German go-ahead for China's Cosco stake in Hamburg port unleashes protest

Nov 1 2022

With the support of Scholz's Social Democrat-led ministries, the cabinet approved a 24.9% stake investment by Cosco in one of logistics firm HHLA's (HHFGn.DE) three terminals in the Hamburg port.The approved investment is less than the initially planned 35% stake that the Chinese shipping giant and HHLA had aimed for and does not give Cosco any say in management or strategic decisions. too dependent on Russian gas has changed many politicians' attitude towards strategic foreign investment. The foreign ministry was so upset over the approval that it drew up a note on the cabinet meeting documenting its rejection, Reuters was told by two government sources.

The investment "disproportionately expands China's strategic influence on German and European transport infrastructure as well as Germany's dependence on China", the document, seen by Reuters, says. It points to "considerable risks that arise when elements of the European transport infrastructure are influenced and controlled by China - while China itself does not allow Germany to participate in Chinese ports".

In the event of a crisis, the acquisition would open up the possibility for China to politically instrumentalise part of Germany's as well as Europe's critical infrastructure, it says. The economy ministry and the four ministries led by the liberal Free Democrats joined in drawing up the note, according to the sources.

Scholz, a former mayor of Hamburg, has once again asserted his will against his coalition partners, the Greens and the Free Democrats. After pushing through a nuclear power extension single-handedly last week, the Cosco move fuels discord at home and among European allies who are against the Chinese investment and already see Scholz as increasingly isolated.

Scholz is scheduled to travel to China next week.

HHLA WELCOMES DEAL

HHLA, which is majority-owned by the city of Hamburg and one of the main users of the port, welcomed the deal.

"We appreciate that a solution has been found in objective and constructive talks with the federal government," said Angela Titzrath, chairwoman of HHLA's executive board.

It was working on finding an agreement with Cosco on the new conditions in a timely manner, she said.

With the original 35% deal, the German logistics firm had wanted to tie its long-standing shipping customer to Hamburg port in the face of fierce international competition.

Cosco did not immediately reply to a request for comment. A German government source told Reuters that the Chinese company had agreed to the deal.

Chinese foreign ministry spokesperson Wang Wenbin, asked about the deal, said on Wednesday that China hoped "relevant parties would see pragmatic cooperation between China and Germany rationally (and) stop gratuitous hype", without giving further details.

Supporters of the HHLA deal say it will allow Hamburg to keep pace with rival ports that are also vying for Chinese trade, some of which are partly owned by COSCO.

COSCO's Shipping fleet accounts for approximately 3% of the world’s carbon emissions.COSCO Shipping Corporation Limited, abbreviated as COSCO Shipping, is a Chinese state-owned conglomerate headquartered in Shanghai. China's COSCO SHIPPING Holdings Co. Ltd. engages in the provision of container shipping, managing and operating container terminals ports, and container leasing services. It operates through following business segments: Container Shipping, Container Terminal, and Corporate and Other Operations.

The company's latest incarnation was founded on March 3, 2005 and is headquartered in Tianjin, China. Li Ka-Shing held commanding shares during its early formative years.

At present, the Group is actively involved in the “Belt and Road” Initiative and controlling global trade and the national strategy of Yangtze River Economic Zone. Currently it's global and forward-looking view has purchased many ports throughout the world which today has the claim to being the globe's biggest shipping company and ruling the maritime world. All this since its state owned communist controlled enterprise beginnings in the 1960's. [and now PLA controlled, indeed a military threat to the world not just the global economy with the planned acquisition of ports]

Losing strategic control of the Panama Canal to the People’s Republic of China

Grey zone skirmish with the PRC

CSIS

Key Decision Point Coming for the Panama Canal

May 21, 2021

The Panama Canal sits at the nexus of international political and economic concerns. Following the Canal’s expansion in 2016, the waterway annually registers nearly 14,000 transits, a value equal to 6 percent of global trade. The Canal’s global shipping role has only increased amid the disruption of global supply chains during the Covid-19 pandemic and U.S. calls for nearshoring away from China. The United States remains the top user of the Canal—in 2019, 66 percent of the cargo traffic transiting the Canal began or ended its journey at a U.S. port; cargo from or destined to China made up 13 percent of Canal traffic. Still, China is the primary source of products going through the Colón Free Trade Zone and its increasing presence in and around the Canal has made the waterway a flashpoint for U.S.-China competition over spheres of influence. China’s influence in the Panama Canal has only grown since 2017 when then-president Carlos Varela severed diplomatic ties with Taiwan and recognized China, further opening the door to China’s expanded footprint in critical Canal infrastructure and laying the groundwork for alignment with the Belt and Road Initiative (BRI).

