China's Big Businesses Risk Trump's Punishment Over North Korea

By and- President Donald Trump’s administration is looking for ways to pressure North Korea to stop developing a nuclear-weapons program, and some American analysts warn that the search may end on the doorsteps of China’s biggest oil companies and banks.

China is North Korea’s largest trading partner, playing a vital role in keeping Kim Jong Un’s regime afloat. Two-way trade increased about 11 percent to $2.55 billion in the first half of 2017, compared with a year earlier.

The U.S. successfully lobbied for stricter UN sanctions against North Korea this month, and the Treasury Department on Aug. 22 sanctioned Chinese and Russian entities it accused of assisting Kim’s development of nuclear weapons and ballistic missiles. U.S. prosecutors also want to recover $11 million from companies based in China and Singapore that they accused of conspiring with North Korea to evade sanctions.

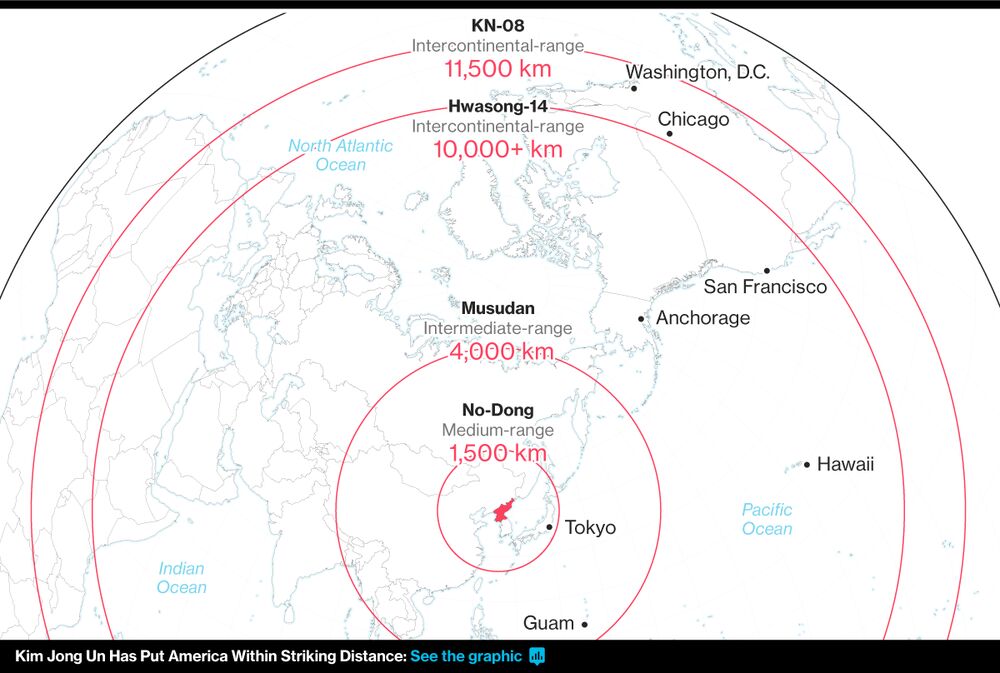

Time’s running out for the U.S. to stop North Korea from getting a nuclear-tipped intercontinental ballistic missile.

Source: Bloomberg

So far, the U.S. is seeking to punish relatively minor companies such as Dandong Chengtai Trading Ltd., which is accused of laundering money for North Korea. But there’s reason for Chinese officials to worry that the America may go after major state-owned enterprises and banks, such as China National Petroleum Corp. and Bank of China.

“We have the ability to say, ‘Any Chinese SOE that we consider relevant is fair game,”’ said Derek Scissors, resident scholar at the conservative-leaning American Enterprise Institute in Washington. “We haven’t even gotten close to the economic coercion we’re capable of.”

Bigger Game

Yet that coercion might unleash a trade war between the two biggest economies that would affect everything from soybeans to smartphones. China is the U.S.’s largest trading partner, with $578.6 billion in two-way trade last year, according to the Office of the U.S. Trade Representative.

“The Trump administration is saying to the Chinese, ‘If you don’t work with us in New York, we will do a lot more of these secondary sanctions and not just against small fry, but also big companies,”’ said Gary Samore, former coordinator for arms control and weapons of mass destruction in the Obama White House.

