What in the world does China own?

With an estimated $4 trillion (£2.7tn) of foreign reserves stashed away in various sovereign wealth funds, China has plenty of cash to splash.

Despite the recent slowdown in the country's GDP, most developed economies would dream of an annual growth rate of 7%.

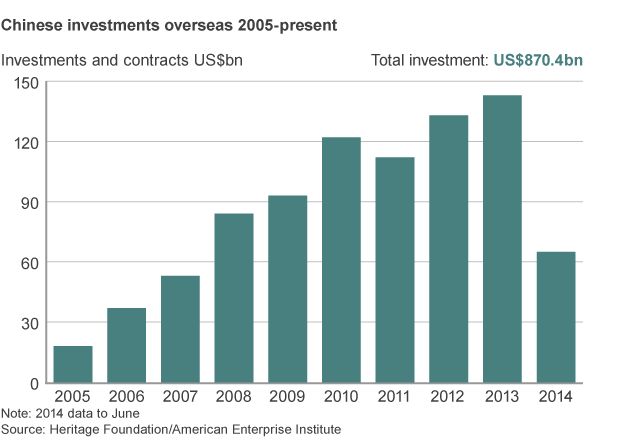

No wonder then that annual Chinese investment overseas has grown eightfold over the past 10 years to reach more than $140bn in 2013.

Somewhat surprisingly, there was a modest slowdown in 2014, with investment in the first half lower than a year earlier, largely due to a fall in spending on energy projects.

But this dip is likely to be short lived, for the simple reason that population growth and, more importantly, the exploding middle classes mean China's voracious appetite for resources will continue to grow.

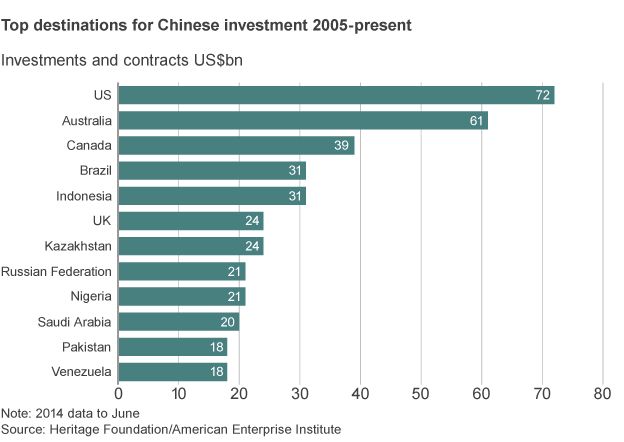

The US has been the largest recipient of Chinese money over the past decade, largely due to a burst of investment since 2012 - this time last year, Australia was the number one destination over the previous 10 years.

In the first half of last year, however, investment in the UK matched that in the US, as it cemented its place as China's favourite European country to invest in - at $24bn it received more than double France's $11bn.

China has made investments and signed contracts all over the world, but Africa in particular has piqued its interest. China, the world's second largest economy, has done business in 34 African countries, with Nigeria top of the pile at $21bn. Ethiopia and Algeria have attracted more than $15bn, with Angola and South Africa each drawing in almost $10bn.

The reason is simply Africa's wealth of natural resources.

At the other end of the scale, political tensions help explain why China has invested almost as much in Mongolia ($1.4bn) as it has in Japan ($1.6bn), the country it recently overtook in the league of the world's most powerful economies.

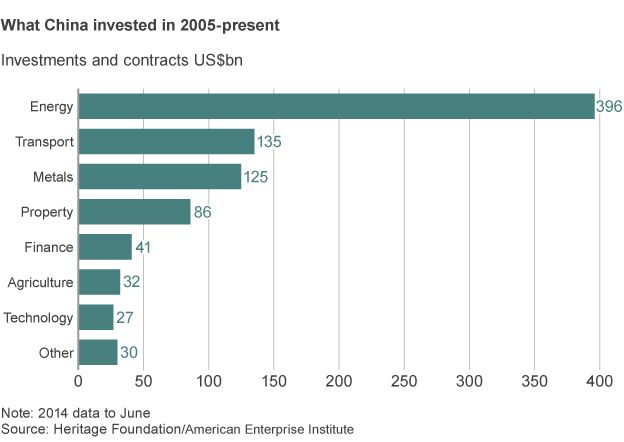

Resources are what China needs, particularly to meet demand for energy that is predicted to triple by 2050.

