Wal-Mart slumps on warning,dollar falls after weak US retail sales - as it happened

Wednesday 14 October 2015

Stock markets slide again

Investors suffered another bruising day, with shares falling sharply as global growth concerns continued to weigh on sentiment. It started off badly with weak Chinese inflation figures, adding to recent concerns about a slowdown in the world’s second largest economy.

Then came disappointing US retail sales, followed by news of a warning on earnings from Wal-Mart, which sent US markets sharply lower and added to the generally downbeat mood. The final scores showed:

- The FTSE 100 finished 72.67 points or 1.15% lower at 6269.61

- Germany’s Dax dropped 1.17i% to 9915.85

- France’s Cac closed down 0.74% at 4609.03

- Italy’s FTSE MIB fell 0.95% to 21,838.20

- Spain’s Ibex ended 0.77% lower at 10,037.6

- In Greece, the Athens market dipped 0.32% at 676.13

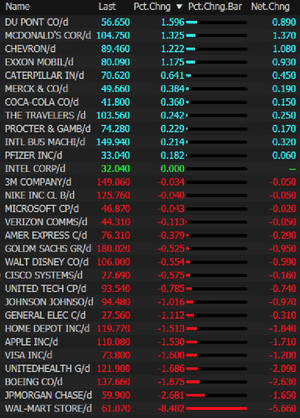

On Wall Street the Dow Jones Industrial Average is currently down 116.25 points or 0.68%. Here are the main movers - with Wal-Mart the standout loser after its warning on earnings:

On that note, it’s time to close up for the evening. Thanks for all your comments and we’ll be back tomorrow.

— Downtown Josh Brown (@ReformedBroker)October 14, 2015

Wal-Mart's really taking this "Everyday Low Prices" thing pretty far...pic.twitter.com/mQ6xjjkdmC

Here’s AP’s take on the Wal-Mart warning:

Wal-Mart said it expects profit to fall for its next fiscal year and cut its sales outlook for this year as it works to fend off intensifying competition and perk up stores with better customer service.The world’s largest retailer said it expects sales growth to be flat for this fiscal year, as it faces unfavorable currency exchange rates. The company had previously forecast sales growth of 1 to 2%.The disappointing guidance comes as Wal-Mart faces a tough economy and pressure from rivals including traditional grocers, dollar stores and Amazon.com. At its annual investor meeting in New York City on Wednesday, chief executive Doug McMillon sought to reassure [them] the company is working to transform in a rapidly changing retail landscape.“We all know that retail has changed and will continue to change at an accelerating pace,” said McMillon, who took the job in February 2014.

Under McMillon, Wal-Mart has accelerated the pace of smaller store openings and stepped up its e-commerce efforts. The company is spending $1.2 billion to $1.5 billion in online investments for the current fiscal year, up from last year’s $1 billion.Such investments are expected to take a toll on profit in the near term, the company said. For its fiscal 2017, it said it expects earnings per share to be down 6 to 12 percent. That also reflects its investment in keeping its prices low and raising wages for workers, Wal-Mart said.By fiscal 2019, it expects earnings per share to be up 5 to 10 percent from this year.The company had lowered its profit forecast for this fiscal 2016 in August, saying it expects earnings to be between $4.40 and $4.70 per share, down from $4.70 to $5.05 per share.The company also authorized a $20 billion share buyback program for the next two years.Google plus Google plus Google plus

Wal-Mart shares slump on earnings warning

Wal-Mart shares are on track for their worst daily performance in more than 17 years.

They have fallen around 9% after the company told CNBC the strong dollar was likely to knock some $15bn off its full year revenues and then warned on earnings.

The world’s largest retailer gets around a third of its revenue - which totalled $485bn last year - from outside the US.

In a presentation to investors, it said that expenditure on its US and e-commerce businesses - including wages and training - would mean a 6% to 12% fall in earnings per share in 2017. But by 2019 it expected earnings growth of 5% to 10% compared to the year before.

Analysts had been expecting earnings growth of around 4% in 2017.

