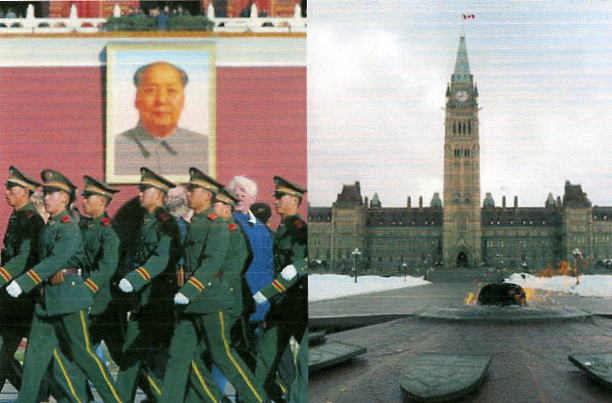

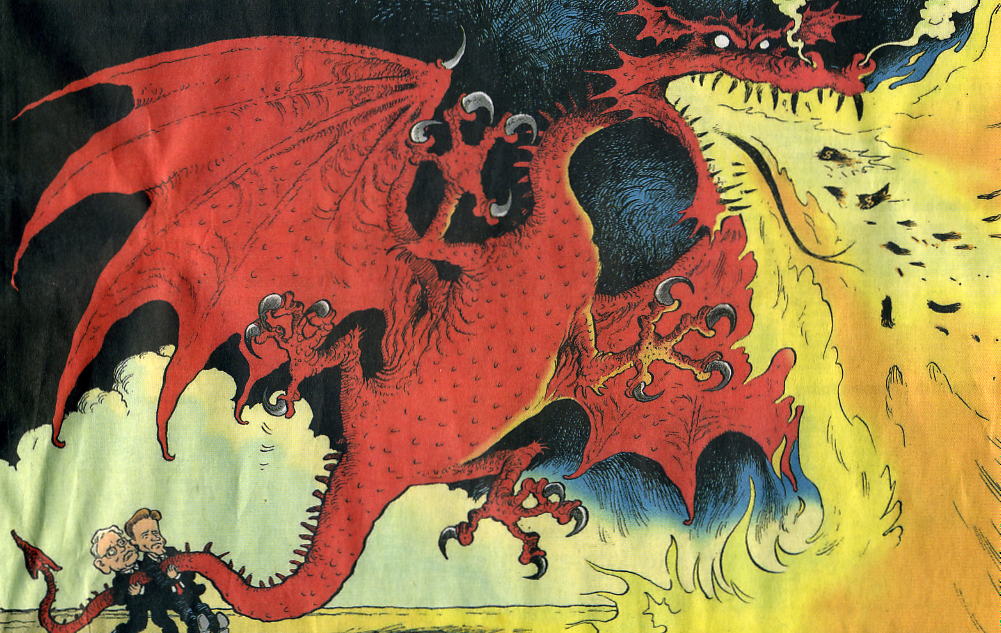

CHINA TALONS

IN CANADA OIL SANDS

Finance Minister Jim Flaherty rolled out the welcome mat

for Chinese investment in the Canadian energy sector,

saying this country’s foreign-investment rules pose little hindrance

to the growth of a Chinese presence....

The high price of developing the oil sands has been a concern for China,

which wants to bring in their own cheap labour to offset costs.

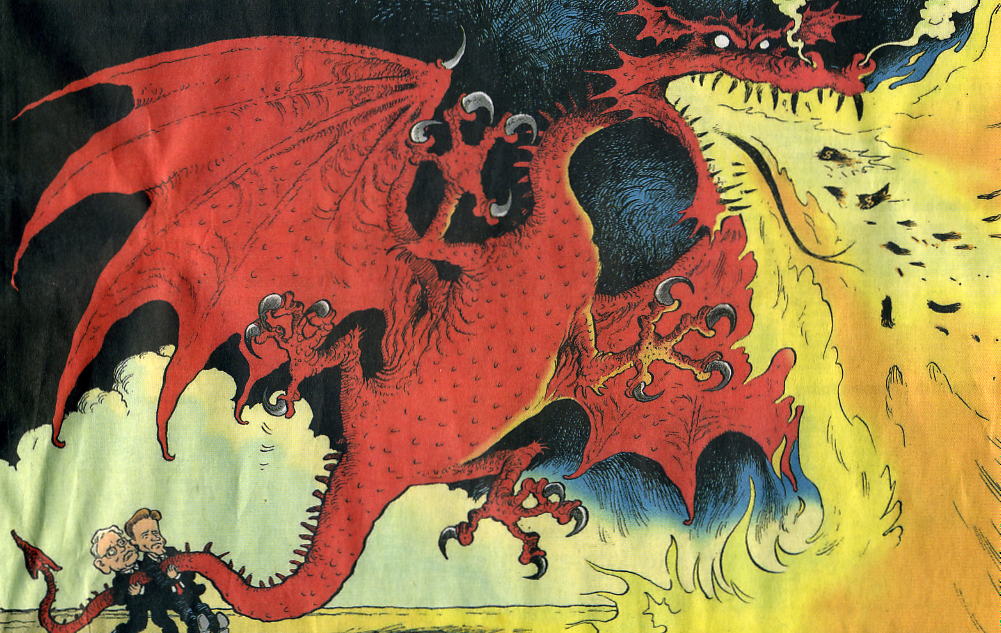

Now the Communist beast wants MORE, MORE, MORE, MORE and Canada's sheeplike, treasonous politicians (owned by capitalist corporations) plan to give it more. As per usual, not one word of dissent is voiced in the right-wing-owned left-wing lap-dog press. See CHINESE TAKE-OVER & CHINADA'S SOVIETIZATION

Resource grabs by Communist China are happening all over the world but in no other nation is it met with such passivity as in Canada. See CANADA GATE FOR CHINA

We don't have even ONE politician speaking out against it. Every single one of them - federal, provincial, territorial, municipal - has seemingly been bought off with junkets to the dragon's den. ~ Jackie Jura

China invests in Canada oil sands

BBC, Sep 1, 2009

Petro China has agreed to buy a 60% stake in two planned Canadian oil sands projects for $1.7bn (£1bn). The firm, which is Asia's largest oil company, is buying the holdings in the MacKay River and Dover fields from Canadian firm Athabasca Oil Sands. The two fields hold about five billion barrels of oil, and Canada's government is expected to back the deal. Canada's Alberta oil sands hold the world's second-largest crude reserves, but the cost of extraction is high. This is because the process of separating the oil from the sand is both energy and labour intensive, and as such it has only been cost effective when global oil prices have been high. Analysts say world oil prices need to be above $80 a barrel for the Canadian oil sands to be viable. Oil is currently trading at about $70 a barrel after hitting highs of $147 last summer, and a low of near $30 at the start of this year. "The Canadian government is looking for investment and injections of capital," said William Lacey, an analyst at FirstEnergy Capital. "I don't see why this wouldn't be viewed as a positive." Canada's oil sands are estimated to hold a total 173 billion barrels of oil, the world's second-largest reserves behind Saudi Arabia.BBC, Sep 1, 2009

