China’s Recent Engagement in Latin America and the Caribbean: Current Conditions and Challenges

Introduction

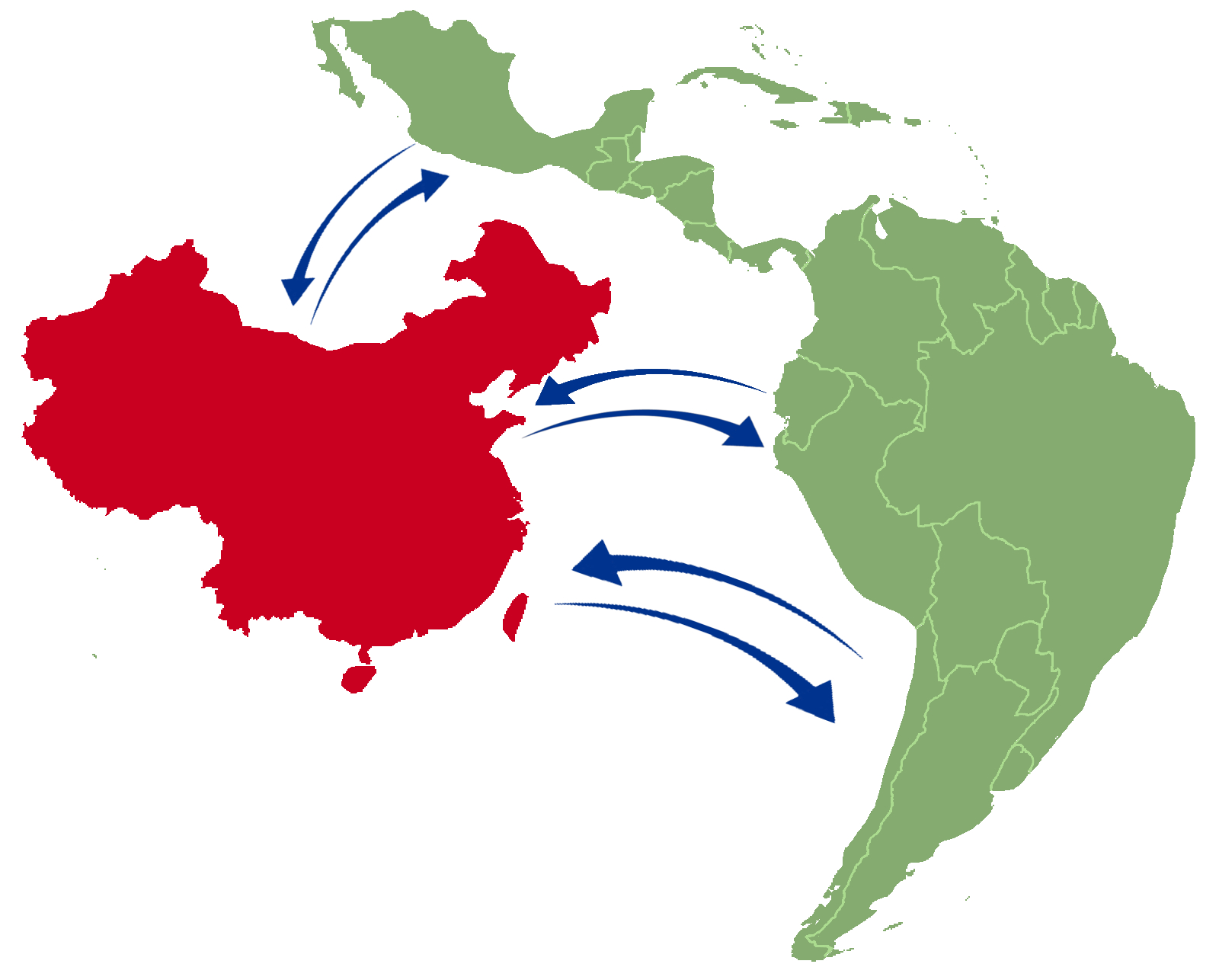

Since the beginning of the 21st century, China’s presence in Latin America and the Caribbean (LAC) has been substantial in practically all socio-economic fields: cultural, bilateral, and multilateral political issues, as well as trade, foreign direct investments, academic exchanges, and other areas. The main objective of this essay is to analyze the effects of China’s presence in the region in terms of sustainable and long-term development. I will include a diagnostic to understand some of the specificities of the LAC-China socioeconomic relationship, followed by the conclusion with a series of proposals.

