Ottawa is investigating controversial foreign worker permits that will allow

as many as 201 Chinese miners to work a proposed project in northern British

Columbia, a government spokeswoman confirmed Tuesday.

http://www.theglobeandmail.com/news/british-columbia/ottawa-joins-bc-in-probing-coal-miners-foreign-worker-permits/article4773274/

Keeping an eye on Communist, Totalitarian China, and its influence both globally, and we as Canadians. I have come to the opinion that we are rarely privy to truth regarding the real goal, the agenda of China, it's ambitions for Canada [including special focus on the UK, US & Australia]. No more can we trust the legacy media as there appears to be increasing censorship applied to the topic of communist China. I ask why. Here is what I find.

Wednesday, October 31, 2012

Our Government Commits Treason Nov 1st

Treason

CP | By Julian Beltrame, The Canadian Press Posted: 10/17/2012 4:44 pm Updated: 10/17/2012 6:08 pm

OTTAWA - The federal government has rejected demands for public hearings on its investment protection agreement with China, leaving the controversial deal even supporters say is far from perfect on a fast track to ratification.

Opposition critics say the haste to ratify a deal that took 18 years to negotiate in just 21 sitting days — and without hearings — leaves Canada vulnerable to costly surprises down the road.

"The Conservative government measures success by how fast they can sign agreements, they are putting speed ahead of quality," said NDP trade critic Don Davies, whose request to hold public hearings on the Foreign Investment and Protection Agreement (FIPA) to the Commons trade committee was rejected by government members this week.

"We all agree that close economic relations with China is a desirable thing, but not at the expense of a bad deal."

Instead, MPs on the committee will be given a briefing — for one hour — by department officials on Thursday. No independent witnesses will be called.

A spokesman for Ed Fast said the trade minister was not available for an interview, but noted MPs can always debate the treaty in days allotted to the opposition in the Commons.

Rudy Husny of Fast's office defended the deal as "very similar to other treaties signed by Canada with other countries" and something Canadian firms have long sought.

The agreement is not wholly reciprocal, say critics, because among other aspects China can place conditions on local preferences, including suppliers and employment, on Canadian investors, while Canada — because of NAFTA obligations — is barred from doing so.

The biggest problem, says Gus Van Harten, an expert on international investment law at Osgoode Hall Law School, is the predominantly one-way direction of expected future investments, meaning Canada will be assuming most of the risks.

"All the other FIPAs Canada has signed is with countries that don't invest in Canada," he explains. "In this treaty, it's fair to conclude that Chinese investment in Canada is very likely to outstrip significantly Canadian investment in China."

The proposed $15-billion acquisition of Calgary-based energy company Nexen Inc. (TSX:NXY) by a Chinese state oil firm is triple the current total investments by Canadian firms in the communist country, and Nexen is "just the edge of the wave" of what is coming, he said.

Van Harten notes that Canada has already been forced to pay about $160 million in compensation to foreign firms for government policies considered to have broken trade rules under NAFTA. The risks are even greater with a FIPA deal with China, a country he says has already shown itself to be litigious.

"You can support FIPAs to support Canadian investors, but this puts us in the sitting duck position because only investors can sue the government, governments cannot sue the investors," he points out.

"This is exactly what China wants if their aim is to acquire major ownership of Canada's resources ... and move them out and be processed in China."

Even some supporters such as Gordon Houlden, a former Canadian diplomat with 22 years in China, agrees the China FIPA is unusual because of its long lifespan and the fact it doesn't give national treatment to new investments. That is not expected to be problematic for Chinese firms looking at Canada, but may not be the case when Canadian firms want a piece of the action in China.

Still, Houlden, who is currently director of the China Institute at the University of Alberta, believes the critics are exaggerating the risks.

China is now one of most desired locations in the world for foreign firms, so its unlikely Canadian investors would be stymied. As well, the deal establishes that disputes will go to international arbitration, taking them out of the hands of notoriously unpredictable Chinese courts.

"I'd say grab it and run with it. If I was investing in a rural province, I'd want a FIPA for protection," he said.

