital controls, you can have your cash in Macau almost worry free. If this sounds like a very effective way for criminals to launder money, that’s because it is. Well, it was until the recent government clean up. Did triads suddenly stop laundering money because the Chinese government said stop? Not likely.

Casino Revenues Dropped

A funny thing happened in Macau when China started arresting triads by the 10s of thousands. Casino revenues dropped despite the Chinese economy hitting hyperdrive. According to the Gaming Inspection and Coordination Bureau of Macao (DICJ), revenues from when the triad crackdowns began in late 2013 to 2015 are down 40%. This year the industry is on pace to drop another 8%. At the very least it’s a strange coincidence.

Global Property Markets

Curiously, once Triads lost the easiest way to launder money, property markets surged. Not in the US, just in the countries with generous tax loopholes, like Canada. In fact, two Canadian cities noted in Sidewinder had very interesting property movements – Vancouver, and Toronto.

The same year the crackdown in Macau occurred, BC real estate reversed direction. The dollar volume in BC housing had declined by 20% in 2012, but increased by 12% when the crackdown was announced the next year. Since then, it hasn’t booked a lower year, continuing to find more money.

Toronto saw a 12% drop in residential real estate dollar volume in 2012. The year of the crackdown, Toronto began to see a reversal and soared 20% in volume in 2013. It has continuously increased since, with 148% growth when comparing year to date vs all of 2015.

Macau Gaming Revenues Vs. BC Real Estate Dollar Volume

Macau casino revenues vs. BC real estate sales. Probably worth noting that in late 2013, China began cracking down on triads.

Property Borrowing

Now the logical way to explain real estate in Toronto and BC is incomes went up and interest rates were slashed. Except, that’s not the case. Income has been stagnant in both Vancouver and Toronto, with many people making less than they did in previous years. This leaves market growth to capital imports – using immigration and foreign buyers.

Capital Controls

China has capital controls that restrict money leaving the country to US$50,000 per year, per person. Foreign buyers need a 35% down payment since they have no domestic income to verify. Now that BC’s average home is US$439,708, this makes the down payment $154,000 give or take. That’s more than 3x the amount of money that you can legally remove from China in a year.

If you did the math, you’re probably scratching your head. How do the 9% of foreign buyers in BC get enough for a downpayment from China? Easy, you don’t follow the rules. This is where smurfing comes in.

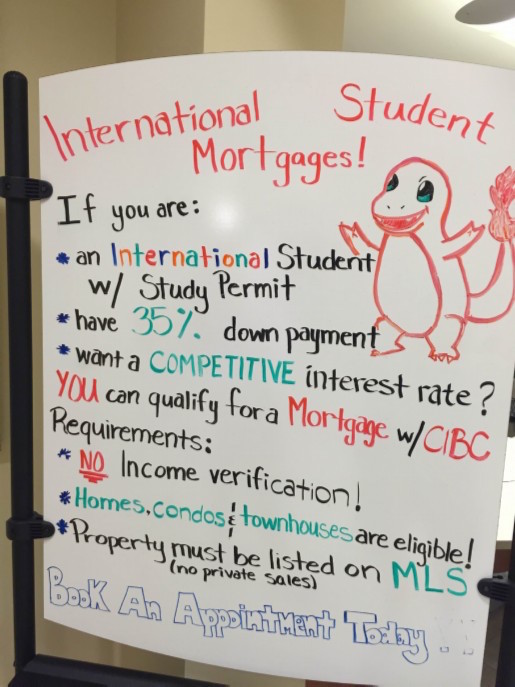

A sign advertising no income verification for overseas mortgages in a CIBC branch. On an unrelated note, the RCMP-CSIS report Sidewinder mentions the bank multiple times. Picture used with permission from Garth Turner’s blog.

WTF Are Smurfs?

China’s rich foreign buyers engage in the same technique that drug dealers, human traffickers, and counterfeiters do, smurfing. Smurfing is when a large amount of capital is broken down into smaller, more discrete amounts. These smaller amounts don’t attract regulatory scrutiny, and sail through the banking system.

Basically, the money is broken down into US$50,000 increments. The money is split amongst your friends, family, or a shadow banker. They then transfer the money to you while you’re here. The person in Canada also needs to open multiple bank accounts to receive the money. This way the Chinese government doesn’t immediately realize what’s happening.

They repeat the process until they have a downpayment. They then repeat as many times as they need to bring the rest of their money over. A wrongful dismissal case at CIBC in 2014 shed a little light on this process. The defendant described this as a “practice CIBC supported”.

It’s important to note that this isn’t a process being used exclusively for illicit money. It’s the process that needs to be used for all money to leave China, and doesn’t violate any Canadian banking laws. Doesn’t matter how someone made that money, selling heroin or socks, it’s all the same to Canadian banks.

So, if you were a member of a criminal organization like the triads, who needed to launder money why wouldn’t you take this fairly simple and routine route instead of the more illegal one? There are already a number of legitimate immigrants coming to Canada, so it would be hardly noticeable if a handful of them happened to be triads. Well, until abandoned teardown houses started going for $3 million dollars. Then locals definitely started getting suspicious.

This Isn’t A Secret…Unless You’re Canadian

The lack of legal framework and resources to prevent money laundering in Canada is far from a secret. Canada is one of the world’s largest tax havens, and has banking laws that have a number of loopholes. While your everyday Canadian may not know this, both the Asia Pacific Group on Money Laundering (APG), and Transparency International have openly made statements.

APG has noted Canada’s questionable money laundering prevention techniques multiple times, including in their latest Mutual Evaluation Report (MER). The MER notes that Canadian authorities “may be underestimating the magnitude of key risks”, such as those “emanating from tax crimes and foreign corruption.” They further note that while Canada has an Anti-Money Laundering (AML) regime, a notable exception is legal professions other than British Columbia notaries. This is a “significant loophole in Canada’s AML framework”, and “in particular the real estate sector.”

Transparency International was perplexed by the promises Canada made earlier this year at the Anti-Corruption Summit in London. Apparently we sent a delegation that made a number of promises. Over the summer, a review committee researched the promises and noted they were “not new”. This begs the question, are the money laundering loopholes there through negligence or design?

How Accurate Was Sidewinder?

One of the reasons Sidewinder was shelved was the concept of Triads cooperating with members of the Chinese government seemed ludicrous. The concept of using “soft sectors” like real estate was too difficult a concept for the government to understand. That or they didn’t want to understand.

20 years laters, China’s government is focused on a crackdown for corruption within the ranks. They’re openly accusing (and arresting) bureaucrats for cooperating with organized crime to get work done. The crackdown coincided with a global capital flight, with tons of money flowing into the exact cities identified by RCMP-CSIS analysts. Additionally, international anti-money laundering organizations are identifying Canada as a safe-haven for laundering.

Now, Sidewinder was a smoking gun of a report. They made a case that they needed to investigate the circumstances.They definitely were onto something in this department.

No comments:

Post a Comment

Comments always welcome!