Capital does have nationality: Germany’s fears of Chinese investments

OSW COMMENTARY

2017-01-25

The flourishing cooperation in German-Chinese relations is transforming into rocky friendship due to the increasingly strong economic rivalry between the two nations. Recent acquisitions of German companies by Chinese investors indicate that Germany is struggling to defend its interests in bilateral relations with Beijing in an assertive manner. Berlin is becoming increasingly aware of the need to devise and pursue a common EU policy towards China. It cannot be ruled out that the rising power of the Middle Kingdom will be a key argument when devising new initiatives within the EU’s industrial policy for defending Europe against an influx of investors from outside the EU. So far, Germany has been the main brake on progress, blocking the adoption of such solutions. In this context, there may be a chance for American-European cooperation, should the new US President Donald Trump be interested in pursuing a more assertive policy towards China.

Until recently, it seemed that German-Chinese relations will continue to develop dynamically. Over the last five years, meetings of high-ranking politicians were held every couple of weeks, the talks were conducted in a friendly atmosphere and the value of the contracts signed set new records. This mood of mutual German-Chinese fascination was disturbed in spring 2016, when the Kuka company, Germany’s leading producer of industrial robots, was acquired by a Chinese investor against the will of the German government. Bilateral relations cooled down, mutual accusations of unfair intentions were formulated and attempts were made by political methods to limit the development of economic cooperation . The wave of distrust culminated in decisions by Sigmar Gabriel, Vice Chancellor of Germany and Minister for Economic Affairs, to launch a procedure for in-depth verification of applications submitted by Chinese investors regarding the possible acquisition of two other German companies: Aixtron and Ledvance. Until recently, it seemed that obtaining consent for such acquisition was a mere formality. Numerous contentious issues are a sign of increasingly evident limitations upon the further development of German-Chinese relations. Germany has become aware that the growing number of economic ties with China may bring in tandem with the many benefits also certain threats.

The Chinese market as salvation for German exporters

The deterioration of the economic situation in the Eurozone, which started in 2010, forced German producers to seek other markets to compensate for the consequences of the stagnation in the Eurozone. For German exporters, who maintained large production capacities, intensified cooperation with the emerging economies came as an attractive alternative. The development of economic relations between Germany and China proved to be particularly successful due to a number of factors. Firstly, despite the global economic deterioration the Chinese economy continued to grow at a rapid pace. According to the OECD, the average GDP growth rate recorded for old-EU states in 2009–2015 was 0.3%, whereas the figure for China was 8.4%. Secondly, when the global economic crisis began the government in Beijing did not report a particularly high debt level, which is why it could afford to launch large industry-specific stimulus packages in subsequent years. A significant portion of these funds was earmarked for the economic modernisation programme, what made it attractive for German companies – the leading producers of machines, energy generation technologies and chemical products. Similarly, Germany took advantage of the increase in the average income earned by members of the Chinese middle class, who began to buy German cars in large numbers. Thirdly, even before the global financial crisis German-Chinese economic relations were developing dynamically, albeit asymmetrically. For Germany, China was the third biggest import market and only the ninth biggest export market. This asymmetry disturbed the trade balance – in 2008 Germany recorded a trade deficit with China to the tune of 15 billion euro. Last but not least, the German government secured the development of economic cooperation with China by avoiding political tensions. In 2010, China was the first emerging economy to be included in the group of states with which Germany held regular meetings under inter-governmental consultations. Issues which the government in Beijing considered sensitive, such as the human rights dialogue, were marginalised on the political agenda and replaced with a debate on the rule of law[1]. This was an evident shift in the policy adopted by Chancellor Angela Merkel, who in previous years decided not to attend the opening ceremony of the Summer Olympics in Beijing in a gesture of solidarity with Tibetan people and in 2007 met with the Dalai Lama. Germany used to play the role of China’s advocate in Beijing’s relations with the EU, for example in the dispute over China subsidising its exports from public funds. Berlin called on its EU partners to avoid the situation in which such tension could reduce the pace of development of economic cooperation. As far as problematic issues in German-Chinese relations are concerned, such as the Chinese government limiting the exports of rare earth minerals[2], Germany has left the task of resolving them to Brussels.