Trade lawyer Lawrence Herman of Cassels Brock judged the deal "not up to the gold standard" but reasonable overall.

"It helps put the business investment relationship into a treaty framework with a set of rules, which helps Canadian investors," he said.

All interesting points, says Davies, and issues that should be studied by the trade committee.

"There are extraordinary and unusual aspects of this FIPA that are raising alarm bells and we think require further examination," he said.

According to the timetable, the deal will be ratified on Nov. 1.

What's In Canada-China Trade Deal?

Opposition critics say the haste to ratify a deal that took 18 years to negotiate in just 21 sitting days — and without hearings — leaves Canada vulnerable to costly surprises down the road.

"The Conservative government measures success by how fast they can sign agreements, they are putting speed ahead of quality," said NDP trade critic Don Davies, whose request to hold public hearings on the Foreign Investment and Protection Agreement (FIPA) to the Commons trade committee was rejected by government members this week.

"We all agree that close economic relations with China is a desirable thing, but not at the expense of a bad deal."

Instead, MPs on the committee will be given a briefing — for one hour — by department officials on Thursday. No independent witnesses will be called.

A spokesman for Ed Fast said the trade minister was not available for an interview, but noted MPs can always debate the treaty in days allotted to the opposition in the Commons.

Rudy Husny of Fast's office defended the deal as "very similar to other treaties signed by Canada with other countries" and something Canadian firms have long sought.

The agreement, whose details were first revealed on Sept. 26, has faced opposition from civil society groups such as the Council of Canadians, but also from non-aligned voices.

Critics have directed their fire at some unusual aspects of the FIPA, including an effective 31-year lifespan — by comparison NAFTA can be cancelled on six months' notice — and failure by Canadian negotiators to received "national treatment" for prospective new investments into China. Existing Canadian investors are guaranteed treatment no worse than domestic Chinese firms under the deal.The agreement is not wholly reciprocal, say critics, because among other aspects China can place conditions on local preferences, including suppliers and employment, on Canadian investors, while Canada — because of NAFTA obligations — is barred from doing so.

The biggest problem, says Gus Van Harten, an expert on international investment law at Osgoode Hall Law School, is the predominantly one-way direction of expected future investments, meaning Canada will be assuming most of the risks.

"All the other FIPAs Canada has signed is with countries that don't invest in Canada," he explains. "In this treaty, it's fair to conclude that Chinese investment in Canada is very likely to outstrip significantly Canadian investment in China."

The proposed $15-billion acquisition of Calgary-based energy company Nexen Inc. (TSX:NXY) by a Chinese state oil firm is triple the current total investments by Canadian firms in the communist country, and Nexen is "just the edge of the wave" of what is coming, he said.

Van Harten notes that Canada has already been forced to pay about $160 million in compensation to foreign firms for government policies considered to have broken trade rules under NAFTA. The risks are even greater with a FIPA deal with China, a country he says has already shown itself to be litigious.

"You can support FIPAs to support Canadian investors, but this puts us in the sitting duck position because only investors can sue the government, governments cannot sue the investors," he points out.

"This is exactly what China wants if their aim is to acquire major ownership of Canada's resources ... and move them out and be processed in China."

Even some supporters such as Gordon Houlden, a former Canadian diplomat with 22 years in China, agrees the China FIPA is unusual because of its long lifespan and the fact it doesn't give national treatment to new investments. That is not expected to be problematic for Chinese firms looking at Canada, but may not be the case when Canadian firms want a piece of the action in China.

Still, Houlden, who is currently director of the China Institute at the University of Alberta, believes the critics are exaggerating the risks.

China is now one of most desired locations in the world for foreign firms, so its unlikely Canadian investors would be stymied. As well, the deal establishes that disputes will go to international arbitration, taking them out of the hands of notoriously unpredictable Chinese courts.

"I'd say grab it and run with it. If I was investing in a rural province, I'd want a FIPA for protection," he said.

Trade lawyer Lawrence Herman of Cassels Brock judged the deal "not up to the gold standard" but reasonable overall.