China deal may unleash frenzy

Calgary Herald, Sep 2, 2009

Calgary - China's oilsands buying spree could herald the start of a fresh wave of foreign investment in Canada and improving trade relations between the two countries, observers said Tuesday. PetroChina's $1.9-billion purchase of a majority stake in a pair of bitumen projects operated by Athabasca Oil Sands Corp. marksthe country's largest direct investment in Canada to date, coming on the heels of the $1.7-billion injection into Teck Cominco in July. Teck has 20 per cent in the Fort Hills oilsands project, which now belongs to Suncor Energy Inc. According to Kenny Zhang, a senior research analyst with the Vancouver-based Asia Pacific Foundation of Canada, the PetroChina deal could open the floodgates to Chinese investment in Canada after years of the Asian giant sitting on the sidelines. He's hoping for "more normal" trading relations after what he described as indifference on the part of the federal government. "It has positive implications for Canada-China relations," he said in an interview. "Canada is part of the global economy and can't ignore the importance of China." After centuries of self-imposed isolation, China's embrace of the outside world marks a dramatic philosophical and strategic shift in thinking, he added. "All indicators show that China is moving to be more influential in all respects of the world economy," he said. "China is going global."Calgary Herald, Sep 2, 2009

In Calgary, Premier Ed Stelmach welcomed the deal, coming at a time when the oilpatch -- and the provincial treasury -- has been hit hard by the global recession. "This shows that we are going to be game-changers in oil resources around the world," he told reporters. "This is going to help grow our economy. It's not only going to help Alberta, but you'll see this growth realized right across Canada because it's close to a $2-billion investment and we'll see the results of that, very positive results shared by all Canadians."

Prime Minister Stephen Harper has been criticized for not doing enough to promote Sino-Canadian relations with criticism of China's human rights record. On Tuesday, he struck a cautionary response to the transaction. Although he said Canada welcomes foreign investment, he said the deal would be thoroughly scrutinized under Canadian laws that prevent state-owned corporations from controlling strategic resources such as oil and gas. "Obviously, this is a more controversial investment," Harper told an audience at the WorldSkills competition in Calgary. "I will just say there are laws in place to review foreign investment transactions when they meet a certain threshold. And our government has strengthened those reviews by including a clause that allows officials to examine issues of national security." Harper said he hasn't seen the legal analysis of the deal and only would say the government will apply the law that's in place. "We've been very clear that, in the middle of a global recession, we will not be introducing further barriers to foreign investment. But the laws that are in place will be the laws under which all transactions are examined.".

China started investing in the Canadian oilsands in 2005, when SinoCanada Petroleum Corp., a subsidiary of Sinopec, bought a 40 per cent interest in the Synenco Northern Lights Project (now owned by Total). In April, the Chinese company upped its stake to 50 per cent. Also in 2005, the Chinese National Overseas Oil Co. bought a 16.69 per cent interest for$150 million in junior oilsands player MEG Energy, where it continues to hold one seat on the 10-member board....

Some have suggested the deal threatens Canada's energy security and special trading relationship with the United States, the country's single-largest customer for Canadian oil. But University of Calgary economist Frank Atkins dismissed those criticisms as fearmongering. "I really don't understand the security issue, Idon't see anything sinister in it," he said. "People are really digging up bogeymen where there aren't any." Bob Keiller, chief executive of Aberdeen, Scotland-based engineering company PSN, said Canada would do well to attract investment from companies, such as the state-owned Chinese corporations, with different funding models that are not pressured by shareholder expectations. "Perhaps they should be looking for Chinese or Middle Eastern investmentin Alberta to provide a different backdrop and a different model," Keiller said. "That's not to say no to international oil companies; they are hugely able and hugely professional in what they do. But if we keep doing the same things under the same conditions, likely we're going to get the same outcome --we'll likely see the chase for the boom and the drop-off when we see the bust."

Representatives from the Canadian Association of Petroleum Producers said the Chinese splash on Canadian shores underscores the global appeal of Canada's oilpatch. "Approximately half of the world's investable oil is in Alberta's oilsands," CAPP spokesman Travis Davies said. "That fact creates global interest and global capital, which in its own right is a positive for Alberta and Canada in terms of jobs and economic activity." "Capital is capital," he added. "A healthy free-market system doesn't discriminate based on the national spectre the money came from."

China strikes deal to take interest in Alberta oilsands

by Marcus Ermisch, Edmonton Sun Media, Sep 1, 2009

Its relentless pursuit of oil has led China's national oil company into the heart of Canada's energy industry, where it has struck a multibillion-dollar deal with a private Calgary oilsands player. If approved, the joint-venture agreement with Athabasca Oil Sands Corp. will give PetroChina Company Ltd. control over three billion barrels of bitumen.by Marcus Ermisch, Edmonton Sun Media, Sep 1, 2009

PetroChina is the publicly traded arm of China National Petroleum Corp., that country's largest oil and gas producer. The $1.9-billion deal, under which PetroChina will take a 60% interest in two oilsands projects in northeastern Alberta -- MacKay River and Dover -- is sure to attract more than the standard regulatory scrutiny given its value and foreign involvement. Like all such transactions, it is subject to Competition Bureau approval and the Investment Canada Act.

Athabasca chairman Bill Gallacher said he's not worried the deal could raise red flags with regulators. But to help ensure a smooth passage, he has given the Alberta and federal governments advance notice of the pending transaction. "That's why we've been very respectful of all the processes that we're going to need to go down, and the pathways we're going to need to follow in order to make sure that we do get this approved," he said in a conference call yesterday. "It's courtesy for us to let both levels of government know that something of this magnitude is coming down and to make sure that they're fully informed." CEO Sveinung Svarte said "we don't believe (the regulatory process) should be a major obstacle to this deal."

