Auditors past and present, frustrated by lack of action in the Vancouver real estate arena, describe a departmental culture that sees law enforcement and principles lose out to the pursuit of easy audits against ‘the little guys’

Aug 26 2016

The Hongcouver blog’s Canada Revenue Agency sources - auditors past and present - are nervous.

“CRA is vicious and will retaliate if they find out I gave you anything, believe me.”

“I’m going to go dark after this. There’s just too much heat.”

“Please be very careful and advise your other source to completely delete all email and texts.”

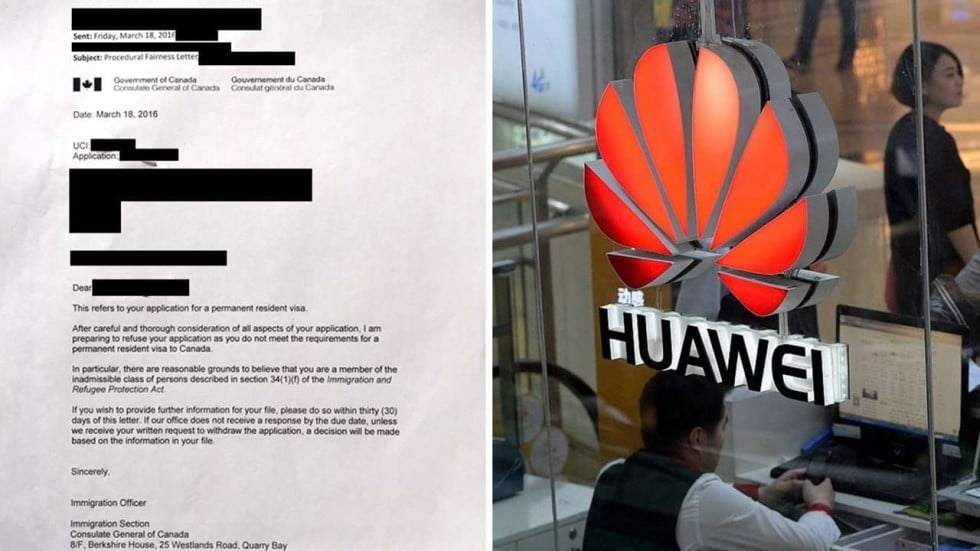

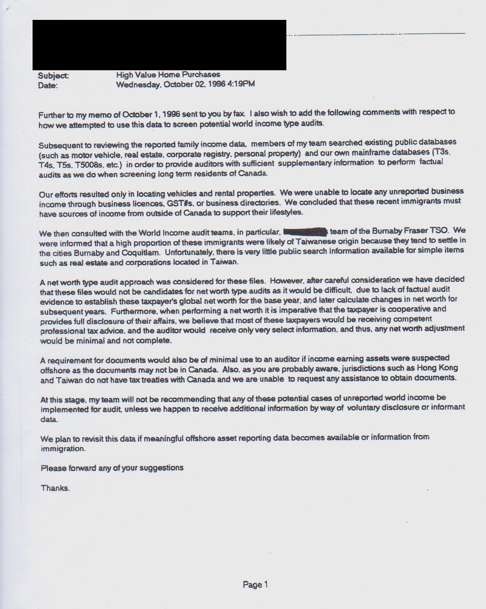

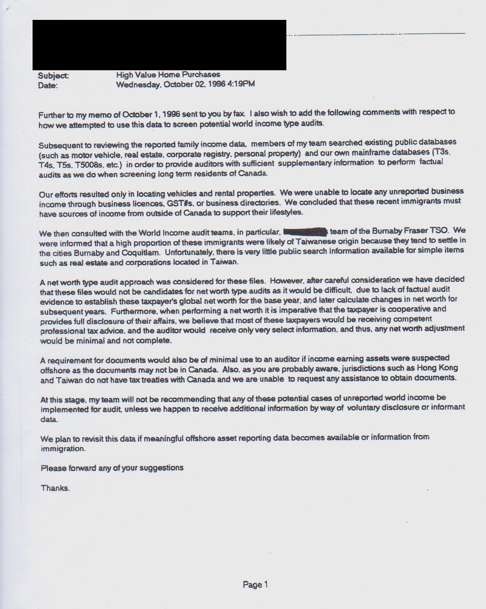

After successive leaks to the South China Morning Post – revealing last month secret plans to crack down on foreign-funded real estate deals in Vancouver, then last week exposing how the agency knew about the huge scale of the problem for 20 years while effectively ignoring associated tax cheating – the CRA sprang into action.