Q1: How is the Panama Canal currently governed?

A1: The Panama Canal has been fully owned and administered by the Republic of Panama since the transfer of management from the joint U.S.-Panamanian Panama Canal Commission in 1999. Today, the Panama Canal Authority (ACP) is charged with the administration and maintenance of the waterway’s resources and security as an independent entity of the national government. Governed by the 11 members of its board of directors, the ACP’s members maintain overlapping terms to ensure independence from each presidential administration. Designated by Panama’s president, the chairman of the board holds the rank of minister of state for Canal affairs and under the supervision of the board, the designated Canal administrator heads the ACP, implementing the decisions of the board. Through contract awards, the ACP in turn grants concession agreements to companies for port operations.

While much of the Canal’s original legislation expired upon turnover of the Canal to Panama, one key treaty relevant to U.S. and Chinese influence in the Canal remains active with no expiration date. The Treaty Concerning the Permanent Neutrality and Operation of the Panama Canal, or the Neutrality Treaty, between Panama and the United States guarantees permanent neutrality of the Canal with fair access for all nations and nondiscriminatory tolls. Only Panama may operate the Canal or maintain military installations in Panamanian territory. The United States, however, reserved the right to exert military force in defense of the Panama Canal against any threat to its neutrality. Any interpreted Chinese threat to the Canal’s neutrality could activate the U.S. forces through this treaty, meaning current and future Chinese interventions should be calculated with this potential response in mind.

Q2: What is China’s influence in the Panama Canal?

A2: Chinese companies have been heavily involved in infrastructure-related contracts in and around the Canal in Panama’s logistics, electricity, and construction sectors. These projects fit naturally with China’s BRI vision, onto which Panama was the first Latin American country to sign in 2018. This, along with Panama’s recognition of China, boosted China’s already existent footprint in the Canal, and Chinese companies have since positioned themselves at either end of the Panama Canal through port concession agreements. In 2016, in a $900 million deal, the China-based Landbridge Group acquired control of Margarita Island, Panama’s largest port on the Atlantic side and in the Colón Free Trade Zone, the largest free trade zone in the Western Hemisphere. The deal established the Panama-Colón Container Port (PCCP) as a deep-water port for megaships, and the construction and expansion was carried out by the China Communications Construction Company (CCCC), a company also active in China’s island-building initiatives in the South China Sea, and the China Harbor Engineering Company (CHEC). The location of the port on the Canal has since allowed China to capitalize on Canal expansion. Additionally, in March 2021 the Panamanian government began the process of renewing the lease of Hutchison Ports PPC, a subsidiary of Hong Kong–based CK Hutchison Holdings, which serves as operator for the ports of Balboa and Cristobal, two major hubs of the Canal’s Pacific and Atlantic outlets, respectively.

Furthermore, in 2018, a Chinese consortium led by CHEC and CCCC announced it was awarded a $1.4 billion contract for the Canal’s fourth bridge, which then-president Varela called “the fifth most important project in the history of the country.” More recently, China Construction Americas finished the Amador Convention Center along the Pacific side of the Canal, a project contracted under the Varela government and funded by Chinese loans. China has also invested in energy-related facilities along the Canal. For example, the Chinese group Shanghai Gorgeous invested $900 million to build a natural gas–fired electricity generation facility. As an economic foothold into Latin America, the Panama Canal is no doubt an important gateway for China’s bid for broader presence and a logistical hub for Chinese goods entering the region.

Aside from infrastructure projects, water management efforts are also a key source of entry for Chinese players. A plan announced in September 2020 would establish a water management system to combat against drought, which threatens the operation of the Canal, but also would impact local access to water for the next 50 years. This presents another opportunity for Chinese investors to increase their presence in Panama beyond the Canal.

In the first and second quarters of 2020, China strayed from traditional infrastructure and business investments to focus on supporting Panama’s fight against the Covid-19 pandemic. Between February and June 2020 alone, Panama received almost $2 million of aid in the form of healthcare-related supplies from China. This interest in Panama’s healthcare resources likely stemmed from the way that the onset of the pandemic in March 2020 brought multiple infrastructure projects, including the Canal’s fourth bridge, to a halt. Some work restarted in late 2020, but progress generally remains delayed.

Q3: What happens on January 16, 2022?