China oilsands bid sparks energy security debate

by Jason Fekete, Calgary Herald Sep 1, 2009

Calgary - PetroChina's $1.9-billion venture into Alberta's oilsands -- giving the state-owned company a majority stake in key bitumen operations -- is sparking questions in Canada and the U. S. about energy security, and what say Ottawa should have in approving the deal. The Alberta government is urging the federal Tories to quickly give their blessing to the agreement, arguing international investment in the oilsands will produce a slew of economic spinoffs.by Jason Fekete, Calgary Herald Sep 1, 2009

Athabasca Oil Sands Corp. announced Monday that state-owned PetroChina International Investment Co. Ltd. will buy a 60 per cent share in its MacKay River and Dover projects for nearly $2 billion, marking the largest foray to date by China in the Canada oilsands.

Under the Investment Canada Act, any international firm acquiring controlling interest of a company with assets more than $312 million will be reviewed by the federal government to determine its total value. Included within that inspection is a requirement that the company prove the net benefit of the deal to Canada. The Deal - PetroChina to buy 60 per cent stake in MacKay River and Dover oilsands projects; Athabasca will continue to operate the projects - $1.9-billion deal is China's largest venture in Canadian oilsands. - Deal expected to close Oct. 31. But the proposed agreement would see PetroChina take a controlling interest in two projects, not the entire company, which has even Athabasca's top brass uncertain what regulatory approvals are required.

Ottawa has hinted it will exercise its power to protect Canadian resources should foreign companies try to take over assets important to the country's security. Bill Gallacher, chairman of AOSC [Athabasca Oil Sands Corp], said while his company gave the provincial and federal governments a heads-up that a deal was on the way, he is unsure which regulatory hurdles have to be cleared. "We know there will be some (regulatory approvals needed), but we just don't know which ones," Gallacher said. There's also provisions included within the federal legislation to review applicable deals for national securityreasons if concerns are raised by Foreign Affairs and International Trade or Public Safety Canada, said Darren Cunningham, communications director for federal Industry Minister Tony Clement. "You have to prove that this transaction is in the best interest of Canada," Cunningham said Monday. Cunninghamwouldn't specifically say whether Ottawa will review the PetroChina transaction under the Investment Canada Act, but noted "the government is always for international investment" because it's a boon to the Canadian economy.

However, Chinese investment in North American oil companies has sparked questions in the past about energy security. In 2005, the Chinese National Offshore Oil Corporation -- a firm largely owned by the Chinese government -- attempted a takeover of U. S.-based Unocal Corp., but the move sparked outrage in Congress. The foreign company eventually abandoned its bid for Unocal.

In Canada, federal Environment Minister Jim Prentice has said in the past he welcomes foreign investment into the oilsands because it will offer Alberta some additional export markets, rather than having to rely solely on the U. S. Both the Stelmach [Albert Premier] government and AOSC [Athabasca Oil Sands Corp] said they're confident the federal government will green light the deal if it's reviewed, recognizing the value to Alberta and Canada. "At the end of the day we are going to follow the proper pathways and channels needed to make sure this goes forward," said Gallacher.

The agreement could help thaw what's been a chilly investment climate in Alberta, with about $100 billion worth of mining and in situ oilsands projects being shelved since last year. It could also produce much-needed employment opportunities for a battered provincial economy that's shed tens of thousands of jobs since last fall. "I certainly would be hopeful that they (Ottawa) would be speaking about this and what the advantages are to both the province and Canada," said Alberta Energy spokesman Tim Markle. NDP environment critic Linda Duncan, an Alberta MP, said it's incumbent upon the Harper government to ensure the agreement produces investment that's environmentally sustainable, but also provides jobs to Canadian workers. "We better make sure we're protecting our interests and the resource in the long term," Duncan said in an interview.

If the PetroChina deal is approved, it will send a signal to U. S. decision-makers that Alberta has alternative markets for its oilsands, regardless of the environmental concerns routinely raised south of the border, said Chris Sands, a specialist in Canada-U. S. relations at the Washington-based Hudson Institute.

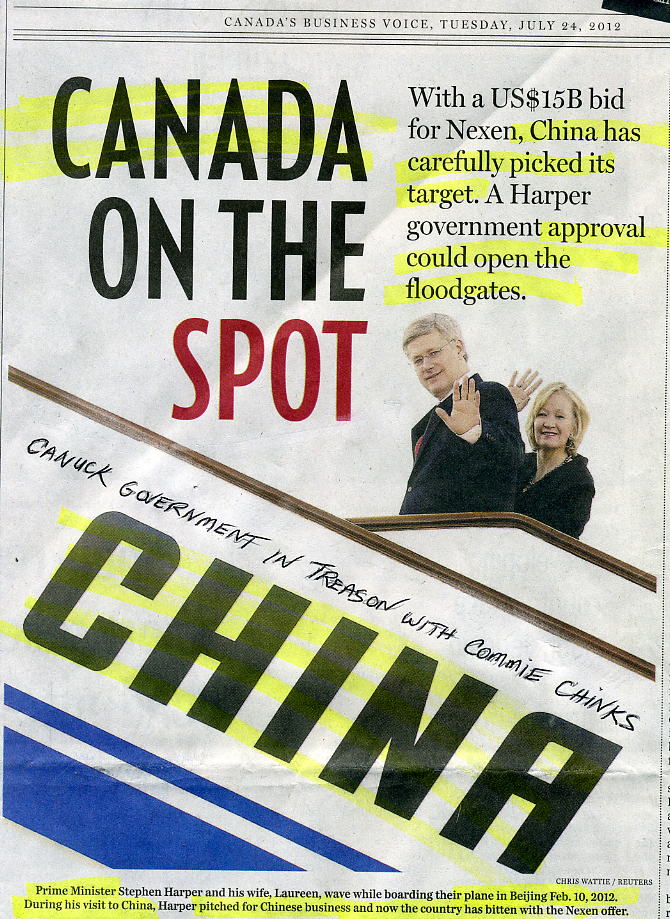

Communist China nationalizes Canada's oil sands

(PM allows Chinese CNOOC takeover Canadian Nexen)

Spy Chief right that politicians in treason with Red China

watch CSIS Fadden says China agents influence Canada gov't

CanNews/YouTube, Jan 1, 2013

CHINA TALONS IN CANADA OIL SANDS

CHINA IN CANADA WARNS SPY CHIEF

GOLDSTEIN CONSPIRACY IN 1984

& JFK OPPOSED MONOLITHIC CONSPIRACY

ORWELL ARCH-ENEMY OF MARX

listen JACKIE JURA INTERVIEW ALL ABOUT ORWELL

& 7.Systems & 35.Big Brother's Brotherhood

Canadians say NO-NO-NO to China owning our resources

(PM allows Chinese CNOOC takeover Canadian Nexen)