While other former advisers in the administrations of Presidents George W. Bush and Barack Obama advocated additional sanctions at a Senate hearing in May, the U.S. is wary of escalating too far.

“If we were to impose penalties on really big Chinese financial institutions, it would have major economic consequences on the U.S.,” said Samore, who is now executive director for research at Harvard University’s Belfer Center for Science and International Affairs.

Confronting high-profile institutions like the Bank of China would be “a big damn deal,’’ said Richard Nephew, senior research scholar at Columbia University’s Center on Global Energy Policy and a former Obama sanctions official. “Those kinds of bigger sanctions are ones being avoided by this administration because they have bigger fish to fry.”

The most dramatic step would be for the U.S. to punish companies for supplying oil to North Korea. China sends at least 1 million tons of crude to its reclusive neighbor every year, accounting for almost all its supply.

Economy’s Fuel

Most of those exports are from state-owned China National Petroleum Corp., said Kim Kyung Sool, a senior research fellow at the Korea Energy Economics Institute. CNPC is the controlling shareholder of PetroChina Co., a Hong Kong-listed company with investors such as JPMorgan Chase & Co., Blackrock Inc. and Citigroup Inc.

“Suspending China’s crude exports to North Korea will be the ultimate card we have,” said Ahn Chan-il, a North Korean defector who is president of the World Institute for North Korea Studies in Seoul. “The nation would virtually come to a stop.”

CNPC declined to comment Thursday.

Go Time

Similarly, the U.S. could sanction state-owned Chinese banks. In November, the Obama administration announced rules to prevent North Korean banks and front companies from having improper access to the U.S. financial system. In June, the Treasury Department followed up by blacklisting Bank of Dandong, a small Chinese institution it said was a venue for North Korean financial activity.

Now it’s time to threaten bigger Chinese banks, said Anthony Ruggiero, a senior fellow at the Foundation for Defense of Democracies, a conservative think tank in Washington. That could pressure China’s leadership to crack down on North Korean business within China, he said.

A wider net of U.S. sanctions could ensnare the Industrial and Commercial Bank of China, China Construction Bank and other big institutions that operate in the U.S., where they help smaller counterparts do dollar transactions, Ruggiero said. Chinese banks that conduct business benefiting North Korean state companies risk access to the U.S. financial system even if they do it unknowingly.

“Medium or large Chinese banks are now under an obligation, if they value their U.S. dollar relationships, to ensure that these transactions don’t occur,” Ruggiero said. “That’s really where the next level can be.”

ICBC and China Construction Bank declined to comment.

While the potential of sanctioning bigger Chinese entities is real, the practicality is uncertain. China’s foreign ministry on Aug. 23 criticized the latest moves by U.S. prosecutors in Washington, calling them the “wrong methods,” and saying China can use its own laws to punish violators.

“China is opposed to unilateral sanctions outside the UN Security Council’s framework, especially countries’ exercising long-arm jurisdiction, in line with their domestic law, on Chinese domestic entities or individuals,” Hua Chunying, a ministry spokeswoman, said in Beijing.

President Xi Jinping has several ways to retaliate against the U.S., creating the possibility of an all-out trade war between the two biggest economies. Apple Inc., Boeing Co., Starbucks Corp. and Westinghouse Electric Co. would be among the biggest U.S. companies at risk.

That also would come at the expense of U.S. efforts to address issues such as China’s trade surplus or the state of intellectual property rights there. Trump has unveiled a 100-day action plan pledging to “use every tool” against alleged foreign trade abuses.

China supported the UN sanctions adopted Aug. 5 that ban North Korean exports of coal, iron ore, lead ore and seafood. Those were seen as a way to de-escalate tensions. Yet China’s in no hurry to see the Kim regime fall, fearing an ensuing refugee crisis and the positioning of U.S. troops on its border.

“China is not a small country that you can just squeeze and it will do whatever,” said Yuan Zheng, a senior fellow at the Institute of American Studies in the Chinese Academy of Social Sciences, a government think tank. “China won’t accept it and will take measures in response. The whole atmosphere of U.S.-China relations will get worse.”

No comments:

Post a Comment

Comments always welcome!