"It helps put the business investment relationship into a treaty framework with a set of rules, which helps Canadian investors," he said.

All interesting points, says Davies, and issues that should be studied by the trade committee.

"There are extraordinary and unusual aspects of this FIPA that are raising alarm bells and we think require further examination," he said.

According to the timetable, the deal will be ratified on Nov. 1.

Loading Slideshow

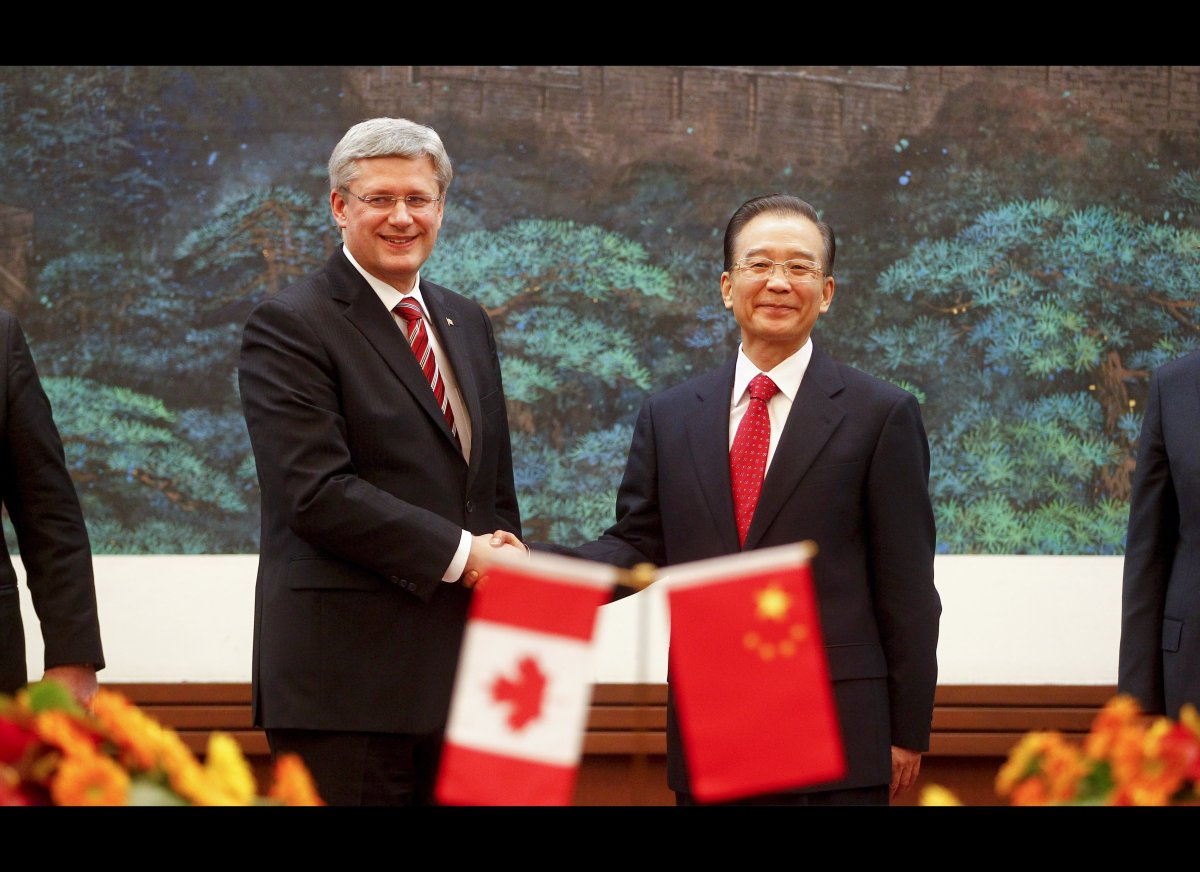

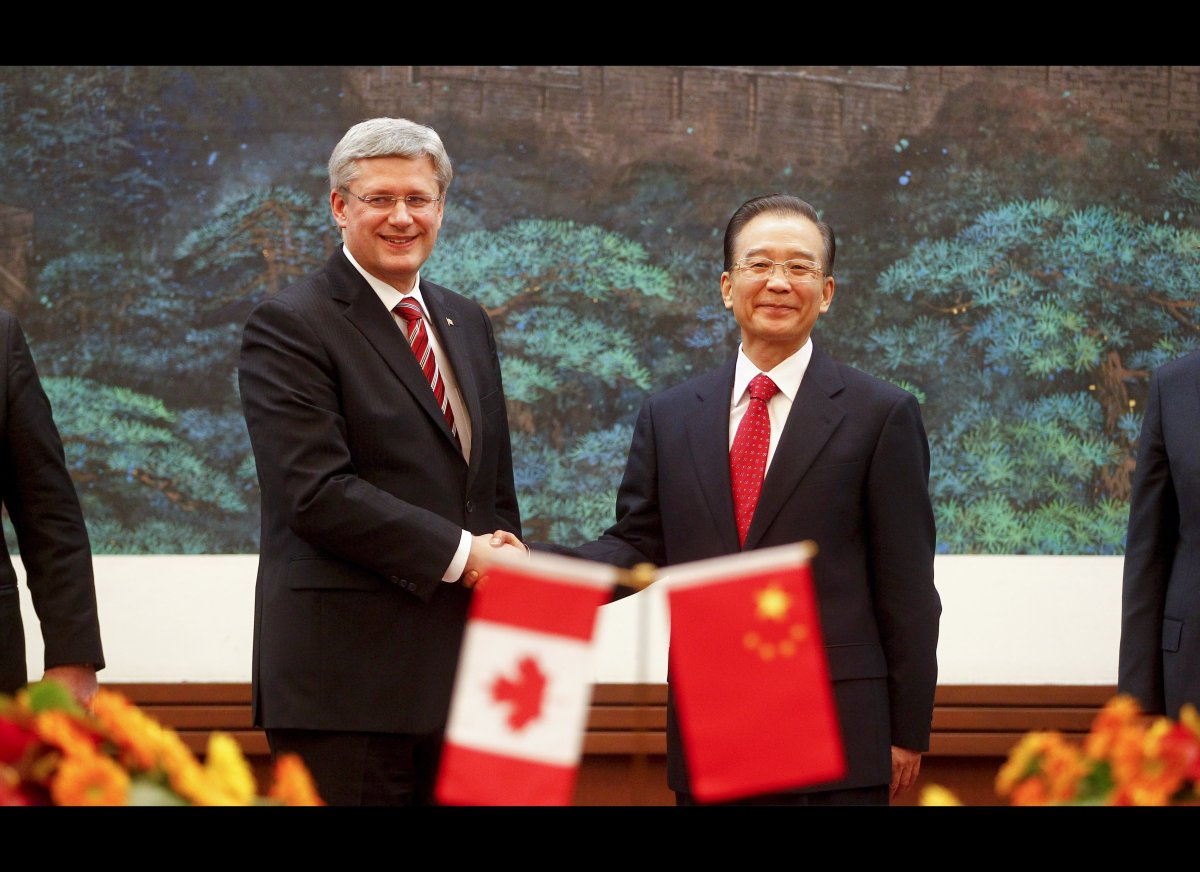

Here are a few details of the major investment deal coming soon between Canada and China, as well as a list of what CBC chief political correspondent Terry Milewski calls a "small blizzard of incremental agreements," signed in Beijing. <em>With files from CBC</em>. (Diego Azubel-PoolGetty Images)The Big One: FIPA