Spy Chief right that politicians in treason with Red China

watch CSIS Fadden says China agents influence Canada gov't

CanNews/YouTube, Jan 1, 2013

CHINA TALONS IN CANADA OIL SANDS

CHINA IN CANADA WARNS SPY CHIEF

GOLDSTEIN CONSPIRACY IN 1984

& JFK OPPOSED MONOLITHIC CONSPIRACY

ORWELL ARCH-ENEMY OF MARX

listen JACKIE JURA INTERVIEW ALL ABOUT ORWELL

& 7.Systems & 35.Big Brother's Brotherhood

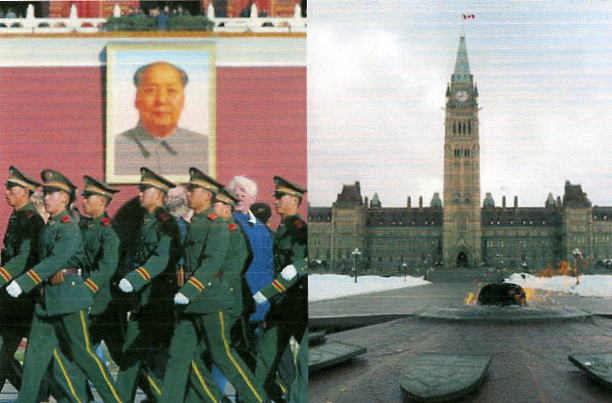

(nightmarish future Chinese army marching down street)

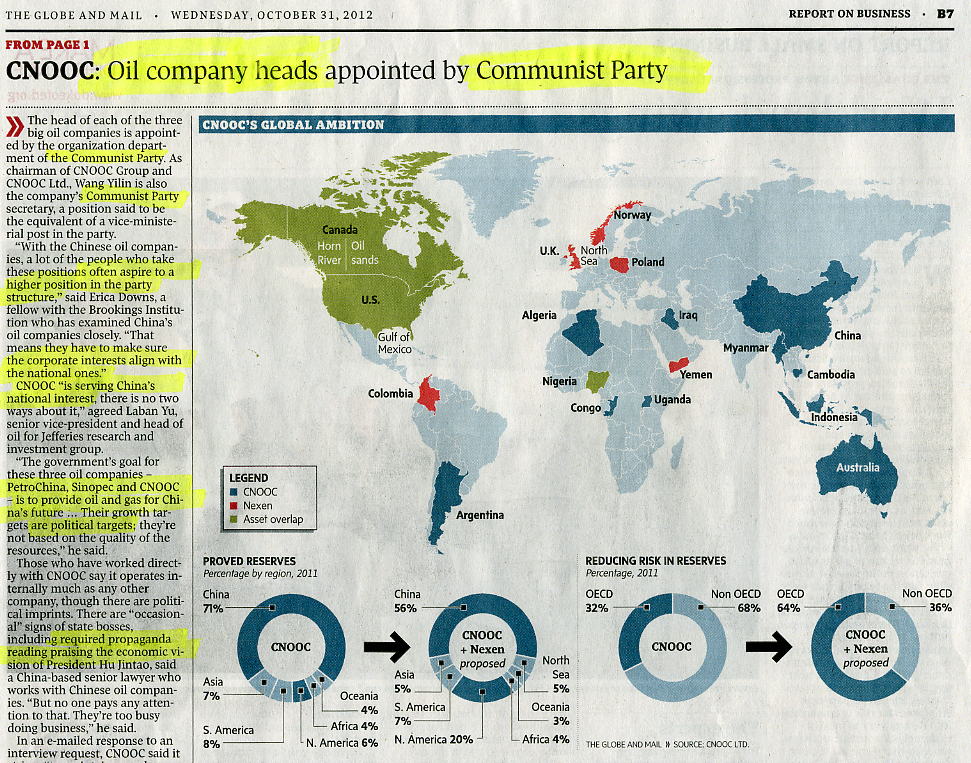

China oil company heads are all high-level Communists

(naive Canadians sheep-walking into takeover by China)

