Cash-rich Chinese property investors are increasingly active in key destinations, new data shows.

They are searching for and snapping up homes in America, the UK, the United Arab Emirates and many other leading markets.

Their number one target is the United States, with agents in San Francisco (pictured) and Los Angeles flying in groups of up to 50 Chinese investors at a time to buy property.

Robert Pearce, Director of Hong Kong-based Blackfish, which markets properties in San Francisco, Los Angeles, Dallas/Austin/Houston and New York City, says, “The Chinese end up buying property as well as top brands like Chanel. What do mainland Chinese have? Cash.”

The Asia Society says the state is the number one target for Chinese buyers, “According to survey data, they exceeded $9 billion in the year to March 2012, making them the second largest group of foreign buyers behind Canadians. Not surprisingly, California’s large Chinese and Chinese-American communities, top-flight higher education, and attractive lifestyles make the state the number one destination.”

The west coast state has the biggest Chinese population in the United States and accounts for more investment deals from China than any other, adds fellow Blackfish Director Charlie Rosier.

Andrew Gates, international realty associate broker at Sotheby’s, New York, says, “The Chinese go to the US for their children to be near schools and universities, clean air, and the American lifestyle, which continues to be highly aspirational for Chinese buyers.”

Gregory Karns, a partner at US law firm Cox, Castle & Nicholson, says, “These Chinese groups see a flattening of their [domestic] market, and are looking to the US and California for greater returns.”

Chinese property investment website Juwai.com confirms that US leads 35 other countries worldwide as the most-searched market by mainland Chinese. New York is the most popular destination, followed by San Francisco, Palo Alto, Los Angeles and Orange County.

The other most popular countries are Australia, the UK, Singapore and Canada.

Chinese investors targeting the UK market are increasingly looking to Manchester, as well as London.

From January-August 2013, searches, page views, inquiries and search results for Manchester on Juwai.com climbed 171%.

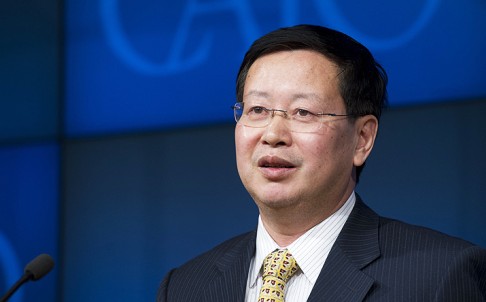

Andrew Taylor, Co-CEO of Juwai.com, tells OPP Connect, “Manchester ticks all the boxes for Chinese investors. The three things most Chinese real estate investors look for are investments that will protect and build capital or income, property their children can live in while studying abroad and a desirable place to immigrate to.”

And he says interest from Chinese investors in overseas property will continue to grow. “The surge of Chinese real estate investing in the UK is only just beginning. The trends show that the number and the wealth of Chinese investors will grow rapidly in coming years.

“In most of the national media in the UK, all you hear about is London, London, London. It’s true that London is the most important destination for Chinese investors, but Manchester is also in the top three.”

Manchester is the third most popular city for UK investors searching on Juwai.com, but London, by far the most popular, has remained in first place for the entire first eight months of the year. The top five destinations in the Manchester metropolitan area are the city centre, Salford, Cheetham Hill, Droylsden and Levenshulme.

“The fact that central Manchester attracts the majority of interest shows that other areas need to improve their marketing efforts so that Chinese buyers understand the value and attractive proposition that they offer,” adds Mr Taylor.

Dubai also remains popular with Chinese buyers who are tempted by rental yields of up to 10% at developments such as International City and Discovery Gardens, according to The National website.

Developer Nakheel has hired Chinese-speaking agents to field sales inquiries from Chinese investors buying homes at its Warsan development announced last month.

“We are seeing a lot of people from China buying for the first time in Dubai – it’s the first time we’ve seen that,” says Nakheel Chairman, Ali Rashid Lootah.

Atomic Properties Sales Agent, Hai Rong Xiao says property available for US$1,500 per square metre in International City, Dubai might fetch US$2,000 in a comparable area in China. “In China, prices have reached the ceiling. In Dubai, they are rising by the day.”