A rash of bankruptcies hits Chinese lenders backed by state firms

The government struggles to control the firms it owns

THE Communist Party dominates China’s economy and uses state-run companies, which it controls with an iron fist, to enforce its diktats. Or so the theory goes. Reality is messier: the party often struggles to monitor state-owned enterprises (SOEs), let alone to get them to toe its line. As it convenes its five-yearly congress, one of the financial system’s dodgiest corners has served up a reminder of the limits to its power.

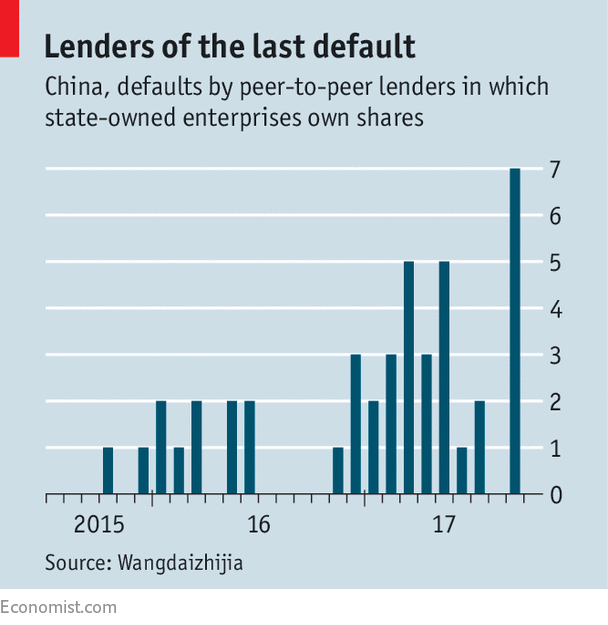

In the past two months at least seven online lenders backed by SOEs have collapsed. It was a business none should have been in, far removed from the industries they were supposed to focus on. The money potentially lost is trivial—roughly 1bn yuan ($150m), compared with government assets worth more than 100trn yuan. Still, these cases highlight how hard it is for the party to stamp its authority on the vast state sector.

The troubled SOEs include distant subsidiaries of the national nuclear company, an aviation company and a big energy company in Shanxi, a northern province. They had acquired stakes, from as little as 20% up to 100%, in online peer-to-peer (P2P) lending platforms.

They were “marriages of convenience”, says Joe Zhang, chairman of China Smartpay, a financial-services company. The P2P firms got instant credibility; SOEs, many of them struggling, eyed quick profits. Some will have done well from the P2P boom: industry-wide loans have increased more than 30-fold since January 2014, to 1.1trn yuan. Yet this frenzied activity has also left problems in its wake. On average more than 100 P2P firms have failed each month since early 2015, some because of mismanagement, others victims of outright fraud.

Investors imagined SOE-backed platforms would be safer. Jinsu Online, a P2P lender backed by a subsidiary of the China National Nuclear Corporation, said its backer would guarantee all its funds. Lala Wealth, backed by a subsidiary of the Aviation Industry Corporation of China, vowed that its SOE shareholders would make it stronger. Both went into default last month. In the former case, the SOE had denied any involvement before the collapse; in the latter the SOE said it, too, was a victim.

The body that regulates China’s state firms warned them last year to stay clear of P2P, fearing that online lenders would exploit their reputations. But industry data show an increase in the number of P2P firms with SOE shareholders since then of a third, to nearly 200.

It seems odd that the government has such weak control over SOEs, given President Xi Jinping’s tightening grip on China’s economy. But more than 100,000 companies technically count as SOEs. Most are owned by local governments. Moreover, as many as five layers of ownership have separated those that invested in P2P lenders from their parent groups; many also include private businesses as large shareholders. An optimistic conclusion is that these collapses might teach investors to think twice before assuming that the state always stands behind SOEs, however risky. A worrying one is that many still rely on such support.

No comments:

Post a Comment

Comments always welcome!