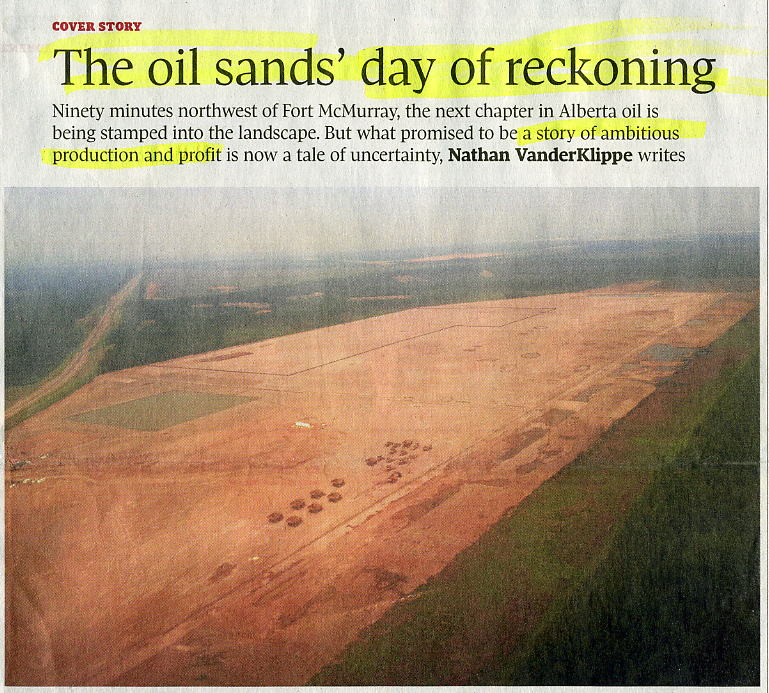

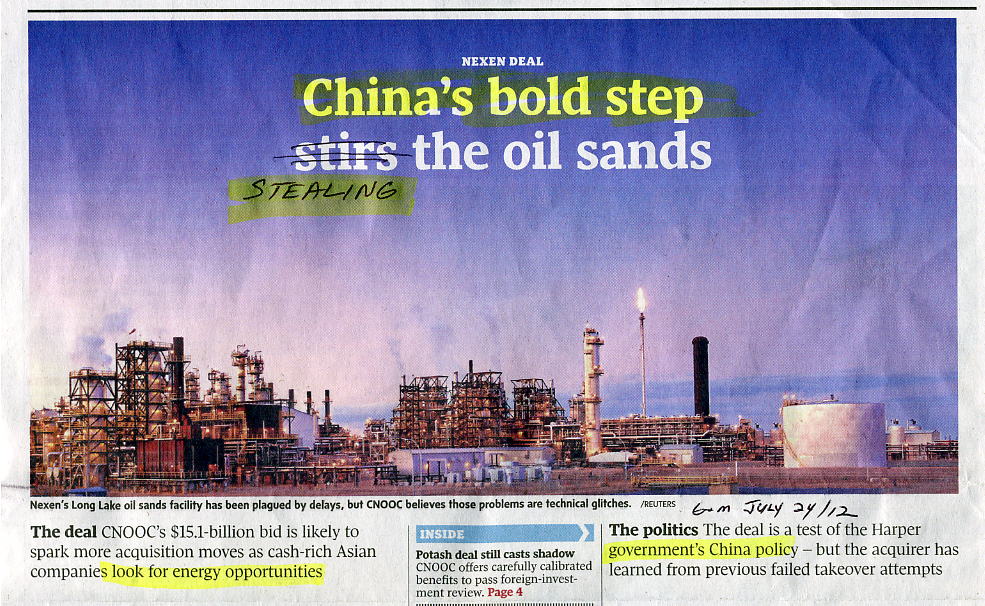

Communist China takes new step in Canada's oilsands

(new partner TransCanada building pipeline for Chinese)

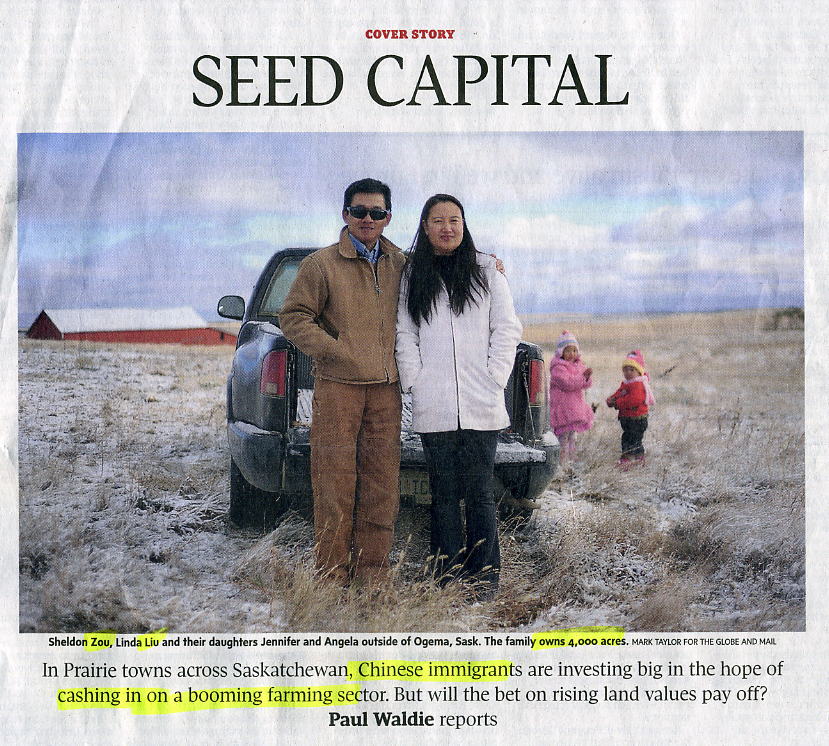

Rich Red Chinese immigrants buying Canada's farmland

(hire farmers to grow crops then ship direct to China)

Head of Canada's Police Chiefs Chu is Chinese

(Chu says democracies need police snooping powers)

Chinese police crackdown on pro-democracy activists

(police silence dissent against Communist government)

CBC/Globe/VanSun, Nov 2, 2012

CHINADA'S SOVIETIZATION

& CHINESE TAKE-OVER AMERICA

& 35.Big Brother Brotherhood & 7.Systems

3.Surveillance & 20.Thought Police

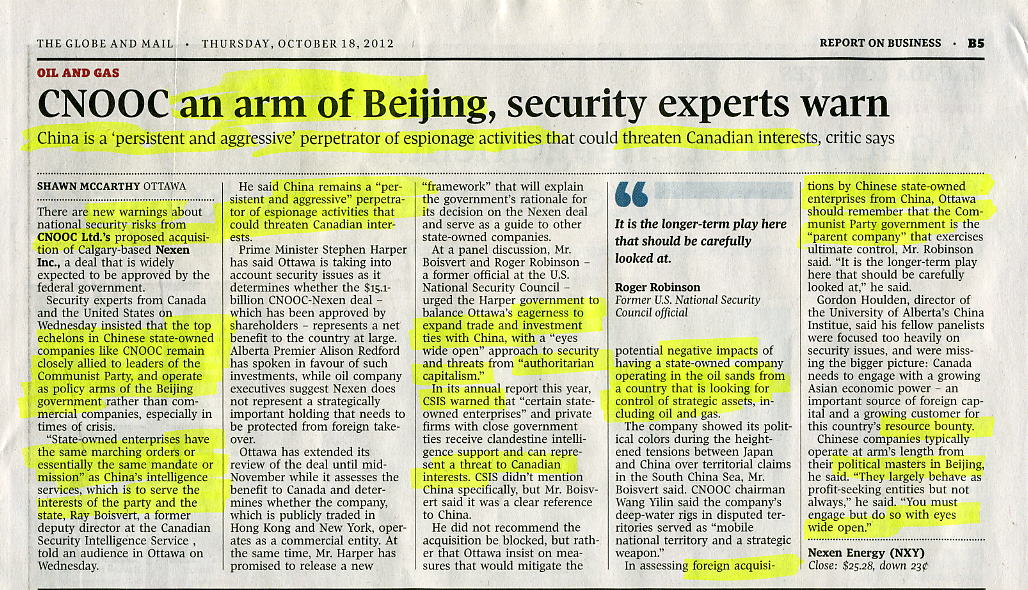

Canada Spy agency CSIS warns of espionage risk with foreign takeovers, Toronto Star, Sep 21, 2012

Canada’s top spy is sounding the alarm over security threats facing Canada, including...state-owned corporations who snoop on Canadian business interests and cyber-attackers who attempt to hack the federal government’s computer network daily. Richard Fadden, director of the Canadian Security Intelligence Service used the agency’s annual report to issue a pointed warning about the potential risks posed by foreign state-owned companies. His message comes as the federal government is reviewing a proposal by CNOOC Ltd., a state-owned Chinese firm, to take over Calgary-based Nexen Inc., an oil-and-gas company. “Certain state-owned enterprises and private firms with close ties to their home governments have pursued opaque agendas or received clandestine intelligence support for their pursuits here,” Fadden says in the report which was released Thursday. “When foreign companies with ties to foreign intelligence agencies or hostile governments seek to acquire control over strategic sectors of the Canadian economy, it can represent a threat to Canadian security interests.”...

