Economist: The Canadian Dollar's Demise 'Couldn't Have Happened at a Worse Time'

Canada's consumers are in a bind.

Bloomberg

Goofy

December 21, 2015

Goofy

December 21, 2015

The U.S. greenback broke above $1.40 vs. the Canadian dollar late last week in the wake of softer-than-expected inflation and wholesale sales prints north of the border.

And according to Scotiabank Economist Derek Holt, the timing of the loonie's slump is abysmal as it drains debt-laden households' purchasing power precisely when big-ticket purchases, of such items as homes and autos, are running at all-time highs. And the higher they are, the farther they could potentially fall.

"The currency's plunge couldn't have happened at a worse time for the country’s household sector," Holt lamented in a note published Friday. "When a currency declines as CAD has alongside a deep negative terms of trade shock, it is among the mechanisms through which markets price a large wealth transfer out of the country to the regions of the world that are large net importers of commodities."

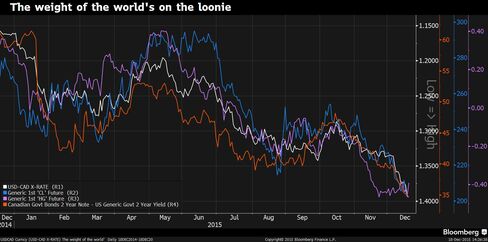

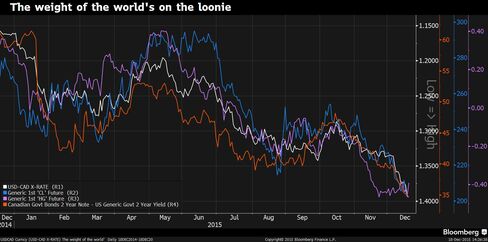

Looking at oil prices (the largest source of the terms-of-trade shock), copper prices (a channel through which the loonie is treated as a proxy for Chinese and global economic activity), or interest rate differentials between Canada and the U.S. (which incorporates the other two factors into the forward outlook for monetary policy), it's no surprise that the loonie's wings have been clipped:

Bloomberg

This loss of national wealth necessarily dampens the outlook for Canadian consumer spending, concluded Holt.

Real retail sales growth has slid from 3.8 percent year over year at the end of 2014 to 0.9 percent as of September. Current dollar retail sales in Newfoundland, Saskatchewan, and Alberta have declined on an annual basis. In those commodity-producing provinces, hits to employment in resource extraction have compounded the deleterious effect that a lower currency has on households' aggregate purchasing power.

Import compression has occurred, Holt acknowledged, with real volumes shrinking in back-to-back quarters, but import substitution—making goods or services domestically that were previously produced by foreigners—might not be in the cards.

"Canada doesn’t produce at home many of the consumer goodies that are desired especially on the bigger ticket side of the equation," he wrote. "It is also unlikely to start doing so."

In some respects, the macroeconomic backdrop in Canada is similar to that of the mid-1990s. One major segment of the economy is overextended and in need of deleveraging. Back then it was the government; now it's households. The loonie had softened, and external demand from a buoyant U.S. was—and is once again—required to help smooth the transition process.

Unfortunately for Canada, the Boy Meets World era is over.

Mexico happened to be in a particularly rough patch in the mid-’90s (remember the Tequila Crisis?), which indirectly helped support the expansionary austerity that took place in the Great White North.

The depreciation dividend, in terms of cashing in on U.S. demand, isn't expected to yield as much for Canada this cycle. That's a function of structural shifts in U.S. noncommodity imports, withCanada's shipments to the world's largest economy stagnatingwhile Mexico's have picked up steam. Currency fluctuations have done nothing to boost Canadian competitiveness in this regard, as the loonie and peso have lost almost exactly as much value relative to the greenback since the start of 2014.

"It adapted, restructured, and became more competitive and its currency enables it to grow import market share in the U.S.," wrote Holt of Mexico.

Moreover, the part of the economy in need of deleveraging this time around—households—is substantially larger.

"When judging the hit to the household sector there are two things to bear in mind: the starting point on the equilibrium matters enormously and that points to record highs across everything we can track by way of consumer and housing metrics," wrote Holt. "When your nation’s consumers have spent to the max because their purchasing power in world markets became so strong and then sharply weakened, the scope for significant downside risks cannot be ignored."

No comments:

Post a Comment

Comments always welcome!