The combination of these factors contributed to a rapid increase in trade exchange between Germany and China. In 2008–2014, the value of goods exported by German companies to the Chinese market soared by 118% to 74 billion euro, and the value of German imports from China increased by 34% to 80 billion euro. For comparison, over that same period Germany’s total exports increased by 14% and its imports by 13%. In 2014, China rose by several places in the ranking and became Germany’s fourth biggest export market and its second biggest import market. Due to favourable trade results, the frequent objections of German companies (such as high levels of corruption in China, attempts of Chinese at taking over/stealing German technologies and limited access to many sectors of the Chinese economy) lose prominence.

The first cracks in economic friendship

The trade results for 2015 triggered certain doubts as to whether it would be possible to achieve a more balanced trade exchange between Germany and China. In 2015, for the first time in many years, the volume of Germany’s exports to China fell by 4%. In that period, the import of goods from China increased by 15%, causing a significant reincrease in Germany’s trade deficit – from 5 billion euro to 20 billion euro, which reversed the previously observed downward trend. This was the first sign that trade relations were not becoming more balanced and that the government in Beijing might, in a situation of economic slowdown, continue to apply instruments to subsidise China’s exports alongside mechanisms to protect its domestic market.

The slower pace of economic cooperation was accompanied by personnel changes in bodies responsible for Germany’s economic policy. After the SPD joined the ruling coalition in 2013, for the first time since 2005, the Ministry for Economic Affairs was to be supervised by a SPD politician instead of a FDP one. The new minister was Vice Chancellor Sigmar Gabriel, who was particularly sensitive to voices from German trade unions. This fact seemed to be unimportant until 2016, when a dispute between Brussels and Beijing emerged involving steel products. In 2001, upon joining the World Trade Organisation, Beijing had to accept the condition that in justified cases the EU may impose anti-dumping tariffs on goods manufactured in China. Some of these procedures were intended to lapse after 15 years[3]. The Chinese government interpreted this provision in its own interest and demanded that China be granted market economy status in 2016, which would involve a significant limitation of EU anti-dumping tariffs imposed on Chinese-made goods. The expectation was that Germany would consent to achieving some kind of compromise with Beijing regarding China’s market economy status, fearing (in a situation of a trade war between Brussels and Beijing) potential losses of German companies operating in the Chinese market.

To Germany, the crisis on the steel production market came as a barrier to an amicable resolution of the dispute over China’s market economy status. In early 2016, European steel manufacturers began to complain about Chinese steel being sold at dumping prices, flooding the EU market. This was a result of massive overproduction of steel in China. After the economic slowdown, the Chinese economy significantly reduced its demand for steel. The problem of massive inflow of Chinese steel onto the European market did not spare German companies – at the beginning of 2016 thousands of workers organised protests in German steelworks. One of the main demands voiced during these protests involved limiting the import of steel from China. In February 2016, Sigmar Gabriel, Minister for Economic Affairs, co-signed a letter written by six ministers of the economy (from Italy, the United Kingdom, France, Poland, Belgium and Luxembourg) addressed to the European Commission and containing a demand to counteract the flooding of the European market by subsidised steel from China and Russia[4]. Brussels reacted within a couple of days and imposed anti-dumping tariffs on producers from these countries[5]. Despite this, the issue was not entirely resolved and Germany began to see the threats connected with granting China market economy status.

Selling off the family silver for next to nothing?

German-Chinese tension became even more evident in the field of investments. In recent years, a conviction was widespread in Germany that Chinese companies will purchase minor German companies riddled with financial problems. It was expected that they would not be interested in acquiring companies which dispose of cutting edge technologies and recognizable brands. Numerous previous acquisitions were examples of this rule – the biggest acquisitions carried out before 2016 included the purchase in 2011 of the electronics producer Medion for 530 million euro and the purchase in 2012 of Putzmeister, a manufacturer of devices used in the construction sector, for 360 million euro. Chinese investors were viewed as an opportunity to provide a new development impetus and to foster greater openness of the Chinese market to German companies struggling with structural problems and insufficient capital. Moreover, Germany was aware that considerably more capital was flowing from Germany to China than vice versa. This was due to the fact that in an attempt to increase their profits in the Chinese market, German companies located their entire production facilities in China. According to calculations by the Bundesbank, in 2013 alone German companies invested 8 billion euro in China, whereas the investments carried out by China in Germany amounted to 0.6 billion euro.