The first section of the paper will examine four issues that are relevant to understanding general and specific topics about the China-LAC relationship:

- China’s increasing geopolitical competition with the U.S. in LAC.

- China’s proposal of a globalization process;

- Particular developments and structures in trade, foreign direct investment, financing and infrastructure; and

- The institutional framework between LAC and China.

The second part of the paper focuses on the concept of “new triangular relationships” and LAC’s challenges given increasing tensions between the United States and China.

Four Topics to Understand the Current China-LAC Relationship

Since the beginning of the 21st century, there has been a qualitative change in China’s global presence, including in LAC. While it is true that China is still a developing country in terms of GDP per capita and other socioeconomic indicators, the size of its population and of its economy, along with its medium- and long-term initiatives, have all allowed China to become a serious global competitor to U.S. hegemony. From an LAC perspective, it is true that the U.S. is still by far the most important “qualitative” actor in the region, with long historical ties with the regional elites, militaries, and academics, and plays an important role in cultural terms. It is also true that China is increasing its presence in LAC, with or without diplomatic ties. Less than a decade ago Chinese scholars argued that China would respect the U.S.’s “backyard” (Wu 2010). Since then, however, China’s presence has not only increased in socioeconomic terms (as we shall see below), but it has also emerged as an additional actor breaking the duopoly of the European Union and U.S. presence in the region. China has become an additional point of reference in terms of economy, culture, education, and even in military terms, such as in the case of Venezuela (Koleski and Blivas 2018).

China’s proposal of a globalization process with Chinese characteristics.

China’s increasing global presence in the context of profound domestic social, economic, and political reforms since the 1970s has also been reflected in the increase of Chinese activities and responsibilities in the United Nations Security Council, in the acknowledgement of China’s relevance in the international financial system through its membership in 2016 and inclusion of the renminbi as part of the Special Drawing Rights (SDR), and by its increasing leadership at the G20. From this international perspective, the launch of the Belt and Road Initiative (BRI) at the end of 2013 is crucial to understanding China’s proposal and ambition of a globalization process with Chinese characteristics. The BRI is China’s key international cooperation strategy with countries in Asia, Africa, Europe, and Latin America since January of 2018, when China formally recognized Latin America at the CELAC-China Forum, specifically through five areas of cooperation: policies, roads and highways, trade, currency, and people-to-people (Long 2015). The BRICS countries (Brazil, Russian Federation, India, China and South Africa) New Development Bank (NDB), as well as the Asian Investment and Infrastructure Bank (AIIB) are some of the new powerful instruments of this global strategy.

The conclusions of the XIX National Congress of the Communist Party of China (CPC) at the end of 2017 and the two CPC sessions in 2018 are relevant to these initiatives (Anguiano Roch 2018, 2019). They not only emphasize a long-term socialist development of China for 2035 and 2050 and elevate Xi Jinping’s thought as part of the CPC, but they also underline the importance of BRI as part of the domestic and global strategy of China. After the Second BRI Forum in April of 2019, 130 countries had joined the BRI (Belt and Road Portal 2019), 17 from LAC. The Asian Infrastructure Investment Bank (AIIB), on the other hand, accounts for 70 members, including 44 regional members and 26 non-regional members, plus 27 prospective members (six regional and 21 non-regional).

As part of these strategies, China has signed an increasing number of trade agreements and today has 10 free trade agreements, including those signed with Chile, Costa Rica, and Peru, in addition to the agreements with the Special Administrative Region of Hong Kong and Macao, as well as negotiations with Pakistan and Israel. From an Asian regional perspective, China has been also leading efforts within the Asia-Pacific Economic Cooperation (APEC) and the Association of Southeast Asian Nations (ASEAN). However, in recent years China has prioritized the Regional Comprehensive Economic Partnership (RCEP) with 16 member countries, including the Philippines, Japan, Korea, Australia, India, and Vietnam. So far, no LAC country participates in that initiative.