Prime Minister Stephen Harper called the foreign investment promotion and protection agreement (FIPA) between Canada and China the first "comprehensive economic agreement" between the two countries. In fact, what was signed by Harper and Chinese Premier Wen Jaibao in Beijing is not the final deal, but a declaration of intent: Now it must be legally reviewed and ratified by both governments, which for Canada will mean a debate in the House of Commons. Once both countries complete this process, it will need to be formally signed to take effect. This deal will protect Canadians investing in China, as well as Chinese investors in Canada, from "discriminatory and arbitrary practices." Once in place, investors can have more confidence that rules will be enforced and valuable business deals will be subject to predictable legal practices. Harper told reporters in Beijing he "absolutely" expected that it will make a "practical difference." "The agreement does not override existing Canadian law in regard to foreign investment and foreign investment review," Harper said. "Those laws remain in place." Negotiations for this agreement took 18 years, and key players in manufacturing, mining and the financial sectors were consulted to get to this stage. It's not unusual for Canada to have this kind of an agreement with a trading partner. FIPAs are in force with 24 other countries that trade with Canada, and active negotiations are underway with 10 other countries, according to the government's announcement. (Diego Azubel-PoolGetty Images)The 'Blizzard' (By Sector):

(AP Photo/Valentina Petrova)Agriculture

- A new protocol, building on a 2010 agreement to restore Canada's market access to the Chinese market for Canadian beef following the 2003 BSE outbreak and resulting border closures, to allow industrial beef tallow (fat) to be imported for the first time in almost a decade. China used to be Canada's top export market for tallow ($31 million in 2002), and now Canada has a shot at a share of the $400 million in tallow China imports from around the world. - A memorandum of understanding (MOU) on canola research, to address a recent fungal disease in canola and rapeseed that threatens Canada's valuable trading relationship with China in canola. - On Tuesday, Chinese aquaculture feed company Tongwei announced it will increase its purchase of Canadian canola by up to $240 million per year by 2015. (DAVID BUSTON/AFP/Getty Images)Natural Resources:

- A MOU between Natural Resources Canada and the Chinese Academy of Sciences to collaborate on scientific research on sustainable development of natural resources. The government release touts benefits including new technologies for resource firms, carbon emissions reduction strategies, reduced environmental impacts and natural hazards from resource development, and new opportunities for Canadian suppliers of equipment and services. - A MOU spelling out a "framework" for Parks Canada and China's state forestry administration to collaborate and share scientific expertise in the management of national parks, natural reserves and other protected areas. The agreement includes language around ecological restoration, conservation measures for endangered wildlife, wetlands development, and the preservation of forests and wetlands. (<a href="http://www.flickr.com/photos/47096398@N08/" target="_hplink">Flickr: eleephotography</a>)Energy

- A continuation of the MOU, first signed in 2001 and renewed in 2006, on energy co-operation to "engage China on energy issues" through a Canada-China joint working group on energy co-operation, chaired by Natural Resources Canada and China's national energy administration, which is responsible for Chinese energy policy. The working group oversees joint research projects, exchange of expertise, and co-operation between energy companies in both countries, including the promotion of energy efficiency and renewables. It aims to both attract capital investment and improve market access for Canadian energy resources and technology. (MARK RALSTON/AFP/Getty Images)Science and Technology

- Approval of seven projects, valued at $10 million, under the Canada-China framework for co-operation on science and technology and innovation, including: a diagnostic kit for acute kidney injuries, a wind energy seawater desalination system, a waste heat-recovery system to help oil refineries consume less fuel, new solar cells for renewable energy panels, a real-time multi-sensor navigational tracking device for hand-held devices, a blue-green algae bloom warning system and "next generation" large-scale geographic information systems. - Two more calls for proposals, valued at $18 million ($9 million from each country) for joint research under the same framework. These proposals are for the development of "innovations with high commercial potential" in the areas of human vaccines and clean automotive transportation. The Canada-China joint committee on science and technology, made up of individuals from industry, academia and government, sets the priorities and oversees these projects. (To date, 21 projects ranging from nuclear power to AIDS drugs, to clean technologies for pulp and paper have received some $28 million in funding.) (TOSHIFUMI KITAMURA/AFP/Getty Images)Education

- A renewed MOU extending and modifying the Canada-China scholars' exchange program, which has seen 900 students travel between Canada and China since 1973. New eligibility rules and scholarships will be in place for the next round of competitions in 2012, including eight to 12 Canadian scholarships for Chinese professionals and 20 awards for Canadian university students. (<a href="http://www.flickr.com/photos/plutor/" target="_hplink">Flickr: Plutor</a>)

Hide Thumbnails

1 of 9

Getty

Tuesday, October 30, 2012

Desmarais & Li Ka-Shing Etc...things to know

Power Corporation of Canada

International Advisory Council

according to the Annual Report 2003

| |

The Honourable Paul Desmarais, P.C.