Over time, Germany became increasingly concerned with the fact that after several years of insignificant growth in the volume of Chinese investments in Germany, in subsequent years the value of these investments soared. The fact that in 2014 the value of Chinese investments in Germany increased to 1 billion euro and in 2015 to nearly 2 billion euro was particularly astonishing, especially given that these figures did not reflect the full scale of the changes, as Chinese investors frequently made their purchases via daughter companies registered for example in Luxembourg. According to calculations by the consulting firm EY, in the first three quarters of 2016 alone the value of Chinese investments in Germany reached 11.4 billion euro, which is more than the total investments carried out by Chinese companies in Germany in 2006–2015[6]. Even greater distrust, especially within Germany’s political elites, was triggered by the fact that investors from China started making attempts at acquiring stakes in companies ranked high among Germany’s leading technology companies. In 2014, Chinese investors purchased a stake in Avic, a producer of aeronautic equipment, for 467 million euro, and in 2016 – a stake in Krauss-Maffei, a manufacturer of plastic and rubber goods, for 925 million euro and EEW Energy, a company involved in designing renewable energy generation technologies, for 1.4 billion euro. German politicians have recognized a model of these transactions: Chinese investors try to acquire technologies owned by German companies, taking advantage of these companies’ low market valuation.

The German public’s concerns returned in May 2016, when the Chinese investment fund Midea communicated its plan to acquire the Kuka company – one of Germany’s leading producers of robots. With full support from Chancellor Angela Merkel, Sigmar Gabriel, Vice Chancellor and Minister for Economic Affairs, almost instantaneously began to seek a solution to block the deal[7]. According to press reports, the Ministry for Economic Affairs tried to convince German companies and companies from other EU countries to submit a counter-bid for the purchase of Kuka. This solution was allegedly welcomed by the Federal Cartel Office[8]. However, European electro-technical companies, such as Siemens and ABB, considered the Chinese bid, amounting to nearly 5 billion euro, too high to outbid it. The actions by the German Ministry for Economic Affairs received support from Günther Oettinger, the then German European Commissioner for Digital Economy and Society, who considered Kuka a strategic company of key importance for the EU’s digital future[9]. German politicians came to the conclusion that the takeover will be a blow to Germany’s economic strategy of industrial development which involves the creation of a comprehensive and highly automated system connecting production plants directly with suppliers via state-of-the-art IT systems. Moreover, certain threats to economic security were identified. There was rising concern that when the deal is struck the Chinese will get access to sensitive data of key German industrial companies which use Kuka robots in their production plants[10].

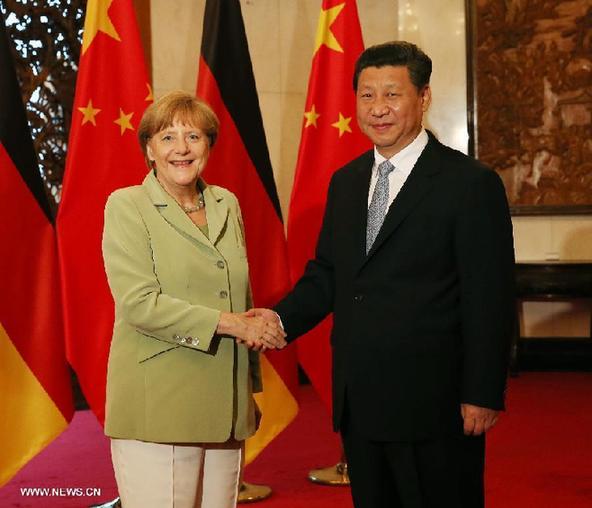

The atmosphere during inter-governmental consultations between China and Germany held in June 2016 was considerably cooler than before and clearly burdened with the dispute over Kuka. No compromise was reached despite the fact that the Chinese partners had declared their will to limit the purchase of the company to a minority stake. during the consulations Chancellor Merkel was more assertive than before and demanded greater openness of new sectors of the Chinese market to German companies.