China has proposed a group of specific initiatives toward LAC. On the one hand, the Chinese public sector published two “White Books” for LAC in 2008 and in 2016 (GPRC 2011, 2017). They integrate a group of issues relevant for this analysis, including 13 priorities on economic and trade topics (GPRC 2017:7-11), among them: the promotion of trade in high-value-added products and with high technological content, cooperation in industrial investment and productive capacity, cooperation in infrastructure and in manufacturing, and cooperation between chambers and institutions to promote trade and investment (GPRC 2017:9). Interestingly, the 2016 White Book states that Chinese firms should “promote linking the productive capacity with quality and advantaged equipment from China to the necessities of the countries of LAC to help them in improving their development capacity with sovereignty” (GPRC 2017:7) and to enhance infrastructure projects and public-private partnerships “in transport, trade logistics, storage installations, information and communication technologies, energy and electricity, hydraulic works, urbanism and housing, etc.” (GPRC 2017:8) China also focuses on cooperation in the manufacturing sector to “establish lines of production and sites for the maintenance of construction material, of nonferrous metals, machinery, vehicles, communications and electricity equipment, etc.” (GPRC 2017:9)

More relevant in the specific context of Chinese proposals of cooperation with LAC is Xi Jinping’s cooperation scheme “1+3+6,” which stands for: 1 plan (CELAC’s Cooperation Plan for 2015-2019), 3 driving forces (trade, investment, and financial cooperation), and 6 key fields of cooperation (energy, resources, infrastructure projects, manufacturing, scientific innovation, and technical innovation). The CELAC-China Forum Cooperation Plan for 2015-2019 includes a wide range of tools for cooperation in politics, culture, education and economic issues, among others. It also includes enhancing micro, small and medium firms, financial institutions, infrastructure and transportation, industry, science and technology, as well as specific sectors such as the aeronautics, information and communication industries. The plan also makes explicit reference to the “joint construction of industrial parks, science and technology, special economic zones and high-tech parks between China and CELAC member states, with the goal to improve industrial investments and the generation of industrial value chains” (CELAC 2015:4). Those initiatives will be accompanied by several forums and funding options, including the Forum on Development and Industrial Cooperation China-LAC, the Fund for China-LAC Cooperation, the Special Credit for China-LAC Cooperation, and other options according to the cooperation priorities. Most of these instruments, as well as new ones, were renewed in the Working Program of the China-CELAC Forum (CELAC 2018).

In this context, China’s presence in the region has been highlighted and criticized from a number of different perspectives, notably using the argument of a “debt trap” and environmental challenges.

China’s Socioeconomic presence in LAC.

The LAC-China socioeconomic relationship since the beginning of the 21st century can be understood as a series of four phases (Salazar-Xiranachs, Dussel Peters, and Armony 2018):

- The stage that starts in the 1990s with a rapid intensification of the trade relationship and China becoming LAC’s second trading partner;

- The stage of 2007-2008, parallel to the global financial crisis, during which China became a major regional financial source for LAC;

- In the same period (2007-2008) China also became a very important source for overseas foreign direct investment (or Chinese OFDI); and

- The stage starting in 2013, in which China is developing massive infrastructure projects in the region, also as part of a series of Chinese global initiatives.

Increased trade between China and LAC.

At least four topics are relevant in this area:

- China’s share in LAC’s trade increased from less than one percent in the 1990s to 14.08 percent in 2017, and China has been LAC’s second trading partner since 2013, displacing the European Union. In addition — and a topic that has received little attention so far — LAC has increased its share in China’s trade becoming China’s second trading partner, moving from less than four percent in the 1990s to 9.52 percent in 2017, second only to the U.S.

- LAC’s trade with China is characterized by an increasing trade deficit — above $80 billion since 2012. These trends are a result of the disaggregated composition of trade. LAC’s main three import goods (according to the Harmonized Tariff System) from China — automobiles, electronics, and auto parts — have increased significantly their share over total imports, from 26.67 percent in 1990 to 38.63 percent in 2000 and 56.85 percent in 2017. LAC’s exports to China are significantly more concentrated. LAC’s main three export goods — soya, minerals and copper — account for at least 65 percent of total exports since 2007.

- The specific content of LAC-China trade is critical. The content of LAC imports and exports from/to China differs dramatically by its technological share. While LAC’s share of medium and high technological exports to China account for less than five percent of total exports in the last decade, imports from China accounted for more than 60 percent. Trade figures with the United States show that LAC’s trade has not only closed its gap in terms of medium- and high-technology goods, but has achieved substantial results, exporting more medium- and high-tech goods than it imported.