A3: A major concession agreement grantee is Hutchison Ports PPC. Its 25-year contract for the Port of Cristobal is set to expire on January 16, 2022, and Hutchison submitted a request for an extension in March 2021; the Panamanian government now faces the critical decision of whether to continue the extendable concession contract or pursue an open bidding process. In 1997, when Hutchison first won the contract, a report from the Senate Foreign Relations Committee concluded that Hutchison’s development of the Canal ports was not a direct national security threat. However, following clampdowns by China on Hong Kong’s autonomy in 2020, having two major ports managed by a Hong Kong–based holding is a greater security concern today than it was two decades ago.

The continuity of Hutchison Ports PPC’s contract will strengthen Chinese presence in the Canal. In recent years, Chinese investors have expanded their participation in Hutchison Ports PPC. Additionally, due to the growth in Canal activities of Chinese state-owned enterprise China Overseas Shipping (COSCO) as well as China-allied investment groups and construction companies, Hutchinson Ports PPC could be vulnerable to influence from fellow China-based companies in coming years.

The expiration of the Port of Cristobal contract represents a valuable opportunity for the United States and interested ally parties to encourage a competitive bidding process with transparent bids on the contract from U.S. and allied firms. Panama’s critical decision regarding the renewal of Hutchison Port’s contract could shape the Canal’s geopolitical players for years to come.

Q4: What are the implications for the United States?

A4: China’s BRI expansion into port-related facilities has stirred alarm for the United States over ambitions seen as endangering the neutrality of the Canal. Of those goods transiting the Canal, over 60 percent originate in or end up in U.S. markets, intrinsically tying free and fair Canal access to U.S. national security and economic interests in the country. Accordingly, the Canal is a major commercial asset, acting as gateway between the Atlantic and Pacific Oceans and a provider of lower shipping costs for U.S. and global trade.

With the expansion of Chinese influence in the waterway, the Canal will likely continue to be a point of tension in U.S.-China relations. China does not operate the Canal, it only manages the two ports on either end, meaning it does not interact or influence all goods transiting the Canal. However, the increase of Chinese companies’ control over transshipment cargo operations bound for the United States and other countries is a point of contention.

China’s expanded reach in the Panama Canal has slowed recently, mostly due to U.S. pushback and the Covid-19 pandemic. For example, the Panama Ministry of Public Works' plans for the announced fourth bridge over the Canal was scaled back in 2020. In 2018, U.S. and domestic pressure ended China’s plans to construct a large embassy at the mouth of the Canal. In fact, numerous initiated projects have been canceled, postponed, or scaled back during the current administration of President Laurentino Cortizo. This scaling back of Chinese projects by the Cortizo administration indicates that there not only exists a desire to maintain open relations with the United States, as embodied by Panamanians’ access to “Global Entry international trusted traveler” status for entering the United States, but also an opportunity for the United States to take the lead in the geopolitical competition surrounding the Panama Canal.

China's Global Network of Shipping Ports Reveal Beijing’s Strategy & PLA Influence

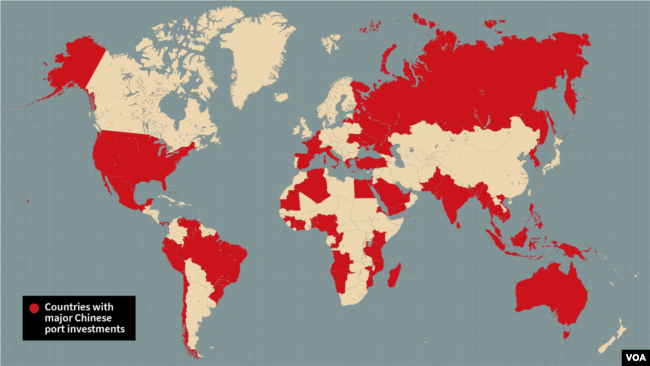

A powerhouse in global trade, China has more shipping ports at home than any other country. Key investments add about another 100 ports in at least 60 nations. And Beijing is looking for more.

Earlier this month, operations at Israel’s port of Haifa, one of the largest maritime transport hubs in Mediterranean, were handed over to China's state-run Shanghai International Port Group to run for the next 25 years.

Another gigantic Chinese shipping company, COSCO Shipping, is poised to expand its footprint in Europe by taking a stake in the port of Hamburg. Negotiations have been reportedly going well, and a deal is expected soon.

If COSCO succeeds, it would be the company’s eighth port investment in Europe.

The state-owned company's previous investment involves the acquisition of Greece’s Port of Piraeus, one of the world's most important shipping centers located at the crossroads of Europe, Asia, and Africa. COSCO bought 51% of the port’s operating company in 2016. After a Greek court gave the go-ahead last month, COSCO now can raise its stake in Piraeus to 67%.