Chairman of the Executive Committee

Chairman of the International Advisory Council Canada

|  |

P.C., Q.C.

Counsel

Torys LLP

Vice-Chairman of the International Advisory Council Canada

Former Premier of Ontario

On the Board of Directors of the Pierre Elliott Trudeau Foundation

Junichi Amano

Senior Corporate Advisor

Nihon Unisys, Ltd.

Japan

Dwayne O. Andreas

United States of America

Lord Armstrong of Ilminster

Former Secretary of the Cabinet and Former Head of the Home Civil Service

United Kingdom

Chairman The Andrea and Charles Bronfman Philanthropies

Chairman of the Board

Koor Industries Ltd.

United States of America

Gustavo A. Cisneros

Chairman and Chief Executive Officer

Venezuela

Director Barrick

Michael Francois-Poncet

Vice Chairman

France

Baron Frere

Chairman

Belgium

Haas, Pierre

Honorary Chairman

Paribas International

France

F. Ross Johnson

Chairman

RJM Group Inc.

United States of America

Donald R. Keough

Chairman

Allen & Company Incorporated

United States of America

Andre, Levy-Lang

Former Chairman of the Board of Management

Paribas

France

The Right Honourable Donald F. Mazankowski, P.C.,

Company Director

Canada

Senior Partner

Canada

Chairman of Quebecor World Inc, part of Quebecor

Member of the Board of Trizec Properties, Inc.

Member of the Board of AOL Latin America

Member of the International Advisory Councils of: CITIC

General Enterprise Management Services Limited

Sylvia Ostry, C.C.

Distinguished Research Fellow

Centre for International Studies

University of Toronto

Canada

Moeen Qureshi

Chairman

Emerging Markets Partnership

United States of America

Schmidt, Helmut

Former Chancellor of Germany

Publisher, Die Zeit

Germany

The Honorable Paul A. Volcker

Former Chairman

Federal Reserve Board

United States of America

NEW YORK - Paul Volcker man tapped by the United Nations to lead a probe into the troubled Oil-for-Food program, has potentially too-close-for-comfort ties to companies he's supposed to be investigating. (Fox) PREVIOUS: Next crisis at UN may involve ties of Volcker, Strong Questions for Paul Volcker UN didn't ask Volcker to disclose finances The Volcker Oil-for-Food Commission: Is it credible?

Wei Ming Yi

Chairman of the International Advisory Council

CITIC Group

People’s Republic of China

The CITIC Group is the state owned conglomerate that oversees the Chinese government's international investments. It was founded by Li Ka Shing and Henry Fok. Li Ka-shing one of the world's richest men, is the owner of Hutchison Whampoa Limited and has been involved in such business activities as the Panama Canal, Suez Canal, and various other business deals of a global nature. The relationship between his communications companies like Hutchison Telecommunications and their part in Internet censorship in China is at this time a question. CITIC Pacific is part of this CITIC group and Paul Desmarais is a board member and is reported to have 4% of the shares. CITIC is one of the 5 companies along with Minmetals that bid for Noranda. The parent company of Noranda is Brascan, owned by the Bronfmans. Charles R. Bronfman (see listing above) is also part of this advisory council. The chairman of Noranda is Trevor Eyton, Conservative Senator, appointed by Brian Mulroney (see listing above).

Wei Ming Yi also sits on the International Advisory Board of MMC: Marsh & McLennan Companies, Inc along with John R. Evans, the Chairman of Torstar Corporation who own the Toronto Star among other newspapers and media and part of Sing Tao Daily the pro communists Chinese newspaper. John R. Evans is also the chair of Canada Foundation for Innovation (CFI).

Subscribe to:

Comments (Atom)