Finally, the takeover of Kuka could not be blocked due to strong resistance from business circles. The president of Kuka’s supervisory board strongly supported the bid submitted by the Chinese investor and rejected the intervention plan prepared by German politicians. Representatives of those German industry sectors which have a strong presence in the Chinese market, such as the automotive and the machine-building sectors, emphasised that so far there was no evidence that the acquisitions carried out by Chinese companies could contribute to a deterioration of the German economy and foster re-location of production from Germany to China[11].

The German concept of a shield against non-EU investments

The controversy surrounding the purchase of Kuka has made the German government aware that at present it does not have sufficient instruments to control the acquisitions by Chinese companies of their competitors in Germany. For this reason the government took measures to amend the law in this respect. At present, pursuant to the law on external economic relations, the German Ministry for Economic Affairs has at its disposal regulations which enable it to block a purchase of a 25% or bigger stake in German companies which are considered important from the point of view of the state’s security or critical infrastructure. Pursuant to this regulation it is authorised to withhold the acquisition by a non-EU investor of a company producing cybersecurity software, but it cannot block any acquisition of a company producing advanced technology products for civilian application. The inherent limitations in these regulations have become evident in the current acquisition projects implemented by Chinese companies and involving the purchase of Aixtron, a producer of electronic chips, and Ledvance, a daughter company of Osram producing lighting solutions. In September 2016, the Ministry for Economic Affairs consented to the deal involving Aixtron, but a month later decided that it is necessary to reconsider the prospective acquisition. According to media reports, this was inspired by information obtained from US intelligence suggesting that the deal may pose a threat to states security[12]. As far as Ledvance is concerned, the ministry used a loophole involving a detailed reconsideration of the proposed deal, even though it concerned the rather uncontroversial lighting sector. At the same time, this could have been a signal to the Chinese government to dampen the appetite of Chinese companies for making acquisitions, as there was press speculation suggesting that they consider acquiring Osram, the leading German producer of electro-technical goods. The price for amending Germany’s policy has been the almost instantaneous deterioration in the atmosphere of political relations. Sigmar Gabriel’s visit to China in October 2016 was given a decidedly cool reception – many of the planned meetings were cancelled by the hosts at the last moment.

In the aftermath of the 2016 experiences with Chinese investors, the German Ministry for Economic Affairs adopted a new plan to introduce new regulations at EU level to obtain the possibility to control acquisitions and, at the same time, to shift the responsibility for disputes in the relations with Beijing resulting from blocking specific transactions onto Brussels, freeing Berlin from this responsibility. German media reported on the proposed amendment to EU law, submitted by the Ministry for Economic Affairs, demanding increased protection of EU companies against acquisitions by non-EU investors. According to this concept, EU institutions could block such a transaction should it be targeting EU companies which “dispose of key technology of particular importance for industrial development”[13]. If this amendment is introduced, Brussels would obtain powers similar to those Washington has on the US market.

Gabriel’s concept received only partial support from business circles and the ruling coalition. Some CDU/CSU politicians fear that the proposals put forward by the Ministry for Economic Affairs, headed by an SPD politician, are too far-reaching and could weaken market economy mechanisms in Germany. Similar objections have been voiced by a portion of business circles who claim that Germany, as an economy which to a considerable extent depends on the freedom of movement of capital and trade, should not be sending signals regarding the increased level of protectionism on its domestic market, as this could affect German investments in China[14]. German companies expect the federal government to step up its political pressure on Beijing to open up new sectors of the Chinese economy to German investments, rather than introduce new restrictions.

The strategic rivalry – the limits of German-Chinese economic cooperation

Germany is becoming increasingly aware that due to non-transparent ties of the Chinese business with the government in Beijing and access to large amounts of foreign currency reserves, they have in practise unlimited capital at their disposal which they can use to carry out acquisitions. In the medium term, the goal of these companies is to become leaders in the sector of industrial goods, which would de facto be tantamount to ousting German companies from this position. For a long time, Germany ignored the aspect of rivalry in its relations with China but the impressive technological advancement of Chinese producers has forced German politicians to reconsider their former views.

Berlin is becoming increasingly convinced that one consequence of the dynamically developing cooperation is that China – Germany’s key economic rival – continues to strengthen its position[15]. German producers are aware that the level of Chinese companies’ technological advancement is growing steadily and that these companies are becoming increasingly strong competitors to German companies on third country markets. German exporters increasingly frequently lose their shares on third country markets, such as India, Japan and the United States, to producers from China. This tendency has been evident also in Germany’s strongest industrial sectors such as the machine-building sector[16].