Another vote for a likely US rate rise in December despite the recent run of disappointing data comes from Unicredit Research. Economist Dr Harm Bandholz said:

While the headline number matched our (below-consensus) forecast, the downward revision to the August figure and the unexpected decline in core retail sales were a disappointment. Against this backdrop, it might be tempting to conclude that global headwinds have finally spilled over to the US consumer and that financial market volatility has taken its toll. We, however, disagree and rather see the September data as an outlier in series of very strong consumption reports.

While the headline number matched our (below-consensus) forecast, the downward revision to the August figure and the unexpected decline in core retail sales were a disappointment. Against this backdrop, it might be tempting to conclude that global headwinds have finally spilled over to the US consumer and that financial market volatility has taken its toll. We, however, disagree and rather see the September data as an outlier in series of very strong consumption reports.

But while today’s report does not impact our fundamental outlook for consumer spending, it certainly does increase the downside risks to GDP growth in the third quarter of 2015 . We already knew that inventories and trade have most likely been significant drags on growth in the summer... But with today’s weaker data the contribution from consumer spending will be smaller than hoped for...The Fed is certainly taking note of these developments, but it is not going to overemphasize them. Most Federal Open Market Committee members have already acknowledged that the third quarter of 2015 will be weaker due to the inventory correction. And...consumer spending kept its solid momentum throughout the summer.We therefore think that the upcoming two employment reports will be more important for the timing of the liftoff than the third quarter GDP number. And as we anticipate some improvement in payroll gains and a further decline in the unemployment rate, we continue to expect the first 25 basis point rate hike for December.

The weak US retail sales numbers make it even more unlikely the Federal Reserve will raise rates this month, with only a strong jobs figure in November likely to prompt an increase in December, according to ING. The bank’s James Knightley said: US retail sales are disappointing, rising just 0.1% month on month in September versus 0.2% consensus while August’s growth rate was revised down two-tenths of a percent to flat. The control group is down 0.1% versus +0.3% consensus with another two-tenth downward revision to August. This control group supposedly better matches consumer spending numbers that feed through into GDP. We had been looking for much better numbers given the firm consumer confidence data and robust auto volume sales.

Looking in the details auto sales did rise 1.8% month on month but there were falls in electronics, building materials, grocery stores and general merchandise with a substantial 3.2% decline in gasoline station sales. This latter figure is due to price falls, but even so there is very little to be positive about in this report.Meanwhile, the PPI report showed a distinct lack of inflation pressures with headline prices falling 0.5% month on month versus a -0.2% consensus prediction with the core rate – excluding food and energy – falling 0.3% versus an anticipated +0.1%.These reports reinforce the view that the Federal Reserve won’t be doing anything later this month with analysts (including us) predicting a December rate hike really needing to see a very strong labour report next month to give them any confidence the Fed will hike in December.

Neil Saunders, chief executive of retail consultants Conlumino, says the US retail sales figures are actually not that weak, once petrol sales are stripped out: While September cannot be described as a stellar month for retail, it is encouraging to see growth picking up after a very weak August. Across all categories sales rose by 2.5% on a year-over-year basis, this compares favorably to 1.4% in August.

Overall growth was dragged down by the lower price of gas, which resulted in sales at gas stations plummeting by 20%. When these are removed from the equation, retail sales increased by a robust 5.2%, with particularly strong performances coming from the auto and foodservice segments. The numbers are all the more impressive given that the comparatives from last year are fairly tough, mostly thanks to the boost to household finances that started to filter through in September 2014 due to the lower cost of fuel.Within core retail, performance across the categories remains uneven. The home related sectors continue to forge ahead, helped by reasonable levels of activity within the housing market. However, electricals remains very sluggish with a 5.2% decline in sales over last year; that said, we expect this to reverse as new consumer electronics products are released in time for the holiday season. On a more positive note, clothing saw an upswing this month with year-over-year growth of 5%, aided by the boost to household budgets as well as a colder, wetter period of weather across many parts of the country which fuelled sales of fall collections.Without robust growth in the underlying fundamentals of the consumer economy, sales over the next few months will be dependent on the direction of gas prices: these will make the difference between a reasonable and a good holiday season for retailers.”

No comments:

Post a Comment

Comments always welcome!