All China corporations arms of Communist Government

Canada's Chinese oil sands

(Chinese Communist Party buying Canadian Government)

Canada exporting uranium to Communist China for nukes

WARNING! Red China dangerous in Canada's oilsands

(gov't breaking rules against Communist ownership)

Canada PM awarded by Israel friends Kissinger & rabbi

Jewish state Israel threatens to bomb Islamic state Iran

(says non-nuclear Iran an evil threat to nuclear Israel)

Oilsands CEO Reinhart approves takeover by Red China

(Zionist Kissinger opened America doors to Red China)

ZIONISM IN AMERICA

& GOLDSTEIN CONSPIRACY IN 1984

& What China wants: Take over Canada's resources

Canada increasing food exports to Communist China

& Canada oilsands CEOs approve deals with Red China

Spy agency warns: China in oilsands threatens Canada

& USA Secretary of Energy Chu is Chinese

Sep 22-28, 2012

CHINA TALONS IN CANADA OIL SANDS

& TAR-BABY OBAMA TARS OIL SANDS

CHINESE TAKE OVER AMERICA

& CHINA IN CANADA WARNS SPY CHIEF

& BIG BROTHER CAPITALIST COMMUNISM

& Systems & SuperStates & BB Brotherhood

Why are you Chinese statues in Canada laughing?

Canada exporting uranium-reactors-technology to China

watch Chink wolf explains nuke deal to Canuck sheep

watch Canuck gov't in treason with commie Chinks

Red China boldly stealing Canada's oilsands

& Commie Chinks laughing at crazy Canucks

Vancouver a running joke to Beijing sculptor

photos Chinese statues a-maze-ing laughter

CHINA IN CANADA WARNS SPY CHIEF

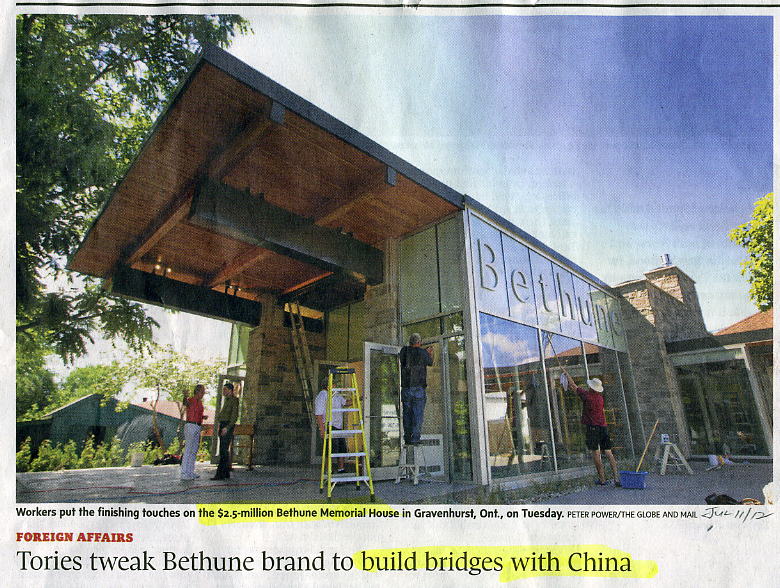

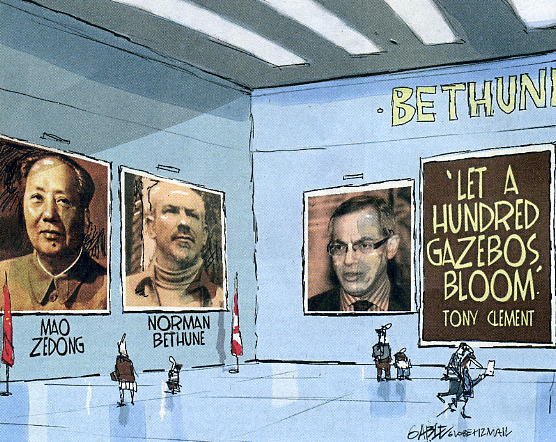

CANADA PULLS RICKSHAW FOR RED CHINA

(tax-funded museum for Mao-worshipping Bethune)

Canada's shrine of shame to Communist China

Canada Treasury head arrives in rickshaw

watch Canada PM backs shrine for Communist

NP/CBC/Sun/Globe, Jul 16-Aug 12, 2012

Mao: In Memory of Norman Bethune

MONSTER MAO UNKNOWN STORY

& 7.Systems & 35.Big Brother Brotherhood

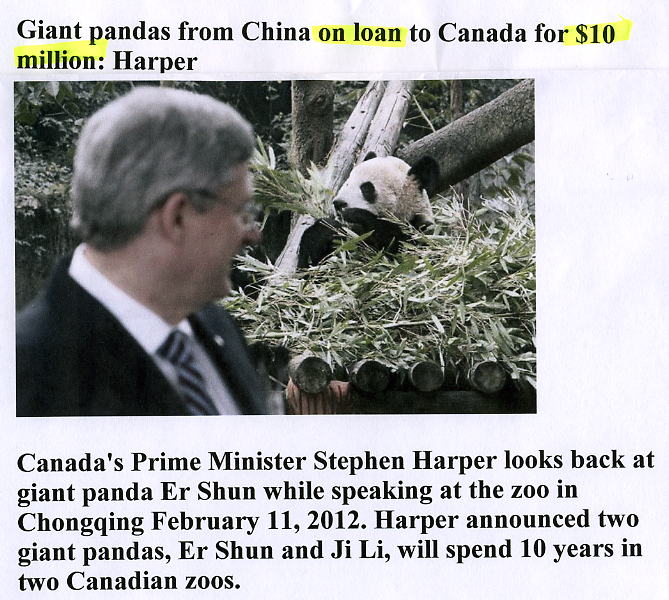

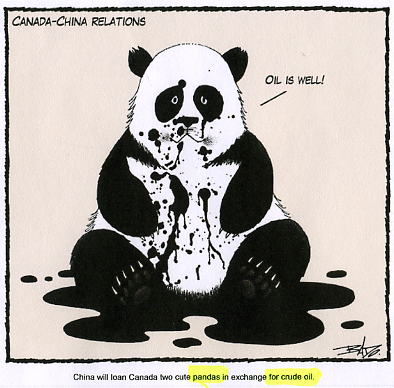

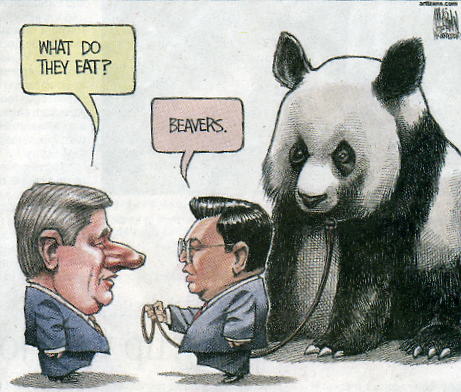

Canada government in bed with Red China screwing Canadians

(oil/gas pipelines to China instead of to eastern Canada/USA)