Not in further pursuit of the suspected tax cheats - but in an attempt to pursue the leakers.

In the past few days, two of the SCMP’s three CRA sources discussed the response by the agency in greater Vancouver.

Meetings have been held. Staff have been questioned. Reminders given about duty, responsibility and values.

Said a current auditor: “Since the [July] leak, everyone has been reminded of ethics. ‘You have a duty, to your employer’, those kinds of things. There were group sessions and emails [in which we were told] if we have concerns, we should talk to team leaders and they will funnel it up, and something will happen. But nothing usually does. No one is willing to go further up the chain to say ‘we don’t even have the resources to do these audits.”

In stark contrast to the previous lackadaisical pursuit of suspected tax cheats – with just one successful audit of undeclared global income having been executed in BC last year - the internal response to the leaks has been swift, starting within a day of the SCMP’s July 14 report, the auditor said.

A retired auditor who is in contact with current staff said employees had been hauled in and “interrogated” about the leaks.

The culture of ‘Teba’

I asked both sources to expand on an issue that still bothered me about their stories: if the CRA is well aware of wide-scale tax cheating among foreign-earning real estate buyers in Vancouver – and has been so for decades - why has it not done more about it?

Both seemed to think me naïve. They cited what they saw as a huge cultural problem within the CRA that deterred such pursuit: a devotion to “Teba”, or tax earned by audit. In other words, the bottom line.

[Teba is] why we end up beating up on the little guys instead, who run gas stations and small businesses, the ones who will put up the least resistance

CRA AUDITOR

They said audits are seen primarily as a means of raising revenue, as opposed to enforcing the law, executing moral rightness or acting as a deterrent to future cheating. A lengthy-but-principled investigation into an obstructive foreign-earning cheat wasn’t something applauded by bosses – it was to be avoided by both managers and auditors. “Like the plague,” said the retired auditor.

The current auditor cited the recently exposed KPMG case (in which self-confessed cheating clients of the world accountancy giant were granted secret amnesty by the CRA if they handed over their back taxes and some interest) as demonstrating that the agency took the easiest path to revenue, regardless of the ethical implications.

“CRA is given a set amount of money by Ottawa and they expect a return on their money,” the auditor said. “We’re the only department that makes money, and foreign-linked audits take a lot of time. It’s hard to verify sources of income coming out of mainland China. Hong Kong is somewhat open, but otherwise - it’s hard.”

Even with 50 auditors newly assigned to real estate cases, pursuit of undeclared global income would prove difficult – in spite of that issue having been first on a list of the CRA’s real estate related projects in the July leak.

“Everything is about Teba, and with global income it can be very low, because the cases are so complicated, and they [CRA] hate going to prosecution,” the auditor said. “That’s why we end up beating up on the little guys instead, who run gas stations and small businesses, the ones who will put up the least resistance.”

The July leak included a breakdown that listed not just the Teba of various real estate audit types conducted in BC last year - global income, flips, capital gains, GST – but also the Teba per hour of audit. Sure enough, the single global income audit yielded the lowest Teba/hr at C$155, compared to about C$300/hour for flips and capital gains, and C$800/hour for GST cases.

The retired auditor, who was involved in last week’s leak of a 1996 CRA study that revealed the huge extent of foreign-funded property-buying in greater Vancouver and widespread suspected tax cheating, concurred with the general point.