The Chinese government does not have an official platform summarizing the overall data for China’s overseas port projects, but publicly available information shows that Beijing now has a foothold in at least 100 ports in 63 countries.

According to data published on the COSCO official website, as of June this year, the group has operated and managed 357 terminals in 36 ports around the world. Its port portfolio has stretched from Southeast Asia to the Middle East, Europe and the Mediterranean.

In addition, China Merchants Group, another major port developer and operator in China, says on its website that the company completed "equity acquisition of eight high-quality ports in Europe, the Middle East and the Caribbean last year alone, expanding the group's global port layout to 27 countries, 68 ports."

In a recent opinion piece published by the Daily Mail, former British Defense and International Trade Secretary Dr Liam Fox and former U.S. National Security Adviser Robert McFarlane noted that China now owns 96 ports around the world. Some of these are at key locations for maritime trade, "giving Beijing strategic dominance without having to deploy a single soldier, ship or weapon."

In 2013, China for the first time surpassed the United States to become the world's largest trading nation. That same year, Chinese president Xi Jinping proposed a strategic framework of what has been dubbed the 21st Century Maritime Silk Road (MSR) - the sea route part of the broader Belt and Road Initiative (BRI).

The specific trade route of MSR connects China to Southeast Asia, Africa, and even Europe by sea. Chinese companies are now owners of all of the major ports along the route.

Dr. Sam Beatson of Nottingham University Business School says it makes sense for China to be engaging in these deals given the volume of containers China continues to deliver at accelerating rates of growth. "China's ports, shipping and maritime trade industry is strategic in part because of its massive size and global role, not only the huge numbers it employs and its role as a national industry that has championed the growth of many of China's largest coastal cities," he told VOA.

The most Mahanian country

Over a century ago Captain Alfred Thayer Mahan, one of the most influential American writers of his day, designated seaports as one of three pillars of sea power. His writing argued that Britain’s control of the seas was critical for its emergence as a dominant global power. The view heavily influenced American policymakers.

"Since the Cold War, China has bought into the Mahanian construct wholesale," James R. Holmes, the J.C. Wylie Chair of Maritime Strategy at the U.S. Naval War College told VOA. "It is safe to say he's more popular in China today than anywhere else in the world."

Reports by official Chinese media in recent years show that since 2013, Chinese president Xi Jinping has visited a port almost every year, including the visit to the port of Piraeus in 2019, where China's MSR and BRI connect and a project that Xi personally pushed for with Greek leaders multiple times, according to China's official Xinhua News Agency.

China experts believe that establishing ports in geo-strategically important countries, including those that are located near maritime chokepoints, are central to Beijing’s global strategy. "These port linkages allow Beijing to exert political influence not only in the country hosting the port, but in many cases the surrounding countries as well," Craig Singleton, a China expert at the Foundation for Defense of Democracies, told VOA.

Holmes, a former U.S. Navy officer, noted prosperity is the top priority for any government. And Beijing’s port investments mean it can hold a large portion of a country's prosperity hostage, compelling its leadership to take political stances agreeable to the Chinese Communist Party. "So, seaports are a critical enabler for China's bid for commercial, diplomatic, and military influence."

Beatson, who lecturers in the department of risk, finance and banking at Nottingham University, pointed out that among all the deals, "neither governments nor companies within countries seem to want to block control of their ports by companies from China - I highlighted this in 2017 I think when pointing out the role of China Merchant Group in ownership of Houston and Miami ports through the joint venture with France's Terminal Links."

As commercial ports could be used for military purposes, analysts have long been concerned about the security implications of ports controlled by Beijing.

China's first overseas military base was established at the port of Djibouti situated at the entrance to the Red Sea and the Suez Canal. "China’s militarization of its port project in Djibouti serves as a warning vis-à-vis Beijing’s port interests in other countries, such as Tanzania, the United Arab Emirates, Pakistan, and Burma, among others," said Singleton.

One of the thorniest issues between the U.S. and Israel in recent years has been the Chinese takeover of Haifa Port, place where the Sixth Fleet of the US Navy docks. Washington feared that the port would provide an opportunity for Chinese surveillance.

Dr. Eyal Pinko, a former Israeli intelligence officer pointed out that the port can easily be used to collect naval intelligence. “You can track the whereabouts of ships and communications. Once you own and operate the port site, these are very easy to do. You can do whatever you want. You are the landlord there," he told VOA in a telephone interview.

No comments:

Post a Comment

Comments always welcome!