The German market is particularly attractive to Chinese investors because it is dominated by small and medium-sized companies which frequently dispose of the best industrial technologies and do not have a strong capital buffer (in Germany these companies are referred to as ‘hidden champions’). In the environment of a weakened euro and the overall weakness of the European market in the aftermath of the Eurozone crisis, Chinese investors may want to use the emerging opportunities and purchase stakes in companies coping with structural problems or lacking capital for further development. The arguments regarding the protection of German companies against takeovers meet with a favourable response from German society, which is becoming increasingly distrustful of globalisation. It was no accident that the resistance among German society to the signing of the Transatlantic Trade and Investment Agreement with the United States was particularly strong, even though German companies were supposed to be the biggest beneficiaries of this agreement.

Much suggests that Beijing intends to step up its measures to limit the access of foreign companies to its domestic market. In recent months, the Chinese government made two spectacular decisions affecting German automotive companies. First, the Chinese leadership demanded that all electric cars in the Chinese market be required to provide their operating data to relevant state institutions. German producers considered this an extremely controversial move because the main competitive advantage of their cars involves strict protection of the drivers’ personal details. Making these available to the Chinese government would undermine this aspect of competitiveness. Moreover, German companies are afraid that the data may be used by their Chinese competitors[17] as an important source of information regarding the technologies used by German producers. Another significant threat to German automotive companies involves the introduction (planned by the government in Beijing for 2018) of the requirement to guarantee a specific share of electric cars in the total production volume of automotive companies operating in China[18]. Should these companies fail to meet this requirement, they would be obliged to buy special certificates, which would equate to a fine. To German manufacturers this new regulation comes as a particular problem because until now they have mainly specialised in the production of internal combustion engines. These examples indicate that the Chinese market is quickly losing its status of an exceptionally profitable market for German companies and the government in Beijing is ready to take unconventional measures to control the expansion of foreign producers on the Chinese market.

Conclusions

- German producers are aware that the actions by the government in Beijing and the increasingly tough competition from Chinese producers will likely limit their extraordinary profits in the Chinese market. German politicians have become frustrated at China abusing the German market’s openness and at the same time maintaining investment restrictions in the Chinese domestic market. Should further disputes between Brussels and Beijing emerge in the near future, this may convince German politicians to intensify their lobbying activities in favour of TTIP, as long as the signing thereof will continue to be under negotiation with the United States. This agreement could help the EU and the USA devise a common framework of cooperation with emerging economies, although until recently the prevalent view in Germany was that this could rather be achieved by way of developing the bilateral relations.

- The German government is aware of the increasing risk involved in consenting to Chinese investments in Germany. These investments not only generate the risk that German technologies may be purchased by Chinese companies but also may weaken the operation of market mechanisms and lead to a complete takeover of specific German companies by the Chinese state. This is due to the opaque ties between the state and Chinese private companies. Moreover, despite their declared intention to maintain production in local plants, Chinese companies are likely to relocate it to China, the case of Volvo being one example of this.

- The rising tension in German-Chinese economic relations may overshadow the development of relations between Central Europe and China, which should be taken into account in the context of the implementation of the New Silk Road project[19]. After offering initially critical comments in German media regarding the cooperation in the ‘16+1’ format, in recent years German commentators have been more cautious. However, it cannot be excluded that in the eventuality of a rapid increase in the involvement of Chinese companies in Central Europe, Germany will view this process in a much more critical manner, fearing that its strategic economic interests in the region may be threatened in the long term. If acquisitions of German companies by Chinese investors are blocked, China may become increasingly interested in buying stakes in companies from Central Europe which operate as sub-vendors to German companies. This would be another attempt at gaining access to German technologies.

- For Central European states the introduction of the ability to block the acquisitions of domestic companies at an EU level may be a favourable solution and a mechanism that also protects their economies against hostile takeovers by investors from Russia. This instrument will be effective only when precise regulations are adopted which would not allow the European Commission to act fully at its discretion. Otherwise, owing to pressure from states which have considerable influence in EU institutions, the risk would emerge that these regulations would be applied selectively for specific purposes.

No comments:

Post a Comment

Comments always welcome!