- The U.S. has been the main loser as a result of increasing competition between China and the U.S. in LAC’s imports. During 2000-2017, the U.S. share of LAC’s trade fell from 53.57 percent to 40.76 percent, while China’s increased from 1.72 percent to 14.08 percent (Dussel Peters 2016). The decline of U.S. exports to LAC has generated an annual loss estimated at around 840,000 jobs, particularly in manufacturing and the auto parts-automobile global commodity chain (Dussel Peters 2015).

China’s OFDI in LAC.

A series of recent studies on Chinese outward foreign direct investment (OFDI) in LAC highlights regional and national characteristics. Some case studies include analysis of particular areas of the global value chains and firms (Dussel Peters 2014; Jiang 2017), with methodological and statistical differences between international, Chinese, and Latin American sources (Ortiz Velásquez 2016). With these relatively detailed discussions on LAC and China in mind, the Monitor of China’s OFDI in LAC (Dussel Peters 2019) provides the following trends for 2001-2018:

- The People’s Republic of China has issued methodological regulations to record the final destination of OFDI (MOFCOM, NBS and SAFE 2015). Such regulations, however, have not yet resulted in the official statistics to record Chinese OFDI.

- Total Chinese OFDI fell in 2018 for the second year in the last decade, as well as to LAC (from 31 percent to eight percent in 2018) and represented 51.66 percent of 2016.

- Chinese firms invested $121.7 billion from 2000 to 2018 in 402 transactions that generated 324,096 jobs, particularly during the most recent period 2010-2018.

- Recent results on China’s OFDI include an increased share of mergers and acquisitions (M&A) (72.2 percent in 2017 and 74.8 percent in 2018), and they show an increased diversity of China’s OFDI, particularly in services and manufacturing (in 2010-2018). For example, raw materials’ share of total OFDI in LAC accounted for only 36.2 percent of total OFDI, and the increased share of private OFDI within the total OFDI, from 29.8 percent during 2000-2018 to 93.7 percent in 2018.

Disaggregating by country, China’s OFDI also reflects interesting recent changes, including increased diversification in target countries, with an increased presence in Chile and Peru, while the share and absolute value of Chinese OFDI to Argentina, Brazil, and Mexico fell substantially in 2018.

China as a major source of financing for LAC since 2007-2008.

A group of authors and institutions, particularly Kevin Gallagher at the Global Economic Governance Initiative (GEGI), have contributed substantially through transaction and country-level analysis, with comparisons on the conditionality of financing, as well as national and sectorial distribution of financing (Gallagher, Irwin and Koleski 2013; Gallagher 2016; Myers and Gallagher 2019; Stanley 2013). In general, China’s financing to LAC during 2005-2018 has been highly concentrated. China Development Bank and Exim Bank have provided more than $140 billion. Most resources in 2018 were channeled to Venezuela, focusing significantly on infrastructure projects. As with OFDI trends, however, Chinese finance to LAC has fallen substantially in 2017 and 2018.

The RED ALC-China (Dussel Peters, Armony and Cui 2018) has provided a detailed analysis and discussion of Chinese infrastructure projects in LAC. The presentation of firm-level statistics and analysis of case studies in several countries results in a wide range of experiences and policy suggestions at the firm and sector level. Until 2017, China had pursued 69 infrastructure projects in LAC, accounting for more than $56 billion and generating more than 214,000 jobs in the region. Argentina, Venezuela, Ecuador, and Brazil have had the most Chinese infrastructure projects in the region, while other countries in Central America and Mexico have, so far, received fewer.

The more qualitative and case study work of Dussel Peters, Armony, and Cui (2018) reflects the pragmatism of Chinese firms through infrastructure projects in the region and the ability to operate in very different labor conditions, subcontracting networks and relations with clients depending on each country’s context. In several cases the same Chinese firms — all of them public firms — generate very different conditions in different countries of the region. In some cases, Chinese firms are able to subcontract all major civil engineering segments of the projects to local and national firms, and subcontract with local suppliers for major segments of the respective infrastructure projects. Workers and working conditions are thus generated by local firms. In several cases, the employees do not know they are working for a Chinese infrastructure project. In other cases, the totality of the project is run by Chinese firms, including the design of the project, financing, subcontracting, workers, engineering activities, construction, and post-construction services. While Chinese firms have the ability to offer these “turnkey projects,” in most cases it depends on the specific conditions of the host country. The involvement of local and domestic firms, workers, and specialized activities, and particularly the contracts defined and accepted by host countries, may in some cases even allow for learning processes and technology transfer. Development, from this perspective, is highly dependent on the host country and government that proposes and signs these contracts. A rather small group of Chinese public firms are the core of these infrastructure projects in the region.

