CORPORATE GOVERNANCE

How independent are Husky’s directors?

This is part of a series examining corporate governance issues at Canadian companies.

Once a proud Canadian-owned and prosperous Alberta oil company

Husky Energy is one of the more tightly-controlled companies in the S&P/TSX 60, with 70 per cent of its shares in the grasp of the Hong Kong billionaire Li Ka-shing. Yet a look at Husky’s proxy shows that a vast majority of its directors are classified as independent, making the board look more like that of a company whose shares are widely held.

A deeper view of the director biographies, however, raises the question of what independence truly means, and whether Mr. Li’s control of Husky’s board is as strong as his grip on the shares.

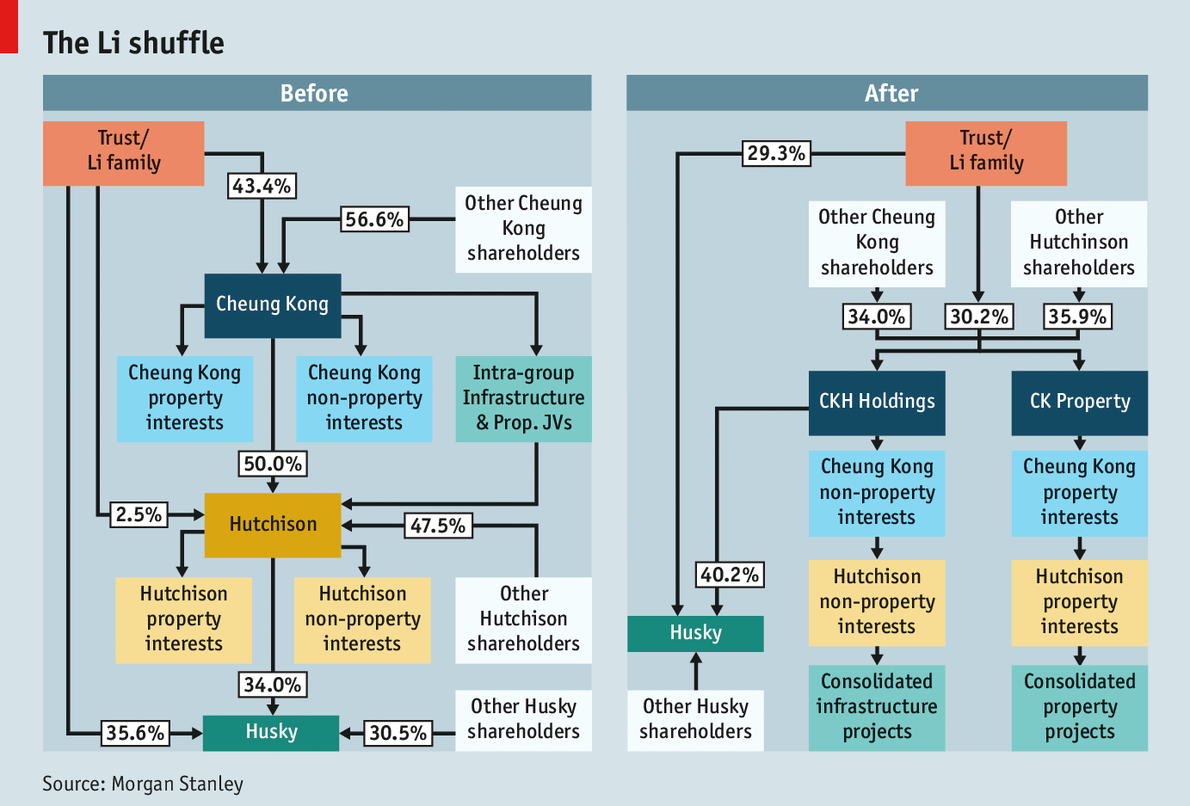

Here, first, are the particulars of Mr. Li’s ownership, plainly stated in the proxy circular for all to see. L.F. Investments S.à r.l., which owns just under 30 per cent of Husky, is “indirectly wholly-owned” by a Li family trust. Another 40 per cent of Husky stock is owned by Hutchison Whampoa Europe Investments S.à r.l., which is “100-per-cent indirectly owned” by CK Hutchison Holdings Ltd. The Li family owns about 30 per cent of CK Hutchison, according to the Husky proxy.

This is important when assessing the Husky board, which has 15 members, including the chairman, Mr. Li’s son, Victor T.K. Li. Victor Li and five other members are classified by the company as non-independent, but the remaining nine are independent directors, the company says.

Of those nine, however, six sit on boards of other companies where Mr. Li has significant ownership, or the boards of Li family charities:

- Stanley Kwok also serves as an independent director on the CK Hutchison board. William Shurniak was an independent director of Hutchison Whampoa Ltd. until June, 2015, when he became an independent director of CK Hutchison.

- Stanley Kwok’s wife, Eva Kwok, is an independent director at both CK Life Sciences International Holdings Inc. and Cheung Kong Infrastructure Holdings Ltd. (Victor Li is chairman of both those companies, as well.) She is also a director of the Li Ka Shing (Canada) Foundation.

- George Magnus is a director of CK Hutchison and Cheung Kong Infrastructure, and an independent director of HK Electric Investments Manager Ltd. (whose chairman is, you might have guessed, Victor Li).

- Colin Russel is a Director of Cheung Kong Infrastructure, CK Life Sciences, and ARA Asset Management Pte. Ltd., a company that counts Mr. Li as a founding investor.

- And Wayne Shaw, a former Stikeman Elliott LLP partner, is a director of the Li Ka Shing (Canada) Foundation.

“Our directors are chosen for the breadth of experience and knowledge they bring to the company,” says Husky Energy spokesman Mel Duvall. “We provide full disclosure in accordance with Canadian securities requirements and our directors are independent in accordance with those requirements.”

Two leading proxy-advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis, agree with the company’s classifications.

ISS believes that the fact Husky Energy directors sit on other Li Ka-shing company boards, by itself, does not render them non-independent. ISS notes, however, that Mr. Magnus is designated as non-independent on the CK Hutchison and Cheung Kong Infrastructure boards, and the fact he has been on those two boards for 36 years and 20 years, respectively, works against the independence argument.

Glass Lewis says that simply having six non-independent directors is more than they’d care to see, but “we suspect that most shareholders both understand and accept the nature and the extent of Mr. Li's control over the company and the composition of the board.” Thus, while the firm would ordinarily recommend withholding votes from some nominees, “we decline to make voting recommendations in this report based on a strict notion of independence.”

The Canadian Shareholder Association for Research and Education, or SHARE, takes a stricter position, however, and believes that there are just three independent directors on Husky’s board. SHARE’s criteria are that directors who have a “close relationship” with an affiliate of the company may not be independent, and directors who “are affiliated with or designated by a shareholder with a significant interest may also be considered not to be independent.”

SHARE recommended “withhold” votes for all six of the independent directors outlined above, but Husky shareholders took the leads of ISS and Glass Lewis, with most of the six having fewer than 1 per cent of the votes withheld. For now, it seems, shareholders understand and accept the nature and extend of Mr. Li’s control, as Glass Lewis said.

No comments:

Post a Comment

Comments always welcome!