“Auditors do not have the tools to get the information we need to do these audits and these taxpayers are very smart with lots of money to hire the best accountants and lawyers to stall us and throw up road blocks …nobody [in CRA] wanted to do these audits and would do whatever they could to avoid them,” the source said.

“Let me stress that: no one wants these types of files. They take forever and usually the returns are not great and we know it. We know there is more [money there] but the information is just too hard for us to get. So, you do what you can and then you get out. It is very, very frustrating.”

Immigration and auditors don’t talk much

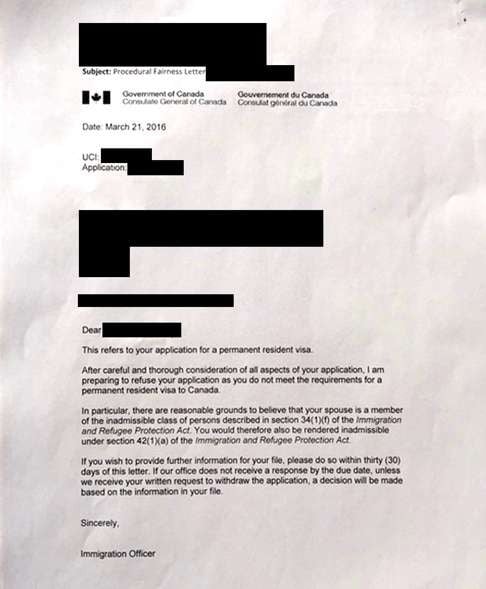

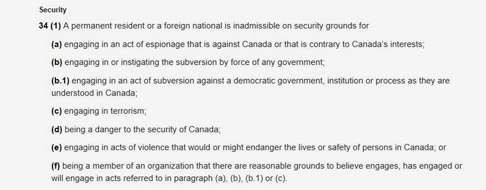

Both sources highlighted another problem: the lack of a simple mechanism for auditors seeking basic information from Citizenship and Immigration Canada, such as an immigrant audit target’s declarations of assets made during the application process and upon landing.

“Auditors do ask … The taxpayer may or may not give it to you,” the former auditor said, adding “it is hard for them to deny the existence of it since they are required to provide it to CIC.”

But this hinged on the co-operation of the auditee. The former auditor, who has discussed the issue with current CRA staff, said: “There was/is no cooperation between CRA and Citizenship and Immigration Canada that we are aware of. If there is, then a memorandum of understanding would have to exist. There may in fact be one - but no one I talked to knows of it.

“And even if there is then you have to go through an intergovernmental affairs officer to get anything - red tape and time. There is no bulk data that we ever knew of, no data base easily accessible by an auditor.”

ThThursda, 25 August,2016ursday, 2 August, 2016

Asked whether auditors could obtain immigrants’ asset declarations from CIC, and, if so, how easy it was, a CRA spokeswoman said: “The CRA continues to work with Immigration, Refugees and Citizenship Canada [CIC] and other federal, provincial and territorial government departments to develop and explore further opportunities to improve information sharing in support of our respective mandates.”

Without specifying CIC, she had prefaced the remark by saying CRA “can obtain or share information with various federal government departments, provinces and territories in support of the CRA’s compliance efforts…All information obtained or shared is done so in accordance with the terms of various memoranda of understanding or legislation such as the Privacy Act.”

Nevertheless, the current auditor said auditors were hamstrung by a lack of auditor-level communication with CIC. “We’ll definitely catch guys flipping houses. But global income is going to be another story. We need more resources for that. I don’t know how - until someone starts coordinating with immigration and customs, to see how much they are coming and going, what they are declaring each time, until that information gets down to the auditor level - I don’t know how we’ll do it.”

The source said auditors did not generally speak to immigration staff, and that instead information would have to be sought via “high-level contacts” within the two departments. Information such as asset declarations to CIC were “not readily available at the auditor level” the auditor said.

This is not to say that the sources underestimate the investigative powers of the CRA.

Both signed off by telling me not to expect to hear from them again in the immediate future.

“They are out for blood,” the former auditor said. “You do realise they can easily tap your phones and email?”