Weak and insufficient institutions in LAC, China, and the U.S. on the LAC-China relationship.

Rather surprisingly, while socioeconomic and political relations between China and LAC have increased dramatically, public, private, and academic institutions working on China in LAC and LAC in China, as well as bilateral institutions between China and specific LAC countries and in the U.S., have not reflected the same dynamism. In general, there is a wide gap between public, private, and academic institutions analyzing the China-LAC relationship both in LAC and in China and socioeconomic growth (Arnson et. al 2014; Dussel Peters and Armony 2015). Beyond the fashion of studying the China-LAC relationship, in general, there are many authors and institutions in LAC, China, and the U.S., including think tanks, that do not review the massive, albeit insufficient, literature in China and Latin America and the Caribbean of the last four decades. WÅith few exceptions, such as the Consejo Empresarial Brasil-China (CEBC), the Institute for Latin American Studies of the Chinese Academy for Social Sciences (ILAS/CASS), the China Institutes of Contemporary International Relations (CICIR), the Center for Chinese-Mexican Studies (CECHIMEX) at UNAM, and the Academic Network of Latin America and the Caribbean (RED ALC-China), the institutional analysis in the public, private, and academic sector is weak, with few attempts to develop a qualitative learning process beyond the institutional competition, and those based on the existing analysis in LAC and China. The best example of the existence of these limited institutions is the CELAC-China Forum (Cui and Pérez 2016). Its presidency rotates annually, it lacks a technical secretariat, and it depends annually on a different ministry of foreign affairs from an LAC country. As a result, the learning process in terms of analysis and proposals is weak, the technical and qualitative learning process is limited, and so are the implementation, evaluation, and proposals on very specific items discussed and proposed by the CELAC-China Forum since 2015.

Looking to the future: a new triangular relationship.

Acknowledging these trends along with the concept of “New Triangular Relationships” (Dussel Peters, Hearn and Shaiken 2013) is critical for LAC today. The region and each of its countries, with no exception, has to understand, deal with and negotiate within this “new triangle.” In some cases, the presence of the U.S. is still very strong, such as in the Caribbean, Mexico, and Central America. In others, the presence of China is considerable, such as in Cuba and Venezuela. Nevertheless, in all cases LAC countries must consider increasingly difficult strategies in their foreign relations given the increasing tensions between China and the U.S. None of the LAC countries can exclude the U.S. or China as important strategic partners. New governments (such as in Argentina and Brazil) have attempted to distance themselves from China recently, with little success. Venezuela, on the other hand, until the recent crisis still had substantial economic linkages with the U.S.

From this perspective, many countries in LAC are at a crossroads and in the middle of the U.S.-China competition. Vice President Mike Pence (2018) highlights: The U.S. will be “heightening our scrutiny of Chinese investment in America to protect our national security from Beijing’s predatory actions.” … “A new consensus is rising across America …” and putting enormous pressure on countries worldwide, including LAC. In 2017 and 2018, three LAC countries — Dominican Republic, El Salvador, and Panama — established diplomatic relationships with China. In response, the U.S. in September 2018 recalled its top diplomats from all three countries and threatened 17 additional countries that still have diplomatic ties with Taiwan, mainly in Central America, the Caribbean, and the Pacific, proposing new legislation in the Senate to “downgrade U.S. relations with any government that shifts away from Taiwan, and to suspend or alter U.S. assistance” (Reuters 2018).

The situation is particularly stressful for countries in LAC that are geographically close to the U.S., such as Mexico and those in Central America, with long historical, political, and economic ties with the U.S. and that are experiencing an increasing presence of China. In the case of Mexico, the renegotiation of the North American Free Trade Agreement in 2018 has led to the signing of the United States-Mexico-Canada Agreement, or USMCA, which still has to be ratified by the legislatures of the respective countries and includes an “Anti-China chapter” (chapter 32.10) that practically prohibits free trade agreements with China (as a “non-market economy”) (Dussel Peters 2018).

Acknowledging the potential risks of their relationships with either China or the U.S., LAC countries might find themselves in the future under strong pressure to choose sides. However, that would make little sense from an LAC perspective given the presence of both powers in all countries of the region.

No comments:

Post a Comment

Comments always welcome!