Uranium/oil/gas/wood etc to China against Canada's interests

(trading energy/nukes to the enemy for Panda bears)

USA must respect China's interests warns China

(Kissinger opened USA's door to Communist China)

Edmonton/Can/Telegraph, Feb 17-22, 2012

CHINA IN CANADA WARNS SPY CHIEF

& CHINESE TAKE-OVER AMERICA

& 7.Systems of Thought & 35.BB Brotherhood

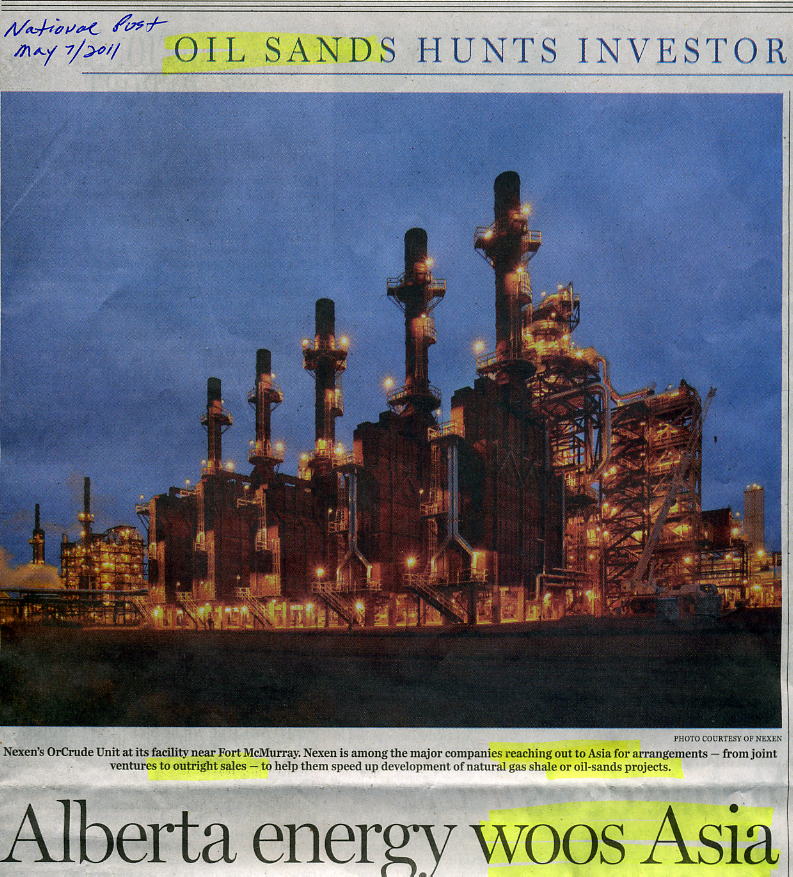

Canada giving ownership of oil sands to Communist China (treasonous gov't dealing nation's natural resources), National Post, May 7, 2011

Canada giving ownership of oil sands to Communist China (treasonous gov't dealing nation's natural resources), National Post, May 7, 2011Why America should love Alberta oil sands, Calgary Herald, Aug 7, 2010

Lessons of oil-sands tragedy, Financial Post, Aug 25, 2009

Ottawa officials and politicians are encouraging Canadians to do business in China and with Chinese entities. But here's a cautionary tale about the possible pitfalls of doing business with the Middle Kingdom: Canadian Natural Resources Ltd. has built Phase I of the gigantic oil-sands project known as Horizon Oil Sands, where it awarded a contract to a subsidiary of Chinese oil giant Sinopec Corp., SSEC Canada Ltd. (whose parent company is Sinopec Shanghai Engineering Co. Ltd.), for the construction of two tank farms comprising 11 storage tanks and the supply of the required labour. SSEC Canada Ltd. brought in temporary foreign workers to do the work in 2006 and 2007. On April 24, 2007 an accident occurred on site. Two Chinese workers died and five more were injured, two seriously. An investigation by Alberta health and safety officials, along with employment standards personnel, ensued and this spring a total of 53 provincial charges were laid against the three companies -- SSEC Canada Ltd., Sinopec Shanghai Engineering Co. Ltd. and CNRL-- for allegedly allowing unsafe working conditions that led to the deaths and injuries, Barrie Harrison of Alberta Employment and Immigration in Edmonton said in a phone interview last week. Accidents happen all the time, but there are two other problems that have arisen in this case. The first is that the court hearing had to be delayed because of Sinopec and the second issue is that the Chinese workers were not paid by their Chinese employer even though they worked four months before the accident. "Sinopec now claims that they have no representatives in Canada, so we are unable to 'serve' them, and the court case was delayed until we can establish who their official representatives are and serve them notice," said Chris Chodan, a spokesman for the Alberta Occupational Health and Safety Branch. "The next court appearance is scheduled for [Sept. 14]. The court case could actually proceed without Sinopec being present, however."

The issue of non-payment is also preoccupying Alberta and other officials. Harrison explained the situation: "There are two issues here. One is the OHS [occupational health and safety investigation and subsequent charges being laid]. Another is an employment standards investigation that led to the discovery of the 132 Chinese workers not being paid for their work from the date of the OHS incident [April 2007] to July of that year. The Alberta government is in receipt of $3.17-million and is in the midst of tracking the workers and determining a process to get this money back in the hands of workers." Canadian Natural has fully cooperated by handing over the payment, which has been put into a trust account by the government. Canadian Natural also has had to pay other contractors to tear down, then redo the work that was stopped after two of the tank structures collapsed, one of which led to the fatalities. Alberta is working with federal immigration authorities to find the workers and the families of all the unpaid workers to dispense the back pay and benefits. This contract was the first time a large group of temporary workers was brought in under one umbrella for one specific job. It has not happened since and the lesson learned is that "employers cannot delegate away safety but had also better be on the site supervising workers," Chodan said. As several of these matters are now before the courts, Canadian Natural cannot provide any comment at this time, the company told me last week.