That is why investment in energy has dwarfed that in other sectors since 2005, with almost $400bn committed to securing power for China's population, which currently stands at almost 1.4 billion.

Investment in energy actually dipped slightly last year, with that in other areas such as transportation, property and technology taking up much of the slack. Energy investments tend to be large-scale and dominated by state-owned companies, so the temporary lull has meant less state and more private investment. In some cases, this makes Chinese money more palatable to host countries.

Metals are another key area of investment, as these are needed in construction and industry to help fuel China's rapidly expanding economy.

The Chinese state has made some staggeringly large investments in individual companies and projects, most of which are, unsurprisingly, in the energy sector.

CNOOC, for example, spent $15bn on Canada's Nexen in 2013, while other state-owned energy companies have wracked up multi-billion dollar deals in recent years.

Outside of energy and resources, finance has also attracted some serious money, with Morgan Stanley and Standard Bank the biggest recipients of Chinese cash.

| Biggest investments by company, 2005-present | |||||

|---|---|---|---|---|---|

| Company | Country | Sector | Investor | US$bn | % share |

| Nexen | Canada | Energy | CNOOC | 15.1 | N/A |

| Rio Tinto | Australia | Metals | Chinalco | 12.8 | 11 |

| Adaz Petroleum | Switzerland | Energy | Sinopec | 7.2 | 100 |

| Repsol | Brazil | Energy | Sinopec | 7.1 | 40 |

| Smithfield Foods | US | Agriculture | Shuanghui | 7.1 | 100 |

| Glencore | Peru | Metals | Minmetal | 5.85 | N/A |

| Standard Bank | South Africa | Finance | ICBC | 5.6 | 20 |

| BP and South Iraq Oil | Iraq | Energy | CNPC | 5.59 | 37 |

| KasMunaiGas National | Kazakhstan | Energy | CNPC | 5.3 | 8 |

| Morgan Stanley | US | Finance | CIC | 5 | 10 |

| Galp Energia | Brazil | Energy | Sinopec | 4.8 | 30 |

| ConocoPhillips | Canada | Energy | Sinopec | 4.65 | 9 |

| Source: Heritage Foundation/American Enterprise Institute | |||||

They may not represent the same kind of outlay, but China has also invested in some household names across the world, from IBM and Barclays to Ford and General Motors.

In percentage terms they may not add up to much, but they still represent a hefty outlay in dollar terms. Some names may be something of a surprise.

| Selected other investments by company | |||||

|---|---|---|---|---|---|

| Company | Country | Sector | Investor | US$bn | % share |

| IBM | US | Technology | Lenovo | 1.74 | N/A |

| Rosneft | Russia | Energy | Sinopec | 3.94 | N/A |

| Anglo American | UK | Metals | China Dev Bank | 0.8 | 1 |

| Blackstone | US | Finance | CIC | 3.03 | 9 |

| Barclays | UK | Finance | China Dev Bank | 3.04 | 3 |

| BP | UK | Energy | Safe | 2.01 | 1 |

| Total | France | Energy | Safe | 2.8 | 2 |

| Blackrock | US | Finance | CIC | 0.71 | N/A |

| Diageo | UK | Agriculture | CIC | 0.37 | 1 |

| Telefonica | Spain | Technology | Unicom | 1 | 1 |

| Ford | US | Transport | Geely Autos | 1.8 | N/A |

| Volvo | Sweden | Transport | Geely Autos | 0.9 | N/A |

| Chesapeake Energy | US | Energy | CNOOC | 2.37 | N/A |

| General Motors | US | Transport | SAIC | 0.5 | N/A |

| Munich Re | Germany | Finance | Safe | 0.72 | 3 |

| Thames Water | UK | Utilities | CIC | 92 | 9 |

| Weetabix | UK | Agriculture | Bright Foods | 1.94 | 60 |

| Peugeot | France | Transport | Dongfeng | 1.1 | 14 |

| House of Fraser | UK | Retail | Sanpower | 0.79 | 89 |

| Source: Heritage Foundation/American Enterprise Institute | |||||

No comments:

Post a Comment

Comments always welcome!