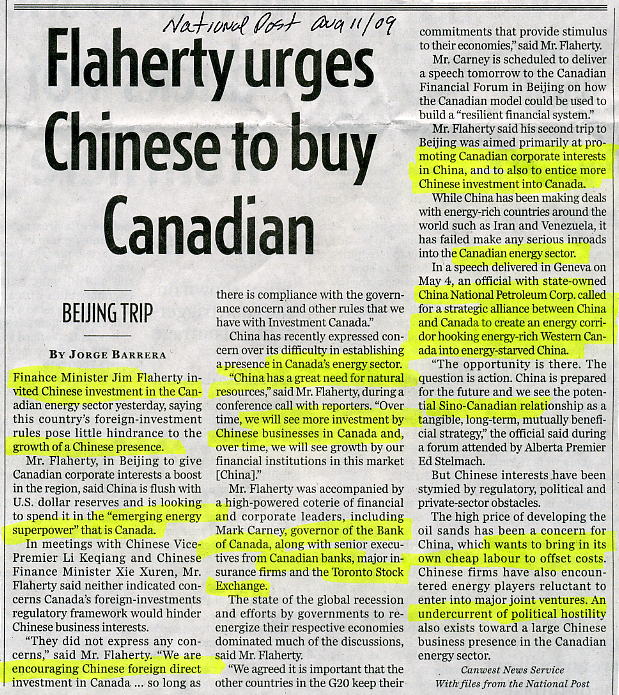

Canada urges Red China buy energy sector (top politicians & bankers entice top communists...China bring own cheap labour to offset costs). National Post, Aug 11, 2009

Canada urges Red China buy energy sector (top politicians & bankers entice top communists...China bring own cheap labour to offset costs). National Post, Aug 11, 2009Flaherty pleased with Chinese relations, Ottawa Citizen, Aug 14, 2009

SHANGHAI — Finance Minister Jim Flaherty left China Friday with the stage set and the audience primed for a visit by Prime Minister Stephen Harper, perhaps as early as November. Flaherty was the fourth top level cabinet minister to visit China in the past four months, ending more than two years of benign neglect of the emerging super power by Ottawa. Robert Martin, the managing director of the Asia division of BMO Financial Group, based in Shanghai, had nothing but praise for Flaherty’s six-day foray in China. The minister “demonstrated with his feet the importance of the Canada-China relations,” Martin said. The banker added: “We have had four wonderful visits and I think now we are on the right track. “(Canada) needed a constructive engagement with China. Many things we agree on, many things we don’t agree on, but we needed to be talking and to be in front of each other. That’s how friends get along.” Martin said he now feltCanada was “out of the wilderness” in China.

Flaherty, who led a delegation of regulators, bankers and insurance executives to China, told the audience at a business luncheon on the 93rd floor of one of Shanghai’s spectacular towers that he judged his trip to be a success. He said Chinese officials greeted him with “direct conversations and plain speaking,” making sure their meetings were productive. He also praised his Chinese counterparts for how well-versed they were on Canada and Canadian business. In Beijing, Flaherty met with vice-premier and heir-presumptive to the Chinese presidency, Li Keqiang. He said he was “honoured” to meet the man who will likely succeed President Hu Jintao in 2012. It was the prime minister’s outspoken criticism of China’s human rights record that first soured relations between Ottawa and Beijing, but there was no chance of those kind of “red-flag” issues spoiling Flaherty’s visit this week. The minister made it clear he considered the sorry state of the world’s economy dictated that finance and economics were at the top of his agenda, not politics. He said there were “no discussions” about the myriad of problems that have plagued the bilateral relationship. He said he did raise “one or two irritants,” but they were more in the way of consular issues. “These were asides,” he said, “not major issues.”

Canada's oil patch open for Chinese business. Calgary Herald, Aug 10, 2009

Finance Minister Jim Flaherty rolled out the welcome mat for Chinese investment in the Canadian energy sector Monday, saying this country’s foreign-investment rules pose little hindrance to the growth of a Chinese presence. Mr. Flaherty, in Beijing to give Canadian corporate interests a boost in the region, said China is flush with U.S. dollars reserves and is looking to spend it in the “emerging energy superpower” that is Canada. In meetings with Chinese Vice-Premier Li Keqiang and Chinese Finance Minister Xie Xuren, Mr. Flaherty said neither indicated concerns Canada’s foreign-investments regulatory framework would hinder Chinese business interests. “They did not express any concerns,” said Mr. Flaherty. “We are encouraging Chinese foreign direct investment in Canada . . . so long as there is compliance with the governance concern and other rules that we have with Investment Canada.” China has recently expressed concernover its difficulty in establishing a presence in Canada’s energy sector. “China has a great need for natural resources,” said Mr. Flaherty, during a conference call with reporters. “Over time, we will see more investment by Chinese businesses in Canada and, over time, we will see growth by our financial institutions in this market (China).”

Mr. Flaherty was accompanied by a high-powered Canadian coterie of financial and corporate leaders, including Mark Carney, governor of the Bank of Canada, along with senior executives from Canadian banks, major insurance firms and the Toronto Stock Exchange. The state of the global recession and efforts by governments to re-energize their respective economies dominated much of the discussions, said Mr. Flaherty. “We agreed it is important that the other countries in the G20 keep their commitments that provide stimulus to their economies,” said Mr. Flaherty. Carney is scheduled to deliver a speech Wednesday to the Canadian Financial Forum in Beijing on how the Canadian model could be used to build a “resilient financial system.”

Mr. Flaherty said his second trip to Beijing was aimed primarily at promoting Canadian corporate interests in China, and to also to entice more Chinese investment into Canada. While China has been making deals with energy rich countries around the world like Iran and Venezuela, it has failed make any serious inroads into the Canadian energy sector. In a speech delivered in Geneva on May 4, an official with state-owned China National Petroleum Corp called for a strategic alliance between China and Canada to create an energy corridor hooking energy-rich Western Canada into energy-starved China. “The opportunity is there. The question is action. China is prepared for the future and we see the potential Sino-Canadian relationship as a tangible, long-term, mutually beneficial strategy,” the official said during a forum attended by Alberta Premier Ed Stelmach. But Chinese interests have been stymied by regulatory, political and private-sector obstacles. The high price of developing the oil sands has been a concern for China, which wants to bring in their own cheap labour to offset costs. Chinese firms have also encountered energy players reluctant to enter into major joint ventures. An undercurrent of political hostility also exists toward a large Chinese business presence in the Canadian energy sector.

No comments:

Post a Comment

Comments always welcome!